Citi Depository Receipt Services recently its annual “Depositary Receipt Services Year-End 2013 Report” which has many interesting facts.

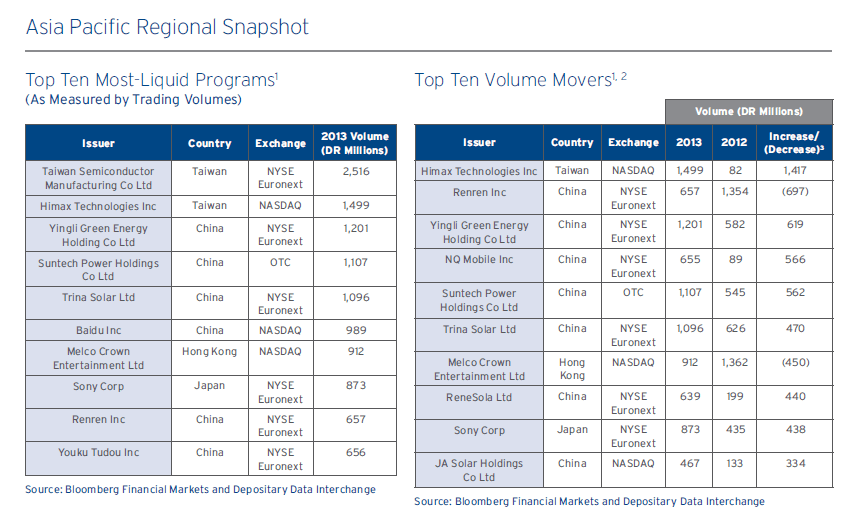

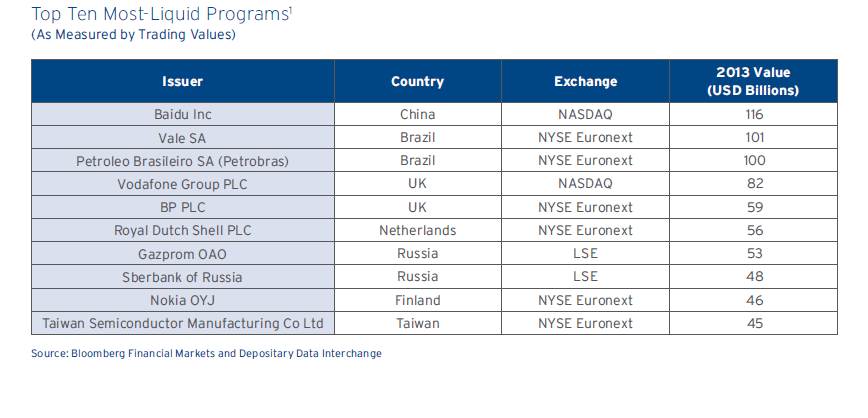

The table below shows the top 10 most-liquid DR programs from Asia in 2013 by trading volumes:

Click to enlarge

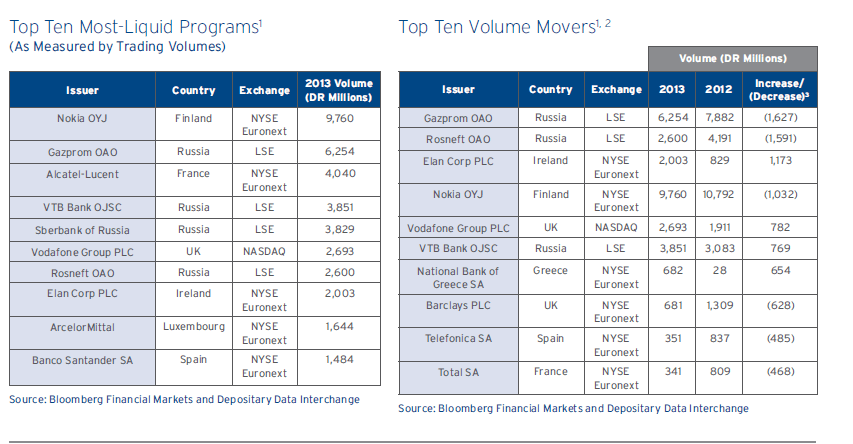

The table below shows the top 10 most-liquid DR programs from EMEA in 2013 by trading volumes:

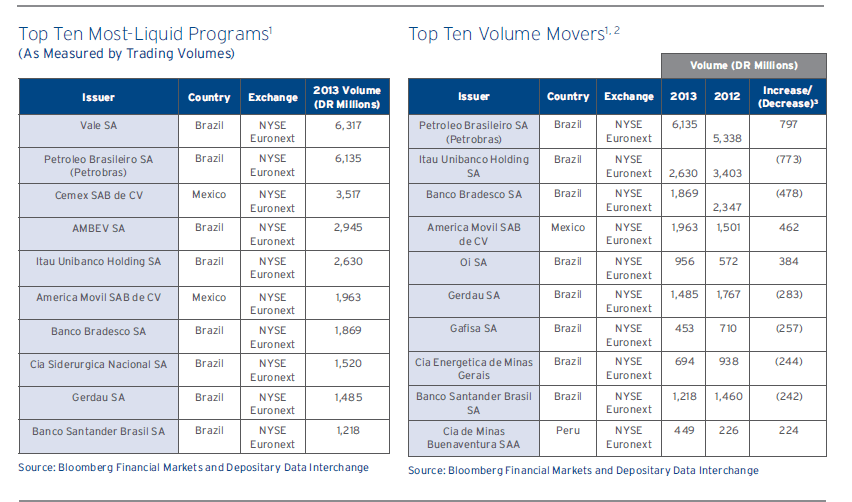

The table below shows the top 10 most-liquid DR programs from Latin America in 2013 by trading volumes:

Notes:

1. Data as of December 15, 2013.

2. Absolute change in DR trading volume/values.

3. Differences may not sum to total due to rounding.

Source: Citi

LSE on the above tables refers to the London Stock Exchange while the others are US markets.Latin American ADR trading volume is dominated Mexican and Brazilian stocks with the exception of Compañía de Minas Buenaventura S.A.A (BVN) from Peru.

Disclosure: Long SAN, BBD, ITUB and PBR