Colombia has elected Convservative Iván Duque as the next President in the runoff Presidential election held yesterday. Duque got 53.9% of the vote and beat leftist opponent Gustavo Petro. The pro-business friendly Duque has the support of former president Uribe and business leaders.

From an article at The Guardian:

Colombia has chosen Iván Duque, a conservative neophyte, to be its next president after a long and divisive campaign that often centred on a controversial peace process with leftist rebels the Revolutionary Armed Forces of Colombia (Farc).

Duque, who opposes the peace deal, won in a second round runoff election on Sunday with 53.9% of the vote. His vanquished opponent, Bogotá’s former mayor Gustavo Petro – once a leftist militant himself – defends the peace process.

Despite being the first leftist in the conservative country’s history to come so close to the presidency, he lost on the night, taking 41.8% of the vote.

Many now worry about the fate of the fragile peace deal signed with the Farc in 2016, which formally ended 52 years of civil war that left 220,000 dead and seven million displaced.

Source: Iván Duque wins election to become Colombia’s president, The Guardian, June 17, 2018

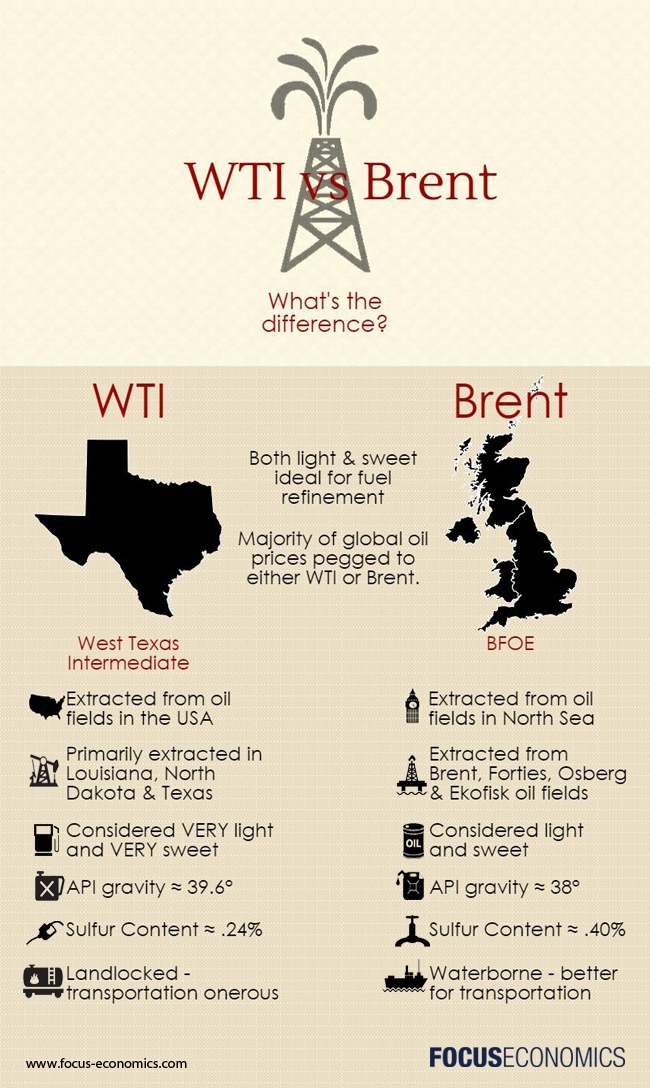

As a result of the conservative win, Colombian stocks could get a boost today. Five Colombian companies including Ecopetrol(EC) and Bancolombia(CIB) trade on the US exchanges. A few more trade on the OTC markets. Oil giant Eocpetrol has soared in the past year and has room to increase further depending on global oil prices.

Disclosure: Long CIB and EC