FP magazine recently published its ranking of top 500 Canadian companies based on revenue. The #1 rank went to George Weston Ltd. with 2015 revenues of over $46 billion followed by Royal Bank of Canada(RY) and auto parts maker Magna International Inc (MGA).

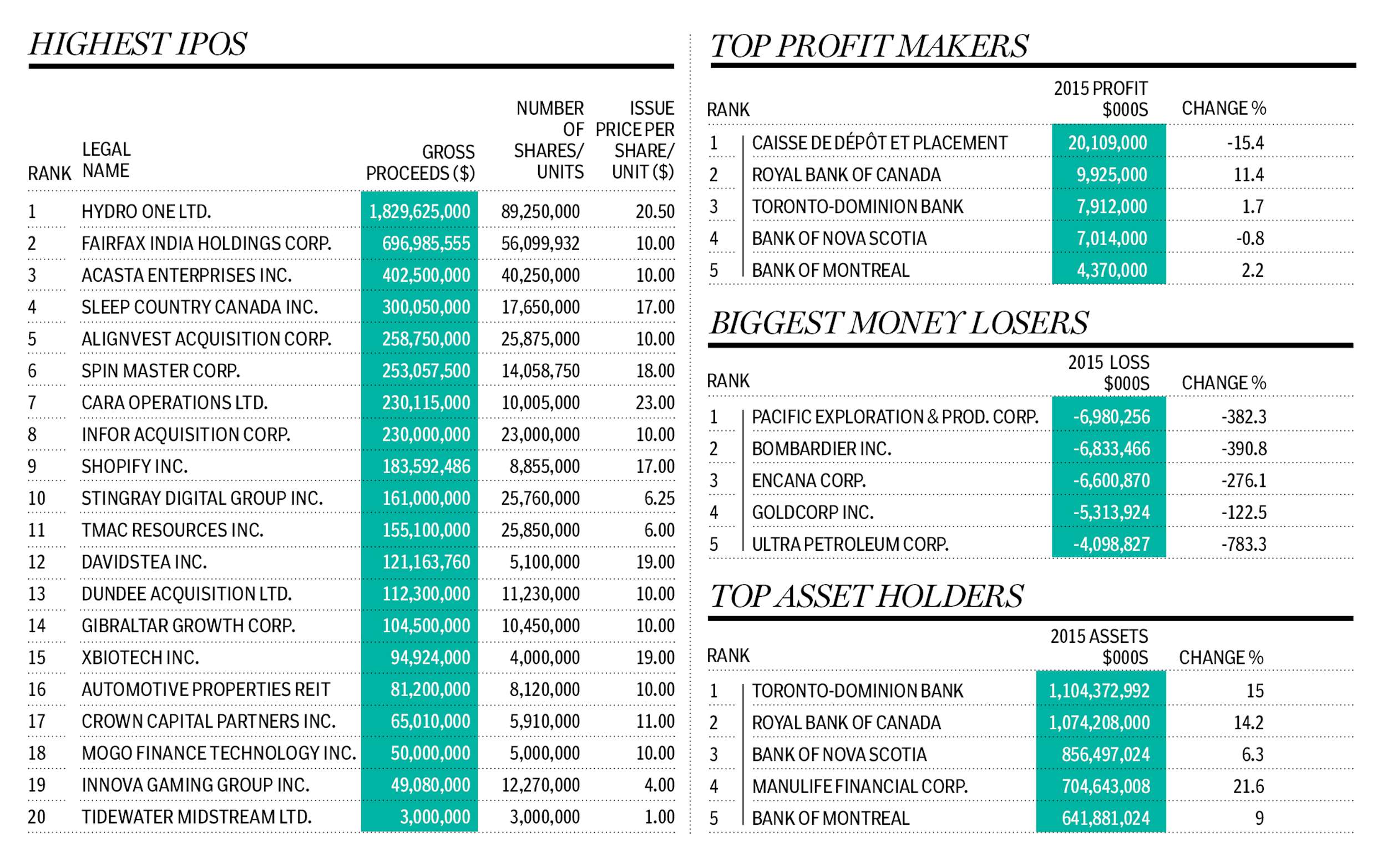

The following graphic shows the top five most profitable companies and other lists:

Click to enlarge

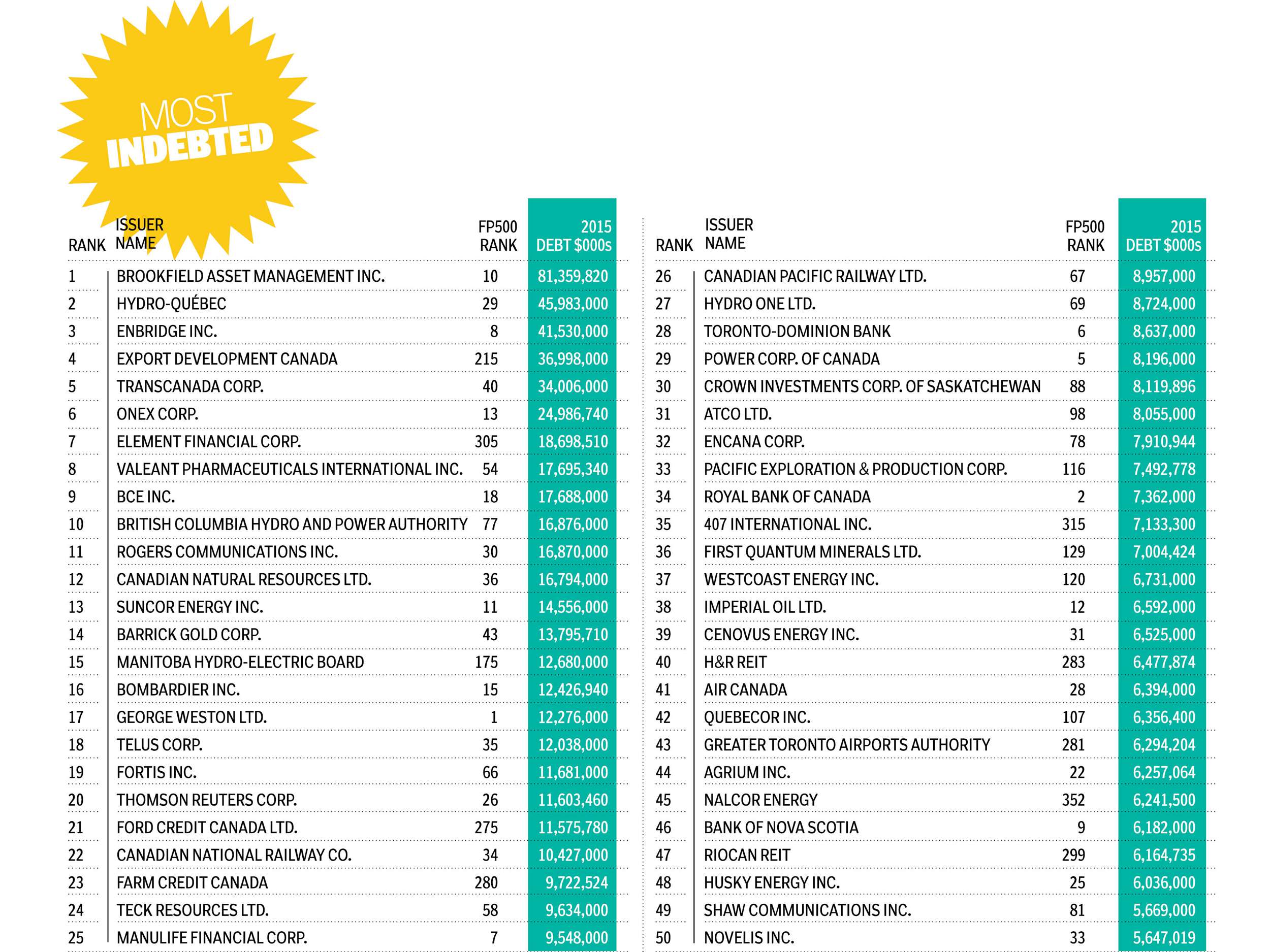

The graphic below shows the most indebted firms:

Source: THE FP500 – The premier ranking of Corporate Canada, Financial Post

Four of the top five profit making firms are banking institutions.

The complete list of the FP 500 firms and other fascinating details can be found here.

Disclosure: Long RY, MGA