U.S.utility stocks can provide shelter in volatile market conditions. Relative to the transportation sector and the overall market, utilities have held up well so far this year.

In general, utilities in the US are excellent to invest in for the following reasons:

- Utilities are a natural monopoly.

- Utility companies generally tend to have high dividend yields.

- When the economy is growing utilities tend to to grow strong as well but in down times they offer protection and stable incomes.

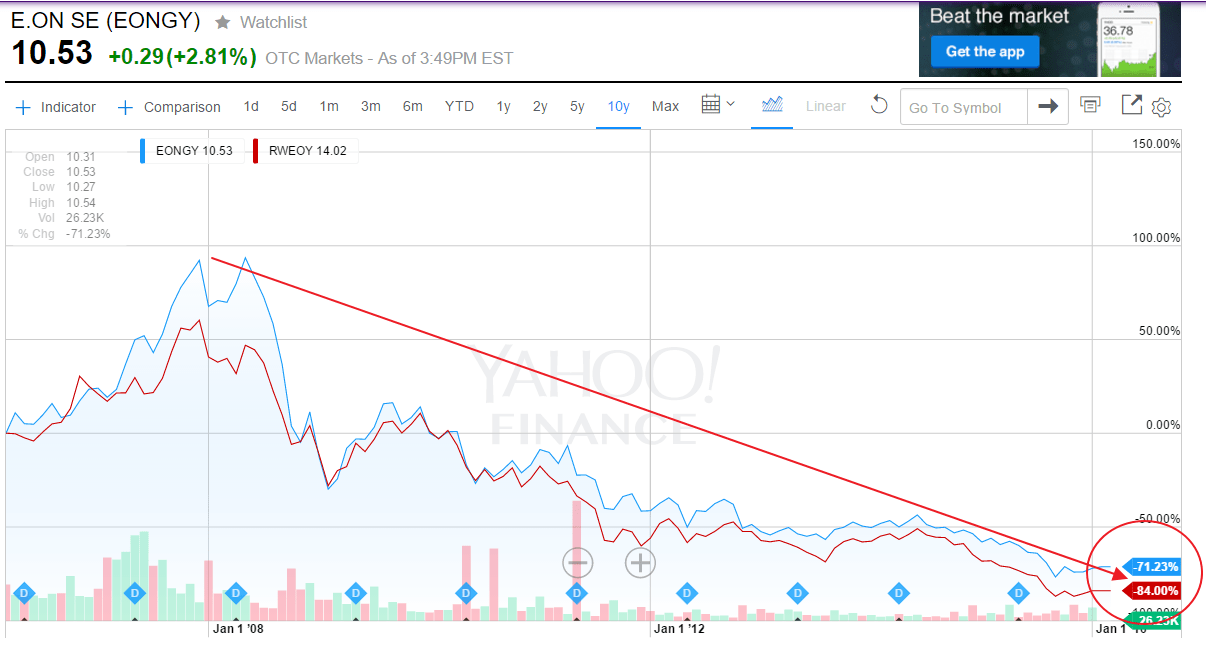

- For the most part, US utilities are not subject to crazy policies like the ones in Germany which has decimated utilities there.

The following chart shows the performance of the two largest German utilities in the long-term:

Click to enlarge

Source: Yahoo Finance

Ten US utilities to consider are listed below with their current dividend yields:

1.Company: Consolidated Edison Inc. (ED)

Current Dividend Yield: 3.75%

2.Company: PG&E Corporation (PCG)

Current Dividend Yield: 3.31%

3.Company: Edison International (EIX)

Current Dividend Yield: 3.11%

4.Company: Portland General Elect. Co. (POR)

Current Dividend Yield: 3.09$

5.Company: Sempra Energy (SRE)

Current Dividend Yield: 2.96%

6.Company: Southern Co. (SO)

Current Dividend Yield: 4.44%

7.Company: Duke Energy Corp. (DUK)

Current Dividend Yield: 4.38%

8.Company: Entergy Corp. (ETR)

Current Dividend Yield: 4.82%

9.Company: NextEra Energy, Inc. (NEE)

Current Dividend Yield: 2.76%

10.Company: Exelon Corporation (EXC)

Current Dividend Yield: 4.09%

Note: Dividend yields noted above are as of Feb 1, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long EONGY, NEE and RWEOY

What about different countries utilities?

There are many options for utilities in other countries.You can check out articles on this site under utilities category.Thz.