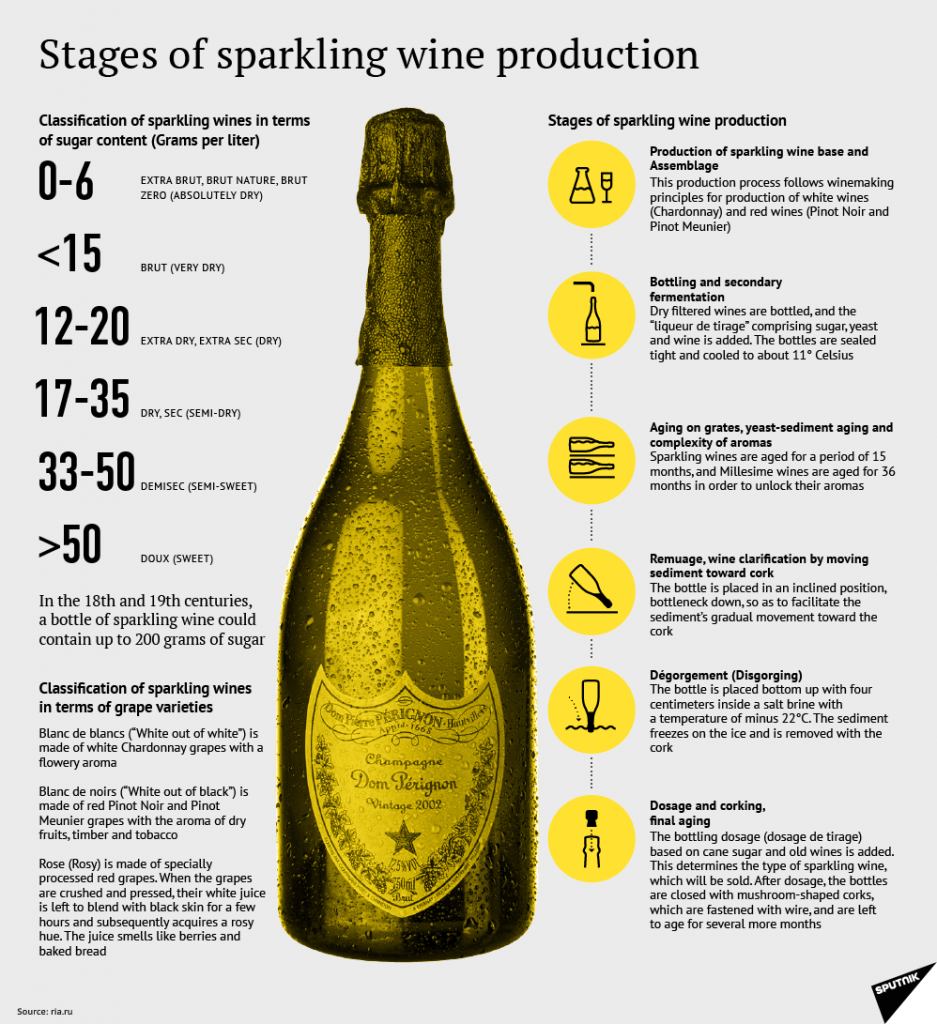

Here is a cool infographic on how champagne is made:

Click to enlarge

According to the legend, champagne was invented on August 4, 1693 by a Benedictine monk Dom Perignon who at the time served as cellar master of the Abbey of Hautvillers. “Come quickly! I’m drinking the stars!” he exclaimed when tasting wine that he was unable to rid of bubbles, and thus the legendary beverage was born.

Source: Sputnik News