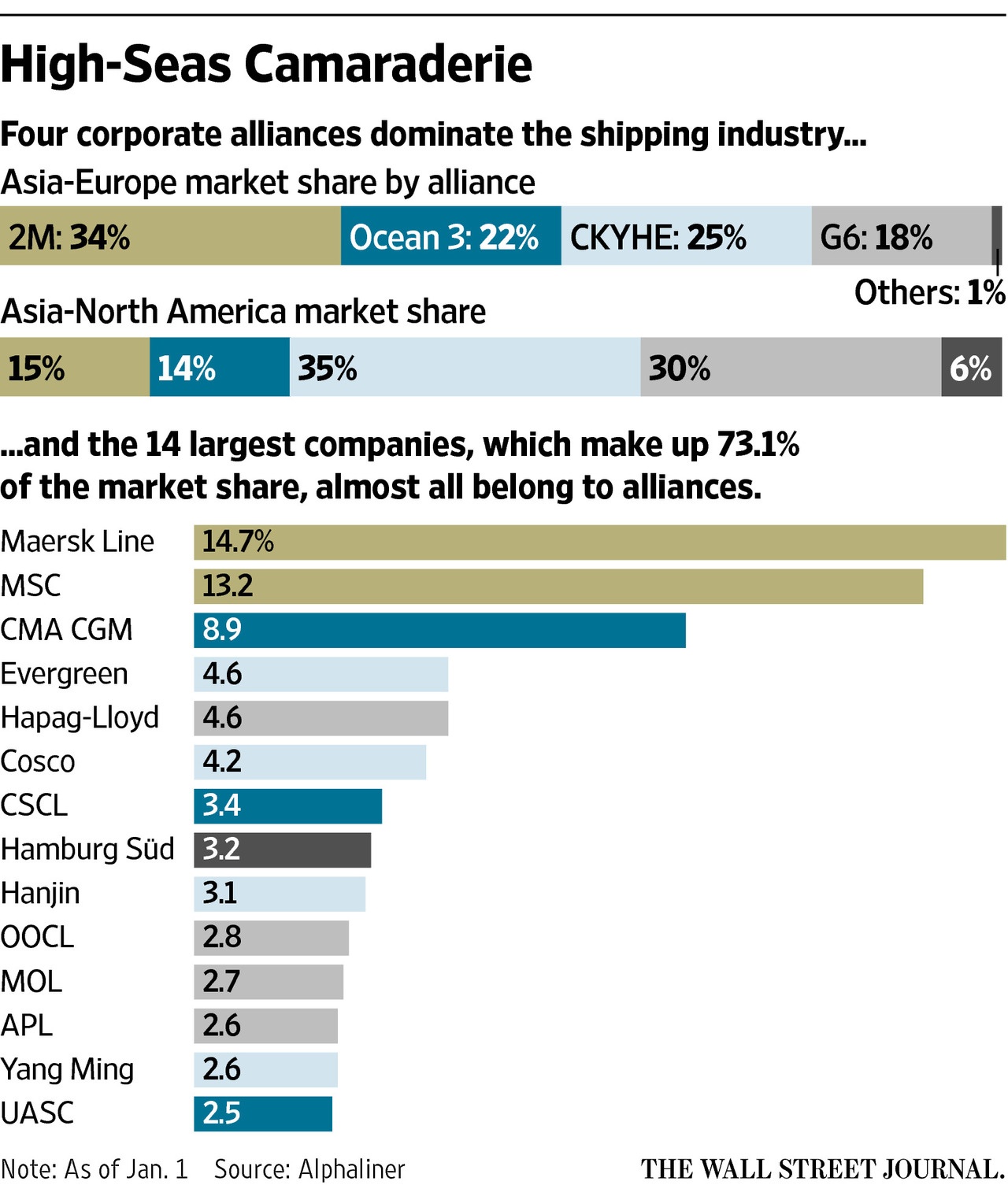

The global shipping industry is dominated by a few companies. With more mergers planned, the industry’s concentration among a few players is going to get bigger. The companies in the industry are huge and are critical to global trade as they operate container ships that transport from one part of the world to another. The world’s largest container operator is Denmark-based Maersk with a market share of about 15% of the total world market. All the major firms in this industry are part of one of the four alliances.

The world’s top container ship companies are shown in the graphic below:

Click to enlarge

Source: Shipping Mergers to Remake Global Alliances, WSJ, April 12, 2016

The four alliances are 2M, Ocean 3, CKYHE and G6. Germany-based operators in the above list are Hamburg Sud and Hapag-Lloyd and CMA CGM is a French company.

It is interesting that just 14 top companies control about three-fourths of the global shipping market.

The world’s largest ship is the latest Triple-E class ships from Maersk. The first Triple-E class ship is Mærsk Mc-Kinney Møller shown below:

Click to enlarge

Here are some fascinating facts about this ship:

- “At 400 metres long the Triple-E ships on order by Maersk Line are larger than any vessel of any kind currently on the water. Its capacity of 18,000 TEU is a significant increase on the current 15,500 TEU capacity of the Maersk E-class

- Maersk Line’s largest ships currently sailing the world’s oceans are the Maersk E-class vessels, which are 396 metres long

- Other known large vessels include the container ship Marco Polo (also 396 metres long), the super tanker Berge Emperor 380 metres), the cruise ship Allure of the Seas (361 metres), and the war ship USS Enterprise (341 metres)

- The largest ship ever built was the super tanker Knock Nevis (458 metres). She was scrapped in 2010.The normal operation of the vessel will be similar to the manning of the Maersk E-class vessels (22 crew members). It is, however, possible to operate with a crew of 13. If needed, the vessel can accommodate 34 persons in total.

- The height (above baseline) of Triple-E is 73 metres, slightly higher than Allure of the Seas (72 metres), which currently is considered the highest.

- Other principal measures of the Triple-E include:- Beam (breadth): 59 metres- Draught: 14.5 metres- Deadweight: 165,000 metric tonnes- Reefer container capacity: 600- Top speed: 23 knots.”

Source: Maersk

The largest ship in the world requires just 22 or a minimum of 13 people to man it.

Update:

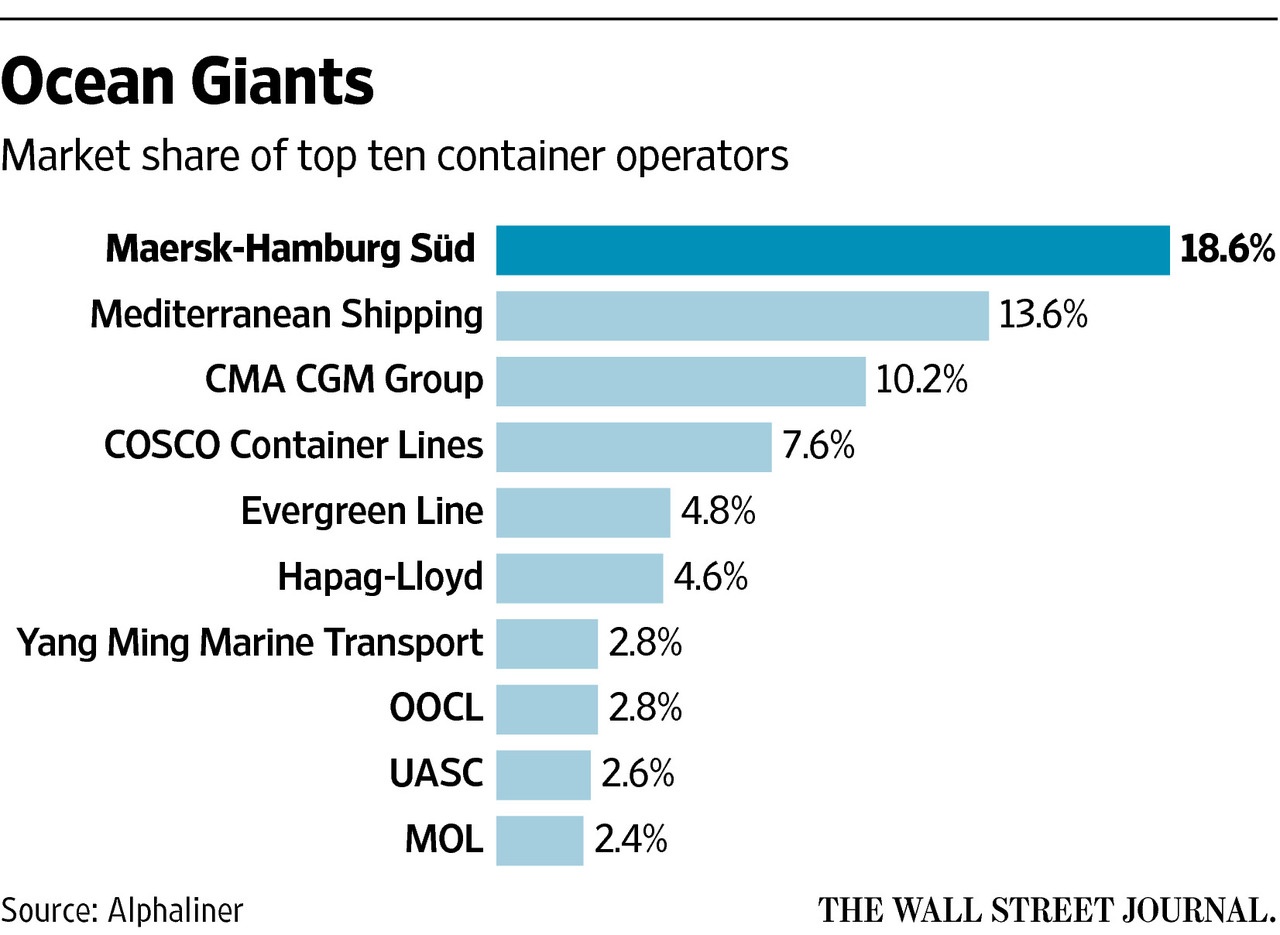

The Top 10 Container Firms in December,2016:

Click to enlarge

Source: WSJ