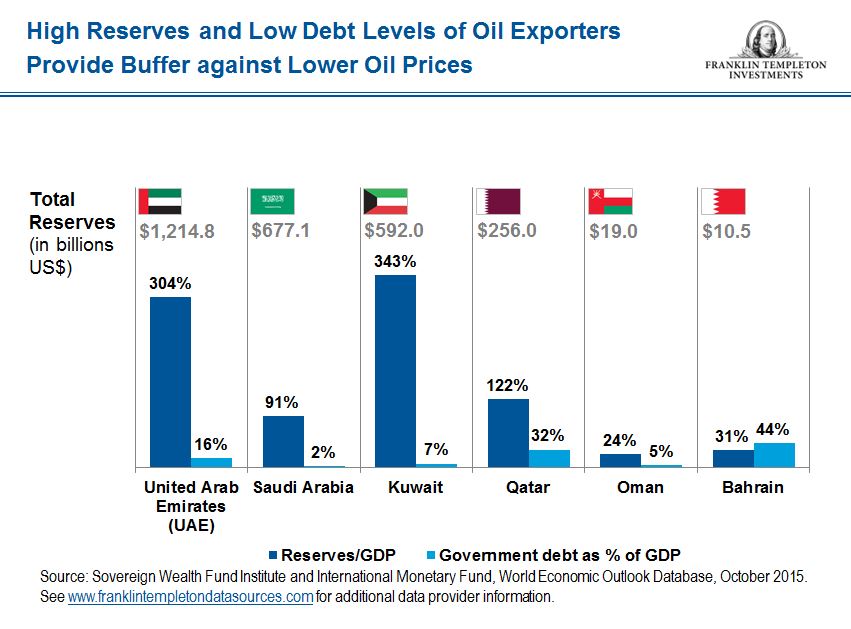

Emerging markets used to be a hot destination for investors a few years ago. Nowadays these markets have become more of submerging markets with equities hit hard due to the collapse in commodity prices and other factors. Countries that are major oil exporters such as Brazil, Russia, etc. are suffering with the fall in crude oil prices. Many investors are avoiding from emerging markets as they continue to go from bad to worse. However astute investors can nibble at emerging stocks at current levels since commodities alone do not determine the future of all these countries. Here is an excerpt from an article by Charles Wilson, PhD at Thornburg Investment Management:

Correlation is not causation when it comes to emerging markets and commodities.

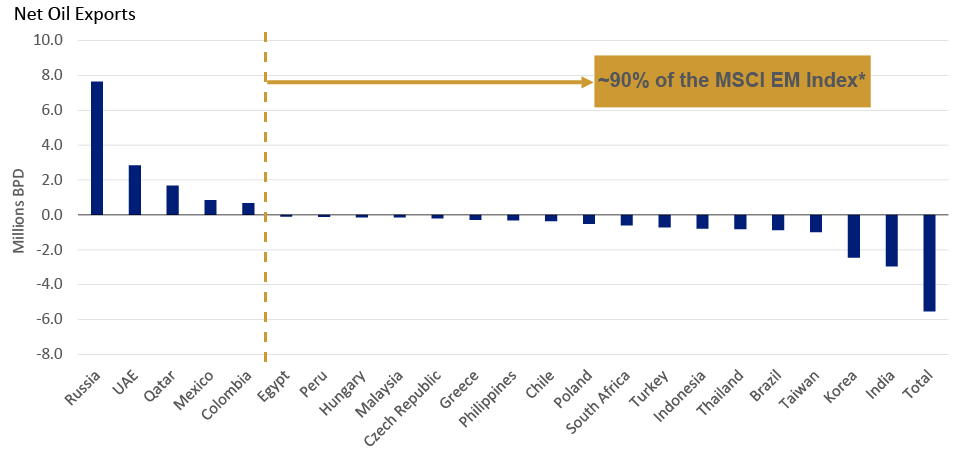

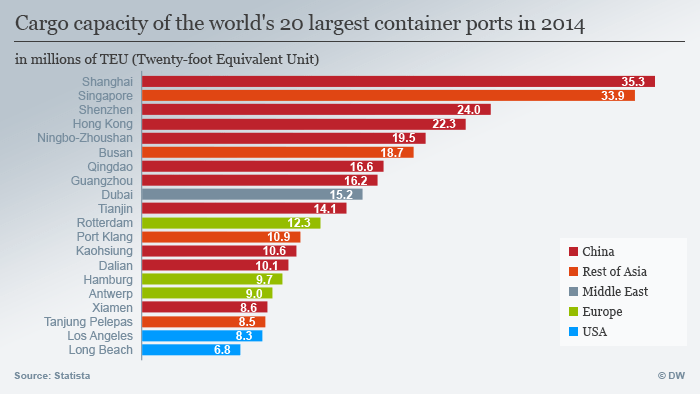

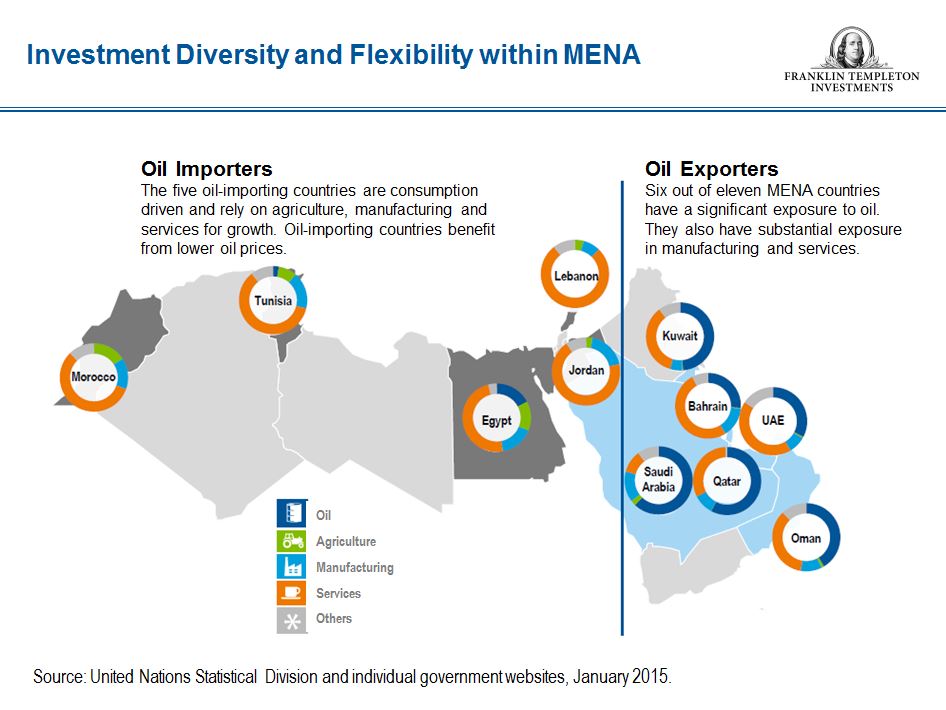

The term “risk assets” has become widely used to describe anything that goes up when the U.S. dollar goes down. Perceptions around the pace of U.S. monetary tightening substantially influence the greenback’s movements. In recent years, risk assets have come to include everything from junk bonds to Chinese steel prices or even Italian banks. In our view, many people have mistakenly confused the correlation between asset prices with causation, especially relative to prices of two asset classes in particular—commodities and emerging market equities. The underlying assumption being that emerging markets are driven by commodity prices. We don’t think that’s really the case on a fundamental level. Most countries in the MSCI Emerging Markets (EM) Index benefit from lower commodity prices in general, especially oil. This makes sense considering that about 90% of the companies in the MSCI EM Index are domiciled in countries that are net importers of energy, as shown in figure 1.

Click to enlarge

Source: Can Emerging Market Equities Work If Commodity Prices Don’t? by Charles Wilson, PhD, Thornburg Investment Management

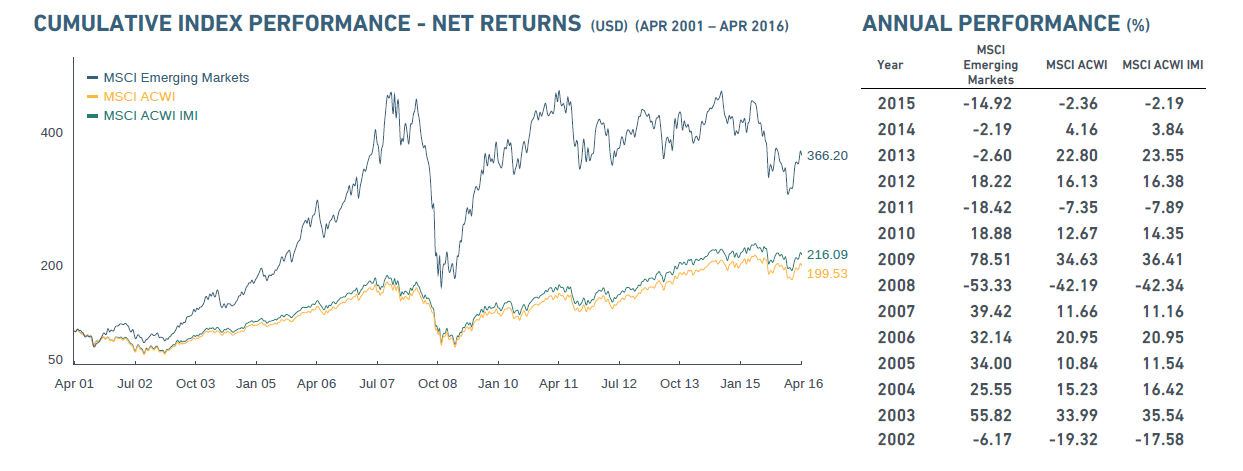

The following chart shows the performance of the MSCI Emerging Markets Index:

Source: MSCI

Five constituents of the MSCI Emerging Markets Index are listed below for further research:

1.Company: Ultrapar Participacoes SA (UGP)

Current Dividend Yield: 3.23%

Sector: Oil, Gas & Consumable Fuels

Country: Brazil

2.Company: Banco De Chile (BCH)

Current Dividend Yield: 4.63%

Sector: Banking

Country: Chile

3.Company: HDFC Bank Ltd (HDB)

Current Dividend Yield: 0.59%

Sector: Banking

Country: India

4.Company: Standard Bank Group Limited (SGBLY)

Current Dividend Yield: 9.71%

Sector: Banking

Country: South Africa

5.Company:Fomento Economico Mexicano SAB de CV (FMX)

Current Dividend Yield: 1.52%

Sector:Beverages

Country:Mexico

Related ETFs:

Disclosure: Long BCH