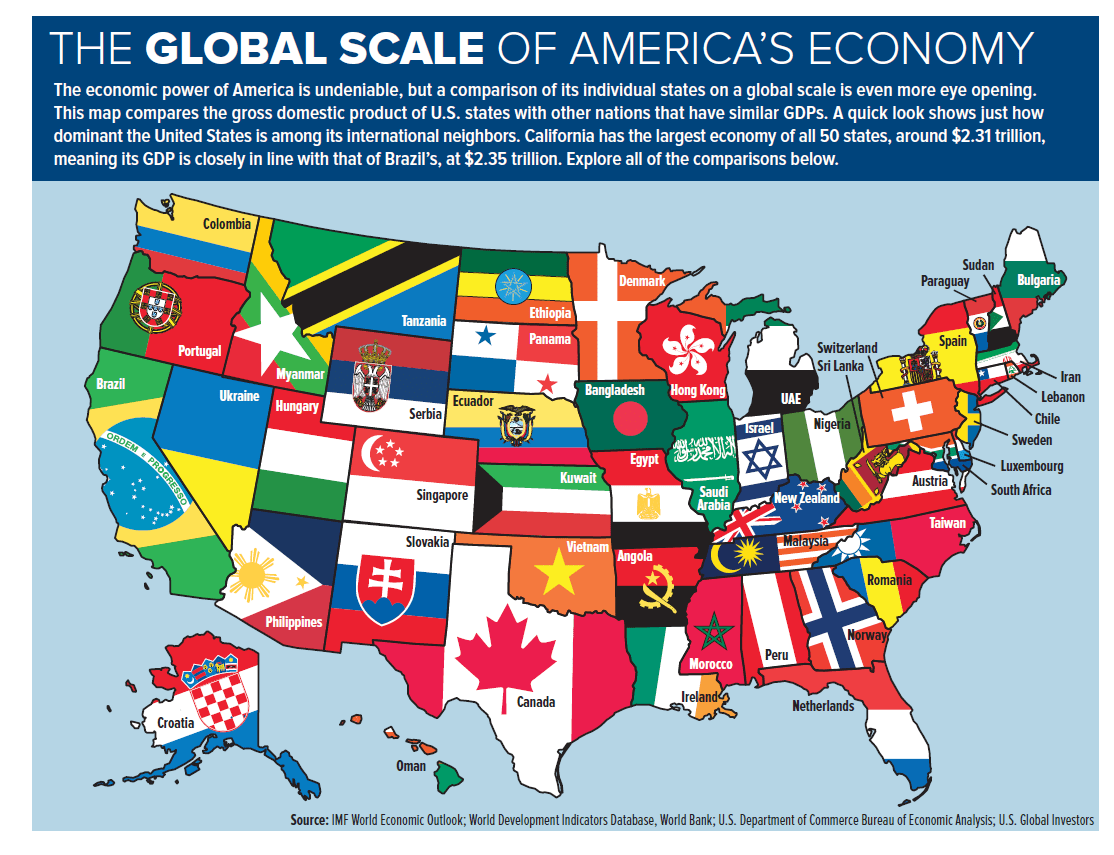

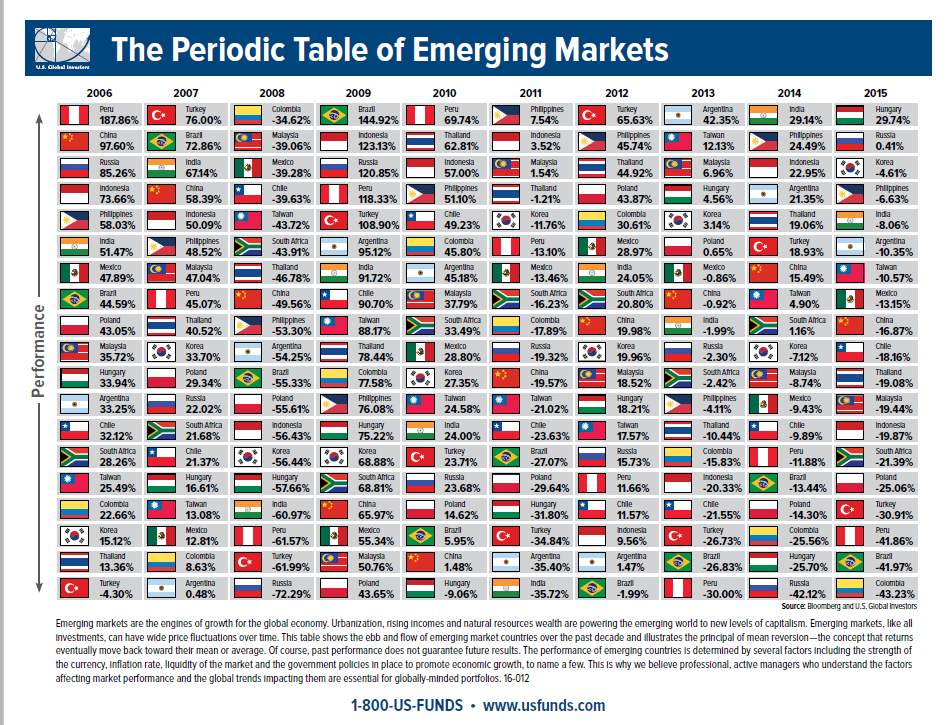

The U.S. economy is the largest in the world with a GDP of about $18.0 Trillion. The GDP of most countries of the world are small compared to the US. Since the U.S. economy is huge, the economic output of each of the individual states in the country is also huge. The size is especially interesting when we compare each state to other countries. The following graphic shows how each state compares to other countries based on the size of economy:

Click to enlarge

Source: Shareholder Report, 2015 Vol 2, U.S. Funds

Though Canada is a separate country, in terms of economic output it is just the size of Texas.

Also see: