The Manufacturing industry has been declining for many years now. While in the past an average American with a high school diploma could get a well-paid job in a local factory and settle down by raising a family, today’s average American with the same diploma might be lucky to find a job flipping burgers at minimum wage at a fast food restaurant. In today’s US a college degree is mandatory even to get a half-way decent job, if one can find one. The decline in manufacturing has forced millions of Americans into the service sector which tend to have poorly paid jobs with no benefits.

The hollowing out of US manufacturing over the years by outsourcing those jobs has led to a decline in standard of living for average Americans. For example, whites and blacks alike lost out when factories to Mexico and other countries after NAFTA was implemented. What jobs were left within the country such as those in construction and farming, were also taken over by illegal Hispanics leaving average-educated Americans fight for other jobs. Dramatic social and cultural changes are already occurring among whites and non-Hispanics. Some of such changes include higher suicides rates, mental issues, graduated college college students staying with mom and dad, etc.

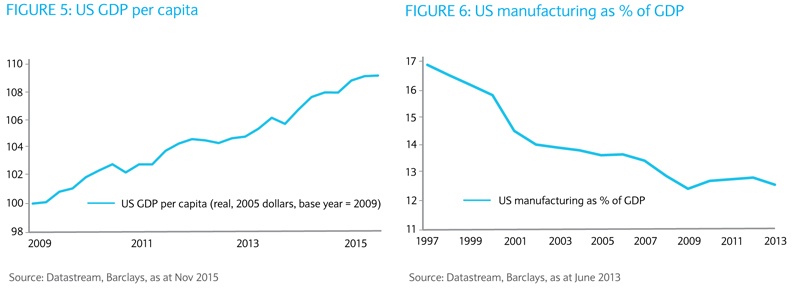

The following chart shows US manufacturing as a % of GDP since 1997:

Click to enlarge

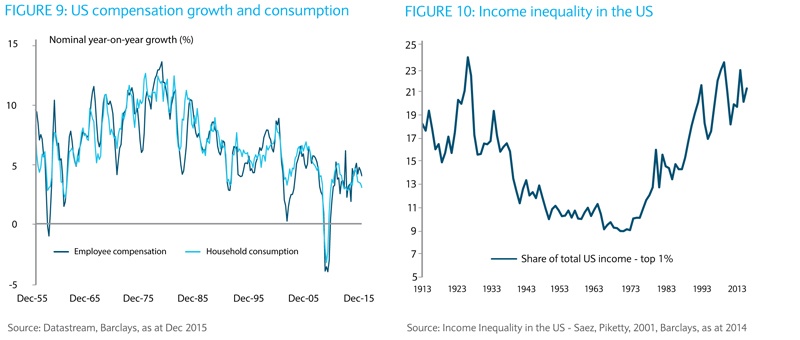

One of the consequences of lack of decent jobs and wage growth is the rising inequality among the population. As the entire system is set up to benefit the rich get richer and poor become poorer income inequality continues to rise year after after. Hence on the one hand the country is a super power with fabulous wealth and awesome military and on the other hand millions of people survive on food stamps and charities or basically survive working multiple minimum wage jobs. This shocking dichotomy makes the country look like a cross between Switzerland and Somalia to those who can look beyond the brainwashing by the media.

The following chart shows income inequality since 1913:

Source: Not all that it seems?, Barclays