Rousseff or Neves? Brazilians Await Bad News Whoever Wins (Bloomberg)

The eurozone’s German problem (CER)

42 stocks that’ll thrive even if the economy gets worse (Financial Post)

Invesco Perpetual’s Mustoe: Why I’m betting big on Europe (FE Trustnet)

12 savvy year-end tax moves (Fidelity)

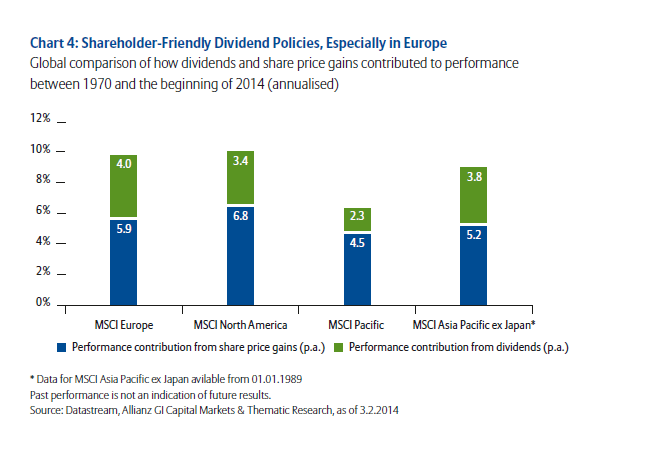

2020 Vision: Yield Scarcity and the Case for Dividends (Franklin Templeton Investments)

STOCKS FOR THE LONG RUN? (Evanson Asset Management)

4 Mistakes to Avoid in International Investing (Charles Schwab)

Can businessmen make good politicians? (The Hindu BusinessLine)

Why Don’t Germans Invest in Stocks? (Bloomberg BusinessWeek , 2010)

The Biggest Myths in Economics (Pragmatic Capitalism)

The Path to Becoming an Emerging Market (AllianceBernstein Blog)

Click to enlarge

Near Central Park, Manhattan, New York City