I have written many times before on the benefits of diversification. A well-built portfolio comprising of various asset classes and types can withstand adverse market conditions including brutal bear markets like the one we witnessed with the global financial crisis of 2008-2009.

According to a research report from Vanguard, broad market diversification cannot insure large losses but it can help to guard against unnecessary large losses. Professional and retail alike can easily be caught off-guard with events beyond their control leading to the complete wipeout of an investment. An example of such an event is accounting fraud that triggered the collapse of Enron.

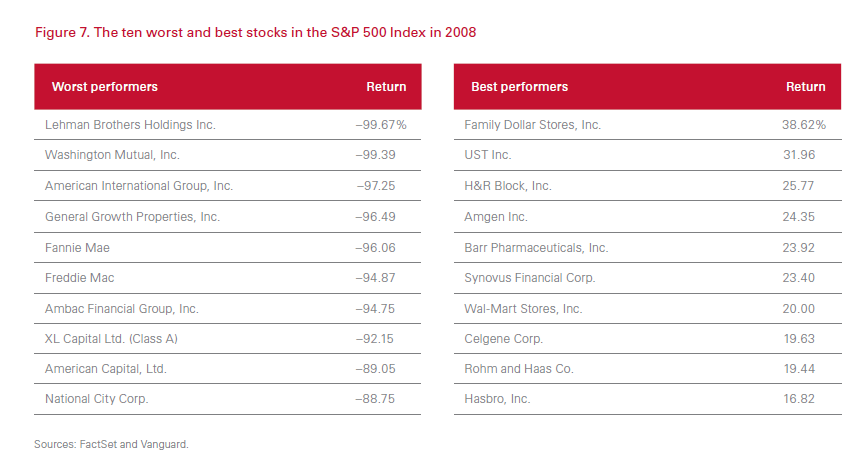

The chart below shows the best and worst performers in the S&P 500 index in 2008:

Click to enlarge

Source: Vanguard’s Principles for Investing Success, Vanguard

In 2008, the S&P 500 had a negative return of 37%. But more a third of stocks in the index fell over 50%. Companies such as Lehman, Wamu, AIG, etc. as shown above crashed dramatically and some of them disappeared altogether. One such case was the Cleveland,OH-based National City Bank which collapsed and was taken over by The PNC Financial Services Group, Inc (PNC) with help from the Feds. National City investors including myself ended up owning PNC stock by this disaster. Most of these worst performers were once “blue chip” companies in the financial sector and were paying solid dividends and were considered “safe” long-term investments. Obviously that assumption turned to be utter and complete false to say the least.

On the other hand, the same year saw the stocks of boring companies such as Wal-Mart, Family Dollar Stores, Hasbro, etc. rise by double digits.

The moral of the story here is that the benefits of diversification cannot be under stated. Seemingly safe and well-run firms may blow up for any number of reasons beyond an investor’s control who are basically “outsiders” trying to look in and discern the condition of a company.

Disclosure: Long PNC