The chart below from a journal article shows some key trade figures among Nafta member nations:

Click to enlarge

Source: What’s at Stake in Nafta?, WSJ

The chart below from a journal article shows some key trade figures among Nafta member nations:

Click to enlarge

Source: What’s at Stake in Nafta?, WSJ

In a post earlier today, I wrote about the proposed reduction in US corporate tax rate by the current administration. Should the rates decline substantially which sectors will be the biggest beneficiaries?. One of the misconception among investors is that the tech sector will be a big winner of a lower tax rate since they have huge cash hoards stashed abroad. However according to an report at Franklin Templeton, the sectors that are likely to benefit the most are financials, consumer staples and industries.

From the article:

Financials, Consumer Staples, Industrials Likely to Benefit

Potential US tax reforms are likely to have a wide range of impacts on different sectors and companies within the equity market, but ultimately it depends on an individual company’s situation. That said, as we look across sectors, we see some companies more likely to benefit and some less likely to benefit. In our view, financial-oriented companies with higher effective tax rates are among the likely beneficiaries. We also would put consumer discretionary, consumer staples and industrials companies in that category, particularly companies with high domestic production operations and/or a specific export focus. Companies competing with large importers of goods may see a competitive advantage.

Those that may see a less significant benefit include health care and technology companies; in these areas we may actually see an increase in cash or GAAP tax rates,1 particularly for companies that have been a bit more aggressive with tax-planning strategies and/or the offshoring of a significant component of their operations.

Overall, we think tax reform is likely to be positive for US equities in general. The benefit from lower tax rates is likely split between earnings and cash flow at the corporate level. Combined with the effects of higher spending and possible domestic investment and other stimulus measures, we see the potential for US GDP growth to accelerate between 0.5% and 1.0% over the next several years.

Source: The Sectors Most Likely to Cheer US Tax Reform by Ed Perks, CFA, Franklin Templeton Investments

Since the election, financials and industrials have soared but consumer staples have lagged. So investors may considering adding consumer staples stocks while waiting for lower prices in the other two sectors and then adding stocks selectively.

The US corporate tax rate is one of the highest in the world especially among developed countries. President Trump has proposed to cut this rate to 19% to make the country competitive globally. However according to a report at Schroders the eventual rate is likely to be in around 25%.

The chart shows the current US rate compared to other countries and the proposed rates:

Click to enlarge

Source: Letter from America – part two: What will be Trump’s top legislative priorities? by David Docherty, Schroders

Mexico is one of the three important trading partners of USA. The Southern neighbor is not only a major exporter of goods to the US market, but the U.S. also exports a substantial amount of goods to Mexico. The following table shows the major trade partners of the US:

Click to enlarge

Source: A Seaworthy Mexico into the Maelstrom by Pablo Echavarria, CFA, Thornburg Investment Management

Mexico had a trade deficit of about $60 billion with the US in 2016 compared with a trade deficit of $366 with China. Mexico is the 2nd largest export market for US after Canada.

From the above article:

Nomura recently calculated the imports/exports ratio for several U.S. trading partners (a measure of balance in bilateral trade relations.) Mexico’s ratio is 1.27x (that is, for every $1.27 of goods imported into the U.S. from Mexico, the U.S. exports $1 of goods to Mexico). That compares favorably to the ratios of the U.S.’s other main trade partners: China at 4x; Korea at 1.7x; and the Eurozone at 1.5x. Moreover, one U.S. Class 1 railroad company running between the U.S. and Mexico recently reported that approximately 60% U.S./Mexico traffic is southbound, and added that it’s actually growing faster than northbound traffic. (emphasis mine)

So the key takeaway is trade with Mexico is not a one-way street meaning it is not just Mexico that is benefiting from sending goods to the US market. This important fact is not widely mentioned as Mexico becomes the target of the current political climate. As noted above U.S. also benefits from selling a lot of goods to Mexico. Hence trade war with Mexico will adversely both countries and not just Mexico.

Also see: The US shouldn’t blame Mexico for “losing” at trade — it should blame Germany, FT Alphaville

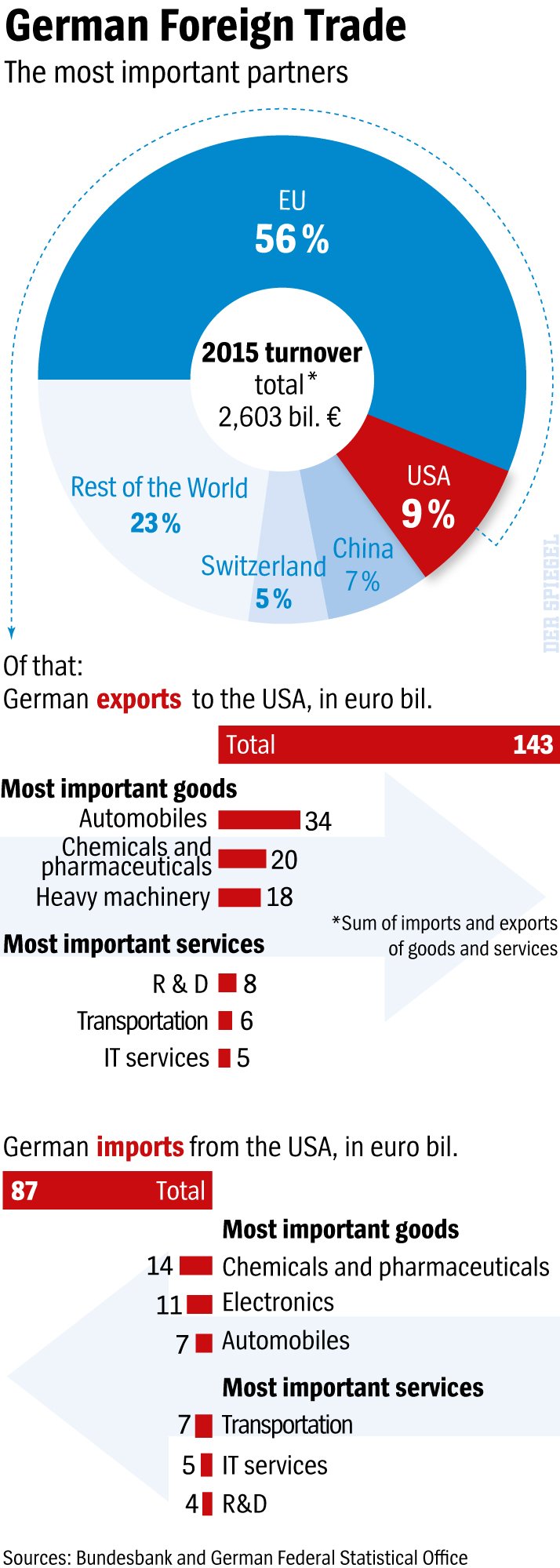

The EU is the largest trade partner for Germany account for 56% of total turnover. At 9%, the US is second major trade partner.Last year German exports to the US totaled 143 billion Euros.

Click to enlarge

Source: The New Age of Protectionism- Trump’s Attack on Germany and the Global Economy, Der Spiegel

The US market is a major market for German auto makers Daimler, Volkswagen, BMW, Audi and Porsche. While the first three have manufacturing facilities in the country, all Audi and Porsche vehicles sold in the US were imported from Germany.

Also see: Germany Inc. Touts Benefits of Trade After Trump Dumps on Euro, Bloomberg