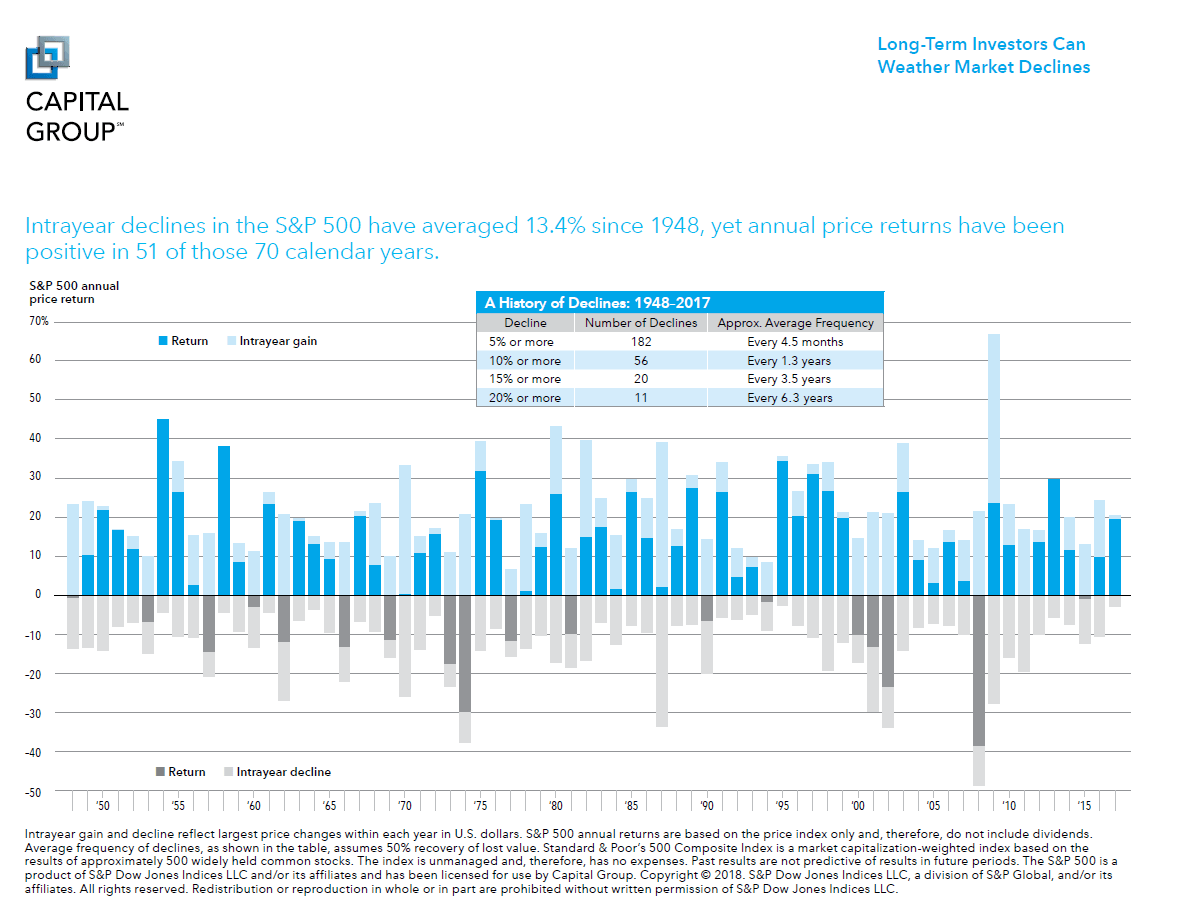

The cyclical bull market in US equities continue. Benchmark indices like the NASDAQ are establishing record highs and investors can’t get enough of some of the big tech names. Naturally some investors are wondering if the current euphoria in the stock market will come crashing down and the bull market will suddenly come to a dead stop. The current bull market that started in the depths of financial crisis in March 2007 is 112 months old.

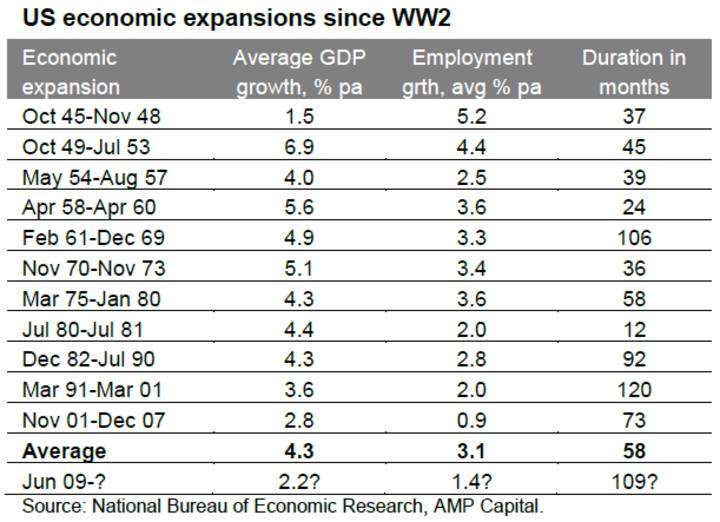

The bull market has followed a strong economic expansion. In fact, the current expansion at 109 months is one of the largest economic expansions since World War II as shown in the chart below:

Click to enlarge

Source: The US economy – does the flattening yield curve indicate recession is imminent? by Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist, AMP Capital