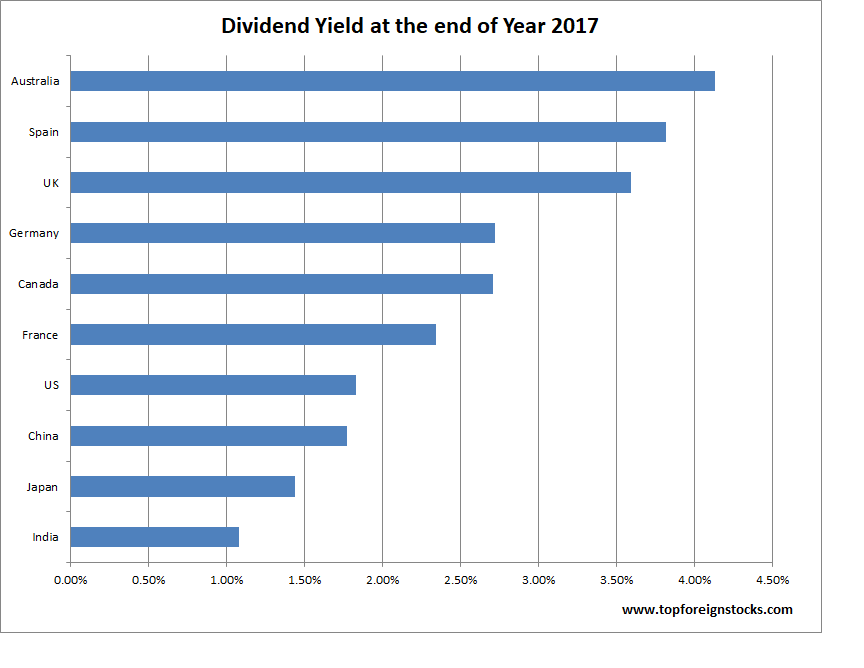

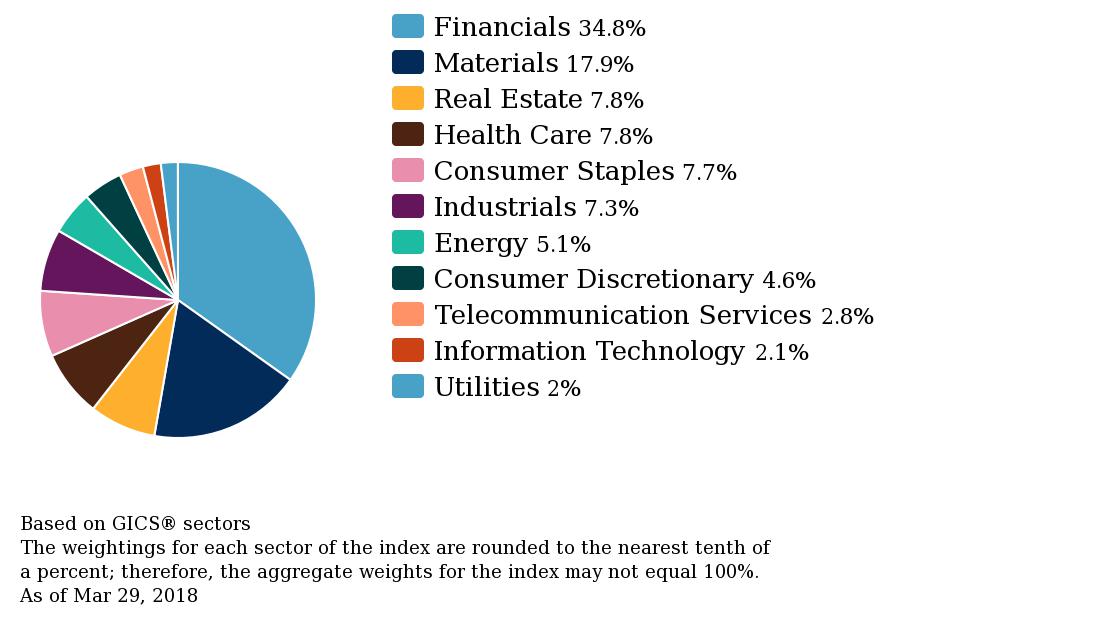

Dividend yields vary by country. Some countries such as those in developed Europe, Australia, New Zealand, etc. are traditionally high dividend payers. Most emerging markets are stingy in terms of rewarding shareholders with dividends. Countries like Japan and South Korea are also not great for dividends.

The following chart shows the dividend yields by country for the largest global economies as of the end of 2017:

Click to enlarge

Data Source: Siblis Research

Australian firms have more than double the dividend yield of US firms.