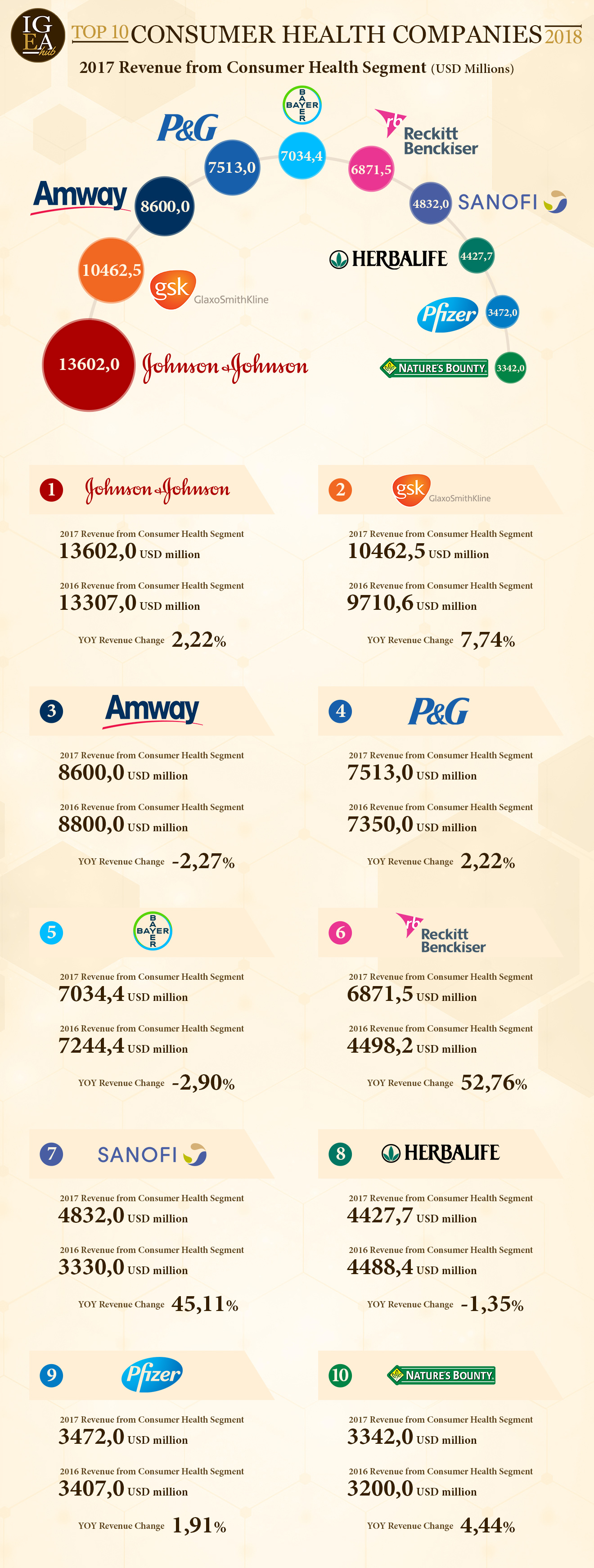

The consumer health industry is a multi-billion industry worldwide. Some of the consumer items in this area include band-aids, teeth whitening products, vitamin products, acne removing creams, etc. In this post, let’s take a quick look at The Top 10 Global Consumer Health Companies in 2018.

Below is a short overview of this industry:

Consumer health companies deals with products in wellness, oral health, nutrition, and skin health. These consumer healthcare products primarily include the “over-the-counter” (OTC) drugs that are sold without a prescription from registered medical practitioner. Globally large number of acquisitions, mergers, and shutdowns has resulted in industry consolidation and large market share is controlled by the top 10 firms. In 2017, top 10 consumer health companies accounted for the collective revenue of USD 70157.1 million, a moderate growth from USD 65335.6 million in 2016.

Click to enlarge

Source: IGEA Hub

Some of the companies from the above list are: Johnson & Johnson (JNJ), Procter & Gamble Co (PG), Reckitt Benckiser Group plc (RBGLY), GlaxoSmithKline (GSK), Bayer(BAYRY), Sanofi (SNY) and Pfizer Inc (PFE).

Investors can avoid PG due to lack of any growth and management issues.

Also checkout:

- The Top 20 Best Selling Drugs in 2018: Chart

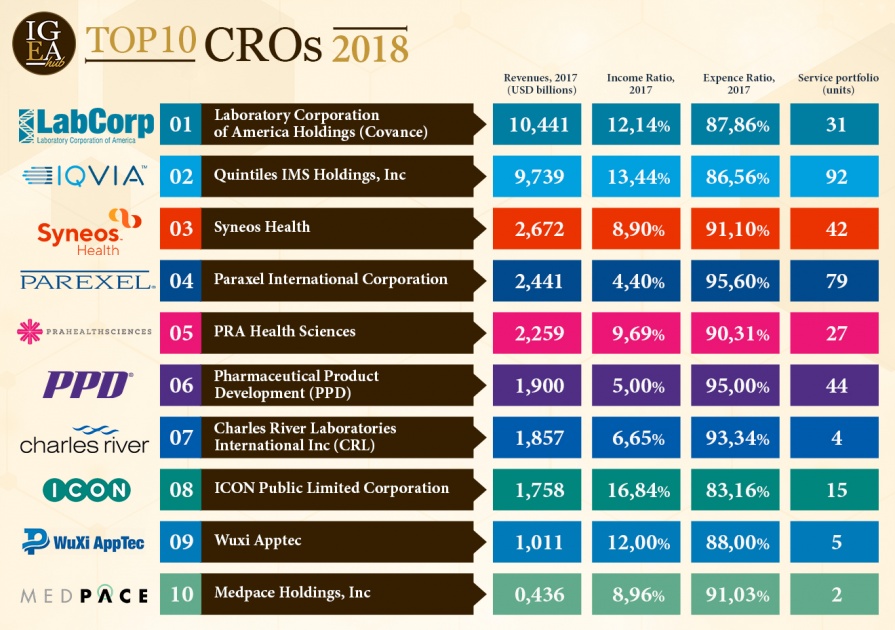

- The 10 Best Global Contract Research Organizations (CROs) in 2018

- The Top 10 Pharmaceutical Companies 2018

Disclosure: Long RBGLY