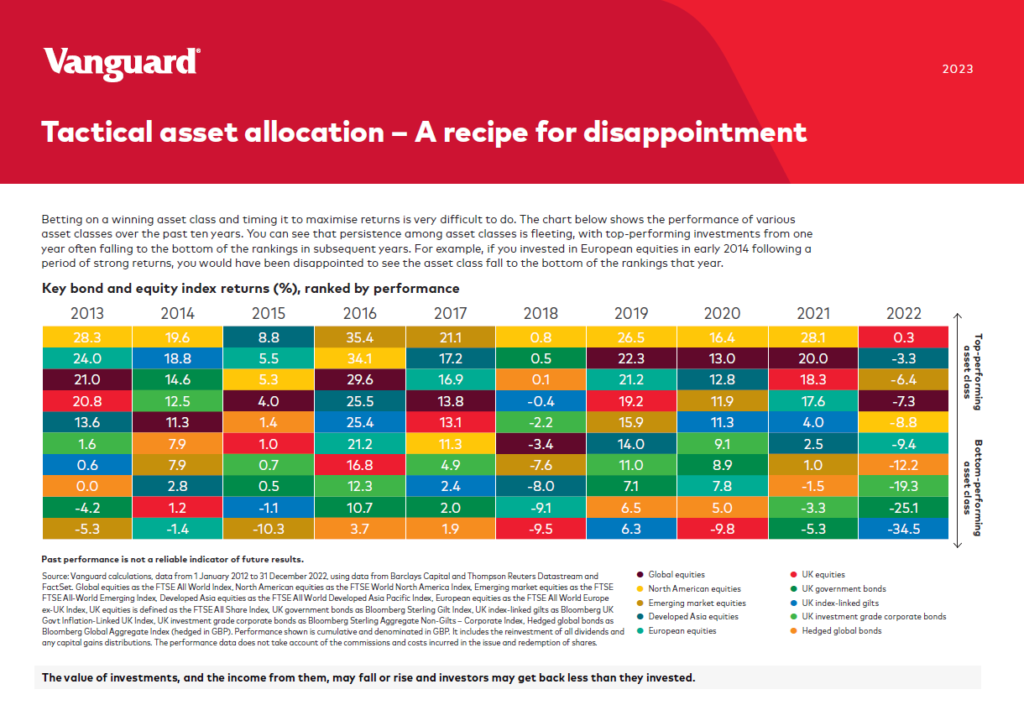

One of the key strategies for success with investing is the simple task of diversification. I have written many times in this blog that diversification is the easiest way to reduce risk and improve returns. Diversification over various asset classes is one way to implement diversification in a portfolio. The following chart shows the importance of diversification using returns from the UK market as published by Vanguard:

Click to enlarge

Source: Vanguard UK