The economy of Brazil has suffered sharply in the past few years due to the decline in the commodity markets and the slowdown in China. The Brazilian economy retracted this year and is predicted to have negative GDP growth in 2016 also.

From a news article published back in October:

SÃO PAULO, BRAZIL – The federal government of Brazil delivered yet another blow to the country’s ailing economy on Thursday by announcing that it now estimates a retraction in the country’s GDP for 2016 of one percent. Earlier in the week the government had revised its retraction of the GDP of 2015 from 2.44 percent to 2.8 percent.

Financial analysts, however, are predicting a more negative scenario. For 2015 market analysts forecast a retraction of the GDP growth by three percent and for next year a retraction of 1.43 percent.

If the numbers are confirmed for both this year and next year, this will be the first time the Brazilian GDP has ever registered a retraction for two consecutive years since the IBGE (Brazilian Statistical Bureau) began making the forecasts in 1948.

Source: Brazil’s Government Admits Negative GDP Growth for 2016 , The Rio Times, Oct 30, 2015

The Journal had an interesting take on the Brazilian economic situation in an August article. From that piece:

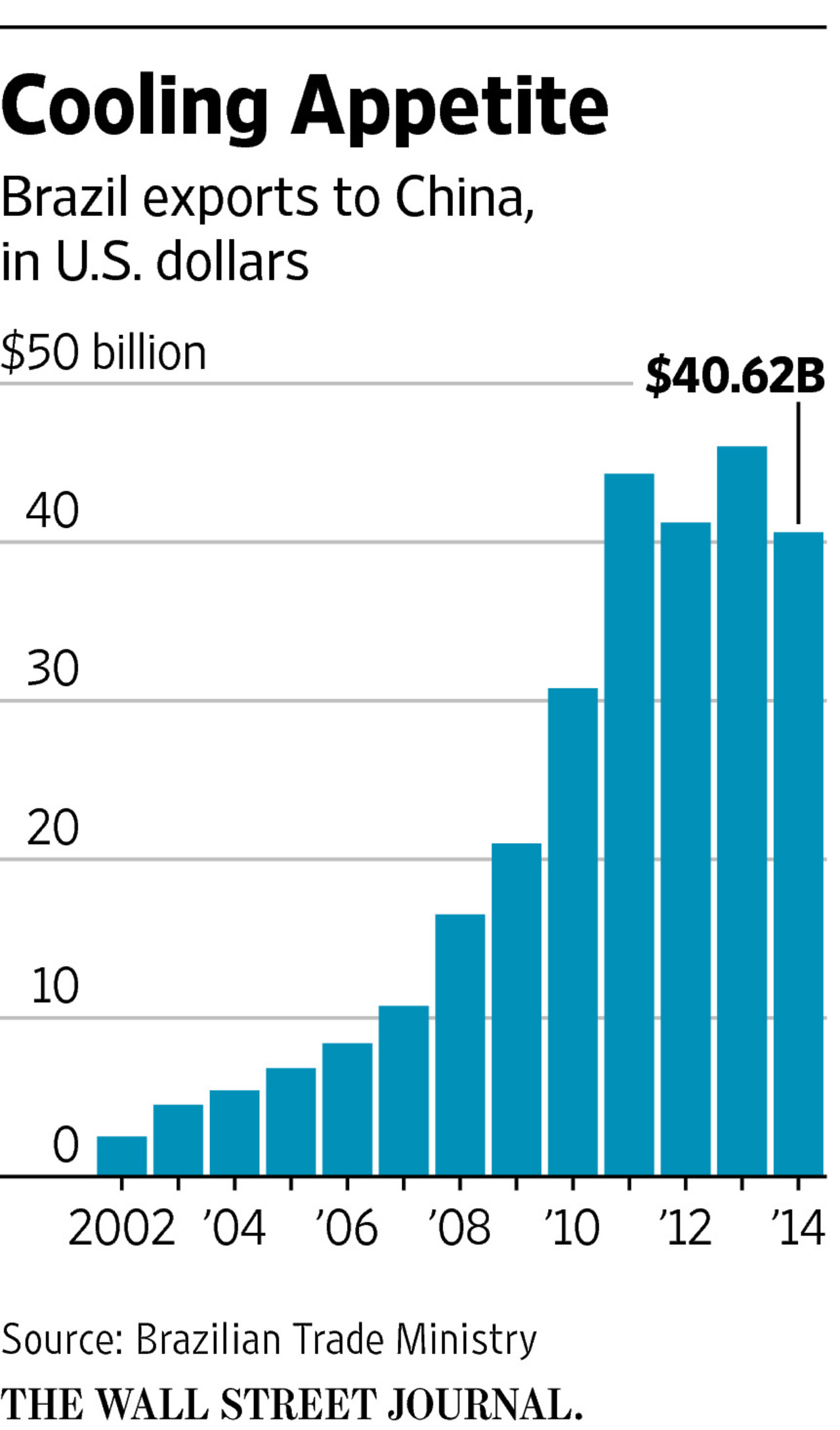

China has caused turmoil in many places, but none more so than in this prime supplier of commodities to a country whose once-voracious appetite for them has dimmed. Brazil’s pain from China’s slowdown isn’t largely confined to the financial markets, as in some countries, but goes to the heart of its real economy.

“We went from Brazil mania to Brazil nausea,” said Marcos Troyjo, a former Brazilian diplomat who leads a Columbia University center studying emerging markets. “We are looking at a lost decade, where growth stagnates, inflation is high, and, most sadly, a decade where you’ve learned nothing.”

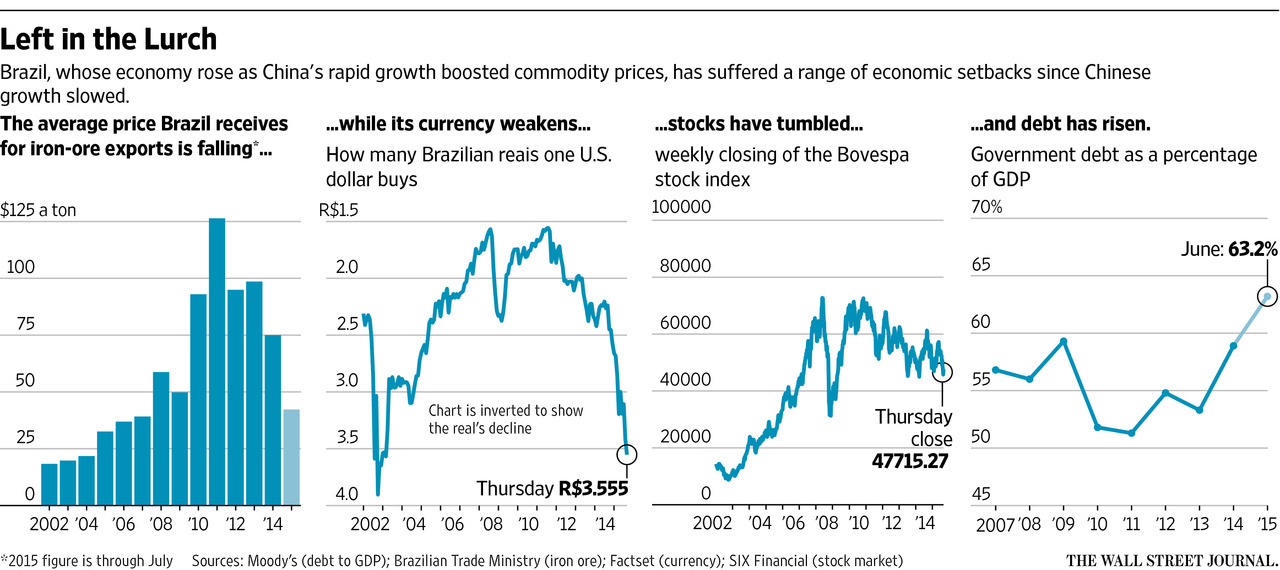

Click to enlarge

For Brazilians who believed, as their leaders were saying, that the country would climb to first-world status during the resources boom, the downturn has come as a profound disappointment. Big antigovernment demonstrations are now regular events: Protesters decry the corruption that a sweeping investigation is uncovering, and many call for President Dilma Rousseff’s ouster. As inflation nears double-digits and as unemployment and interest rates rise, middle-class households are starting to miss car payments and the poor are eating less meat.

“Beef is the first to go!” said Janeide Ferreira, a 54-year-old cleaner in Rio de Janeiro who must take a sweaty two-hour bus ride to work each day from the slum where she lives. “Things were so much better five years ago.”

Click to enlarge

Brazil is in danger of losing its investment-grade rating, to judge by the negative views of credit-rating firms, potentially sparking a disorderly currency decline.

Some wealthy Brazilians aren’t sticking around to find out. Rich Brazilians are snapping up homes from South Florida to Scarsdale, N.Y., often with the long-term plan of raising families there. A cover story on the phenomenon in the weekly magazine Istoé this month is titled: “Bye-Bye Brazil.”

Source: How Brazil’s China-Driven Commodities Boom Went Bust, The Wall Street Journal, Aug 27, 2015

As the economy went South, the equity market also declined accordingly. The Bovespa is down just over 10% year-to-date. This is in sharp contrast to the Mexican market which is basically flat. This is because the Mexican economy is more manufacturing-driven and not commodity-based like Brazil’s. In addition, Mexico is highly dependent on the US economy. As the US economy is growing Mexico is befitting from it. Brazil on the other hand is dependent on China importing its commodities and in general the collapse of commodity prices has hit Brazil hard.

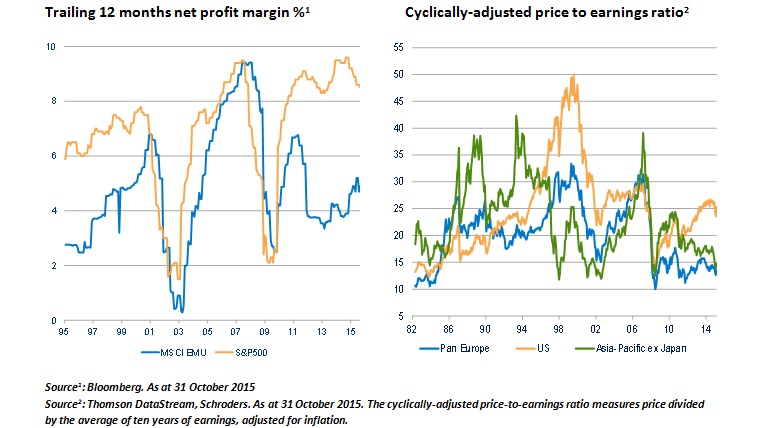

From an investment perspective, is it time to buy Brazilian stocks or simply say Bye-Bye Brazil?

The answer to the above question is difficult to predict at this time. Unless the commodity markets improve, Brazilian equities may find it difficult to attract investors’s attention. Domestic-oriented industries such as banking are also not performing well as consumers cut back on spending.

The following table shows the year-to-date percentage changes of exchange-traded Brazil ADRs:

| S.No. | Company | Ticker | Price as of Dec 2, 2015 | Year-To-Date Change (%) as of Dec 2, 2015 | Industry |

|---|---|---|---|---|---|

| 1 | Fibria Celulose | FBR | $13.16 | 8.49% | Forestry & Paper |

| 2 | Braskem | BAK | $13.48 | 4.42% | Chemicals |

| 3 | BrasilAgro | LND | $2.71 | -8.75% | Real Estate Inv&Serv |

| 4 | Ultrapar | UGP | $16.67 | -12.59% | Gas,H20&Multiutility |

| 5 | Embraer | ERJ | $31.23 | -15.27% | Aerospace & Defense |

| 6 | Gafisa | GFA | $1.29 | -16.23% | HouseGoods&HomeConst |

| 7 | SABESP | SBS | $4.92 | -21.78% | Gas,H20&Multiutility |

| 8 | Banco Santander Brasil | BSBR | $3.90 | -22.31% | Banks |

| 9 | AMBEV S.A | ABEV | $4.82 | -22.51% | Beverages |

| 10 | Petroleo Brasileiro-Petrobras | PBR | $4.95 | -32.19% | Oil & Gas Producers |

| 11 | Centrais Eletricas Brasileiras-Eletrobras | EBR | $1.45 | -32.24% | Electricity |

| 12 | BRF S.A. | BRFS | $14.62 | -37.39% | Food Producers |

| 13 | CPFL Energia | CPL | $8.09 | -38.48% | Electricity |

| 14 | Companhia Siderurgica Nacional-CSN | SID | $1.27 | -38.94% | Indust.Metals&Mining |

| 15 | Itau Unibanco | ITUB | $7.19 | -39.22% | Banks |

| 16 | Banco Bradesco | BBDO | $6.27 | -41.78% | Banks |

| 17 | Telefonica Brasil | VIV | $9.60 | -45.70% | Fixed Line Telecom. |

| 18 | Comp. Paranaense de Energia-COPEL | ELP | $7.12 | -45.94% | Electricity |

| 19 | Banco Bradesco | BBD | $5.51 | -50.54% | Banks |

| 20 | TIM Participacoes | TSU | $9.72 | -56.24% | Mobile Telecom. |

| 21 | Gerdau | GGB | $1.55 | -56.34% | Indust.Metals&Mining |

| 22 | Vale | VALE | $3.36 | -58.92% | Indust.Metals&Mining |

| 23 | Companhia Brasileira de Distribuicao-CBD | CBD | $12.56 | -65.90% | Food &Drug Retailers |

| 24 | Companhia Energetica de Minas Gerais-CEMIG | CIG | $1.66 | -66.60% | Electricity |

| 25 | Oi | OIBR | $0.71 | -78.81% | Fixed Line Telecom. |

| 26 | Gol | GOL | $0.86 | -85.04% | Travel & Leisure |

Source: BNY Mellon

Most of the stocks listed above have declined some with losses of over 50%.

In my opinion, it is too early to state that it is time to buy Brazil. Political risk is still too high and further declines in commodity markets can hurt Brazil even more. So new investments in Brazilian equities can be avoided at this time.

Disclosure: Long ITUB, BBD and PBR