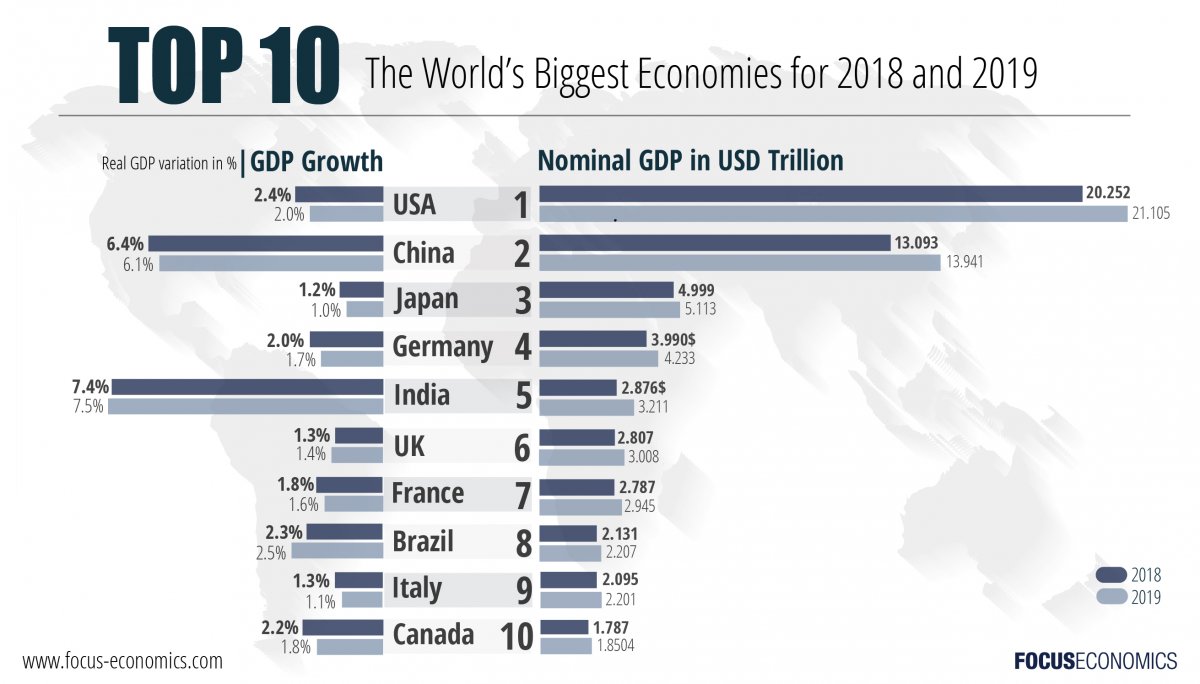

The US is the biggest economy in the world now and is projected to be maintain that leadership in 2019 as well. However China’s economy is growing faster and the country is catching up fast with the US.

Click to enlarge

Source: The World’s Top 10 Largest Economies, Focus Economics

In addition to China, the emerging economies of Brazil and India are also among the top economies of the world.