U.S. equities have soared by double digit percentage points so far this year. However they may not be the winners next year. More specifically when investing in stocks it is important to focus on the future and identify opportunities as opposed to looking the past returns. So investors can look for better growth outside of the US.

In addition, no country is the top performer in terms of equity returns every year in a row. The top market in one year may turn to be worst next year and vice versa. To put it another way, no one country can be the best performer consistently year after year.

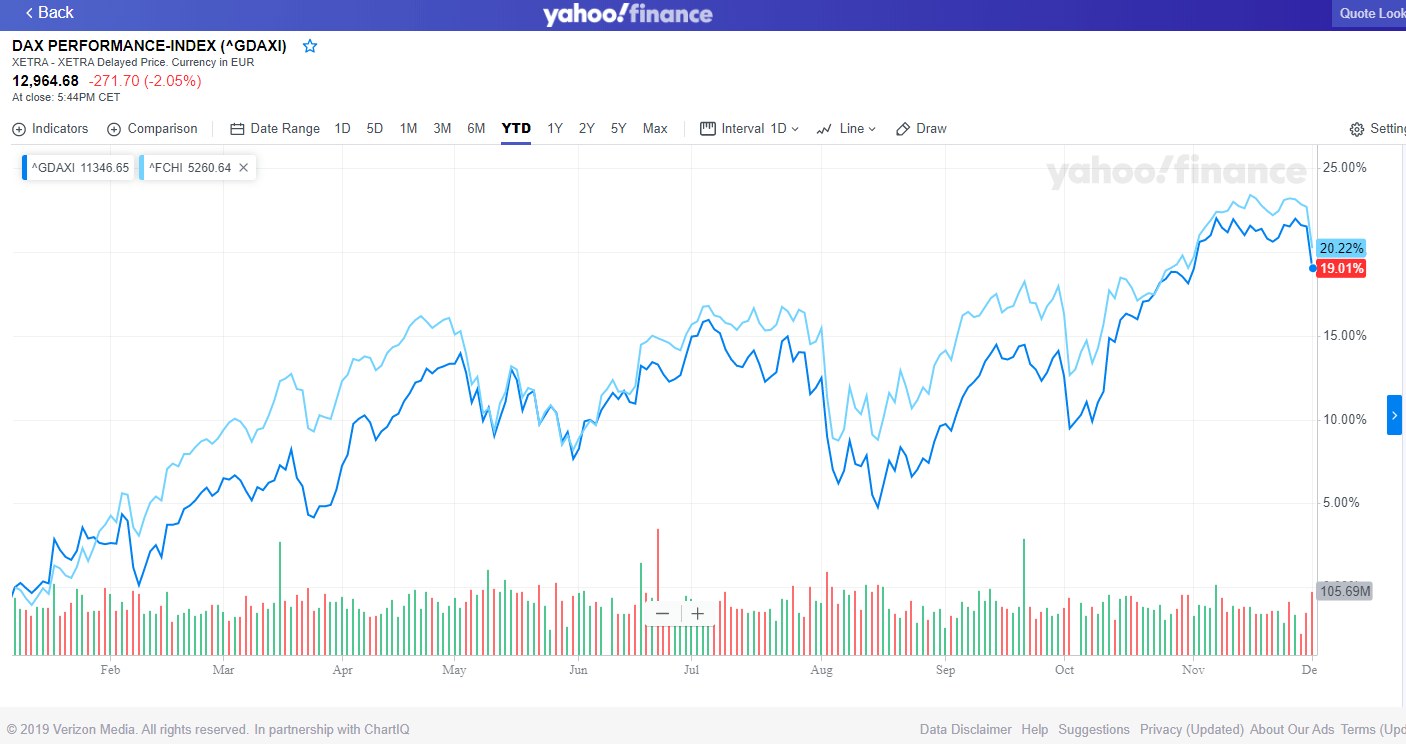

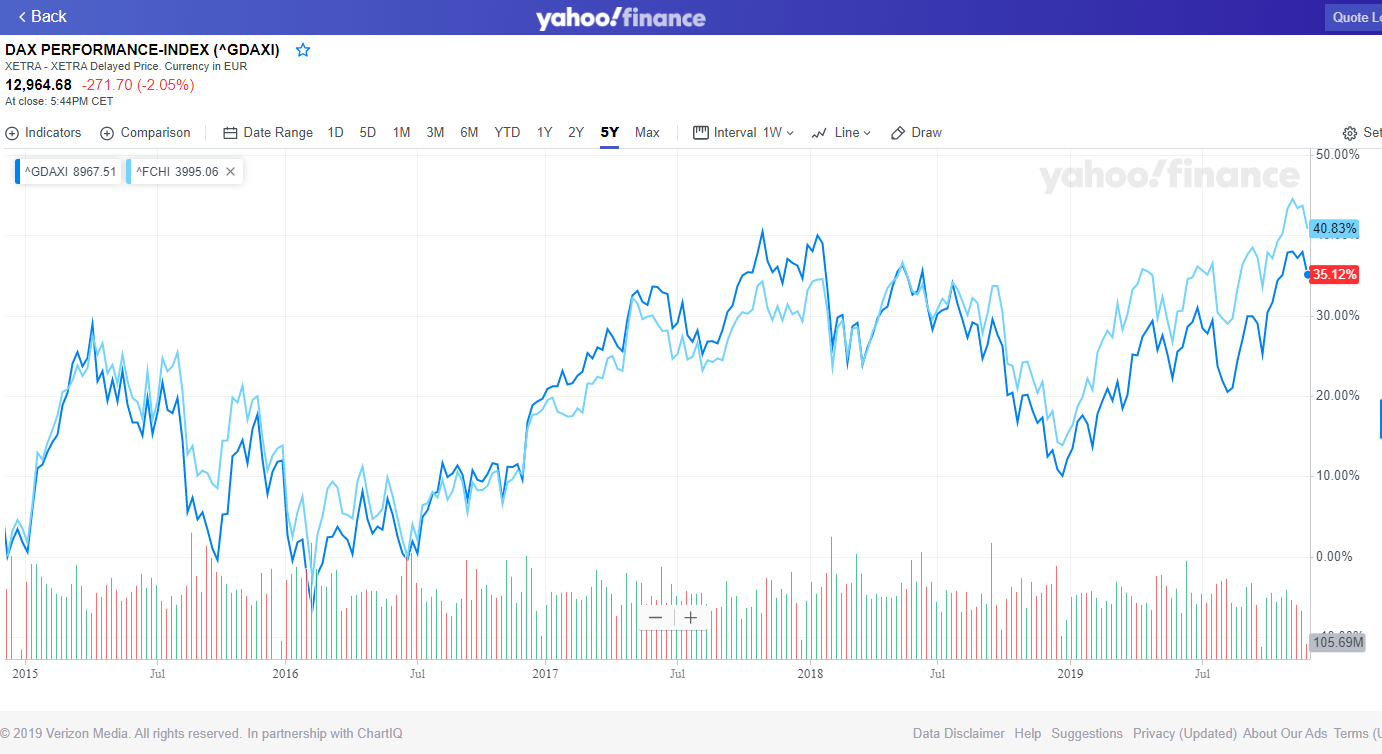

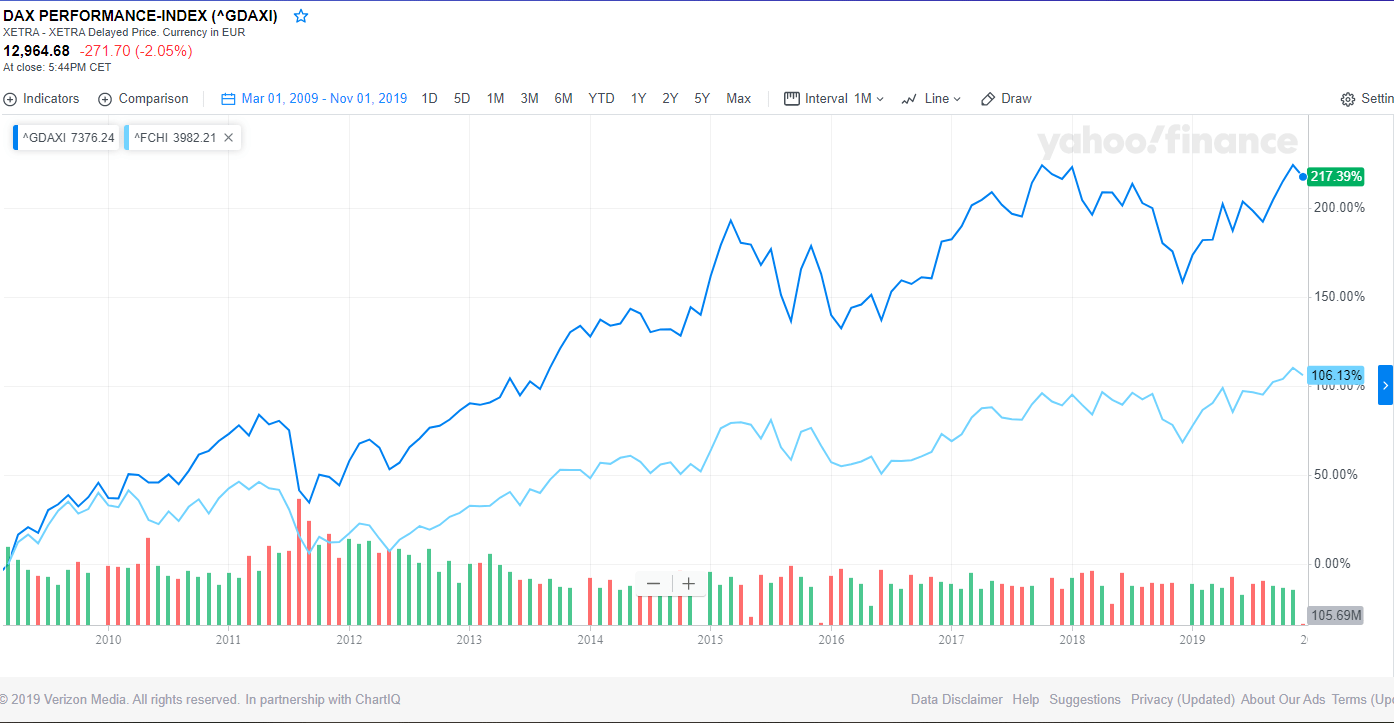

Relative to the US market, European markets offer attractive options for next year according to a few recent articles. While many European benchmarks have done well in 2019, they are still way behind their American peers from a long-term perspective. From an bullish article at Thornburg Investment Management:

The case for Europe

Yet, Europe has some green shoots. The European Central Bank (ECB), the monetary policy maker for the eurozone,1 recently launched another aggressive quantitative easing program. Meanwhile, the eurozone’s annualized wage growth is already heading in the right direction, from 2.3% to 2.7% in the last four quarters. Unemployment in the eurozone has come down in recent months from its 2008 highs to around 7.5%.2

Although the U.S. S&P 500 Index has outperformed the MSCI Europe Index seven of the last 10 years, the MSCI Europe Index has bested the S&P 500 Index in 10 individual years of the last 2 decades.3 Moreover, from 2000, when the U.S. tech bubble burst, to 2008, the MSCI Europe Index led U.S. markets.

If that’s not a sufficiently compelling investment case, consider these additional facts:

- Many of the largest companies in Europe generate less than a third of their revenue from the eurozone, so macro considerations at home may not affect company performance.

- Developed European equities are trading at a wide discount to U.S. equities on a forward P/E basis at 14.05X versus 17.26X, respectively, while the MSCI Europe Index has a dividend yield of 3.79% versus that of the S&P 500 at 1.9%.4

- Some European companies are global leaders and innovators in industries such as luxury goods and renewables.

- Europe has more companies with higher ratings for sustainability and ESG management than any other region,5 ratings that are linked to lower enterprise risk and better corporate performance over time.

PERCENTAGE GDP CONTRIBUTED BY MSCI ACWI INDEX REGION, 2018 (AT 12/31/2018)

Developed Europe represents about 15% of the MSCI ACWI Index but is also the third biggest contributor to global domestic product (GDP), meaning it should not be ignored.

Sources: Thornburg Analysis, FactSet, MSCI, IMF

MSCI EUROPE: CONSTITUENTS’ CUMULATIVE REVENUE BY REGION (TRAILING 12 MONTHS TO 10/31/2019)

The 443 companies in the MSCI Europe Index sourced nearly 70% of their cumulative revenue from outside developed Europe in the last year.

Sources: Thornburg Analysis, MSCI, FactSet

Below is an excerpt from an outlook on European stocks piece at Schroders:

Opportunities in stocks sensitive to the cycle

Cyclical value looks attractive for a start. This means undervalued stocks that are sensitive to the economic cycle. Our view is that we are at a turning point in the cycle, with a more synchronised global recovery expected in 2020.

A classic business cycle call is to buy economically-sensitive stocks when purchasing managers’ indices (PMIs) are low and consensus is pessimistic. PMIs are forward-looking surveys of trends in the manufacturing and services sectors, and they are at weak levels last seen in the Global Financial Crisis. Our business cycle process therefore points towards a cyclical tilt.

This takes us to some very unloved areas of the market. We think oil & gas is a sector where there is significant potential, specifically oil & gas services where many businesses are trading on very depressed valuations. However, we believe they could be in the early stages of a recovery with day-rates for rigs improving and oil majors increasing investment.

Banks are another area we think look compelling. Many have become lowly valued by the market owing to the argument that low interest rates (and correspondingly low bond yields) are squeezing profit margins beyond all hope of a near-term return to significant profitability. However, yields don’t need to move a great deal for sentiment to change. We are particularly supportive of those European banks with strong franchises and decent market share.

Other, more highly valued, pockets of the market still have attractive equity stories too, such as technology. Semiconductors have enjoyed strong performance this year and select businesses may have further to go. Areas such as software and computer services could also offer opportunities.

Source: Outlook 2020: European equities, Schroders

Another recent article at Reuters also discussed about how fund managers are finding foreign stocks’ valuation attractive at current levels. From the article:

Even with the MSCI All World Country Index, which tracks global equities, nearing record highs set in January, 2018, fund managers and analysts say global stock markets still offer a better chance to outperform U.S. stocks in the year ahead. The cite significantly lower valuations after failing to keep pace with the U.S. equity market for much of the last decade.

“We’re starting to see a period where valuation is going to be the driver for future returns,” said David Marcus, chief investment officer at Evermore Global Advisors. He has been shifting more of his portfolio into European stocks such as Belgium-based medical lab equipment maker Fagron NV (FAGRO.BR) and French media giant Bollore SA (BOLL.PA).The forward price-to-earning ratio for the broad Stoxx 600 index, for instance, is 15.4, well below the 19.3 forward P/E of the S&P 500, according to Refinitiv data.

Any narrowing of that large gap in valuations could be a driver, even for companies that have strong stock performance this year, said Thomas Banks, a portfolio manager for the Federated International Small-Mid Company fund who has been increasing his stake in European companies.

He remains bullish on companies such as London Stock Exchange Group PLC (LSE.L) and Sweden-based casino game operator Evolution Gaming Group AB (EVOG.ST), both of which are already up 50 percent for the year to date.

Source: International stocks to outperform U.S. in 2020: investors, Reuters

Related ETFs:

Disclosure: No Positions