In the oil and natural gas industry, there is a group of companies called the National Oil Companies (NOCs). Unlike the private oil companies like Exxon(XOM), BP(BP), etc. the NOCs are majority or fully owned by the government of the country where they are located. For example, Pemex, the largest oil company of Mexico is owned by the state. Most of the NOCs are in emerging markets. In the developed world, a few NOCs exist such as Equinor(EQNR) of Norway.

While private oil majors may have bigger market capitalization NOCs own the most of the known oil reserves and have great influence in the domestic market and beyond.

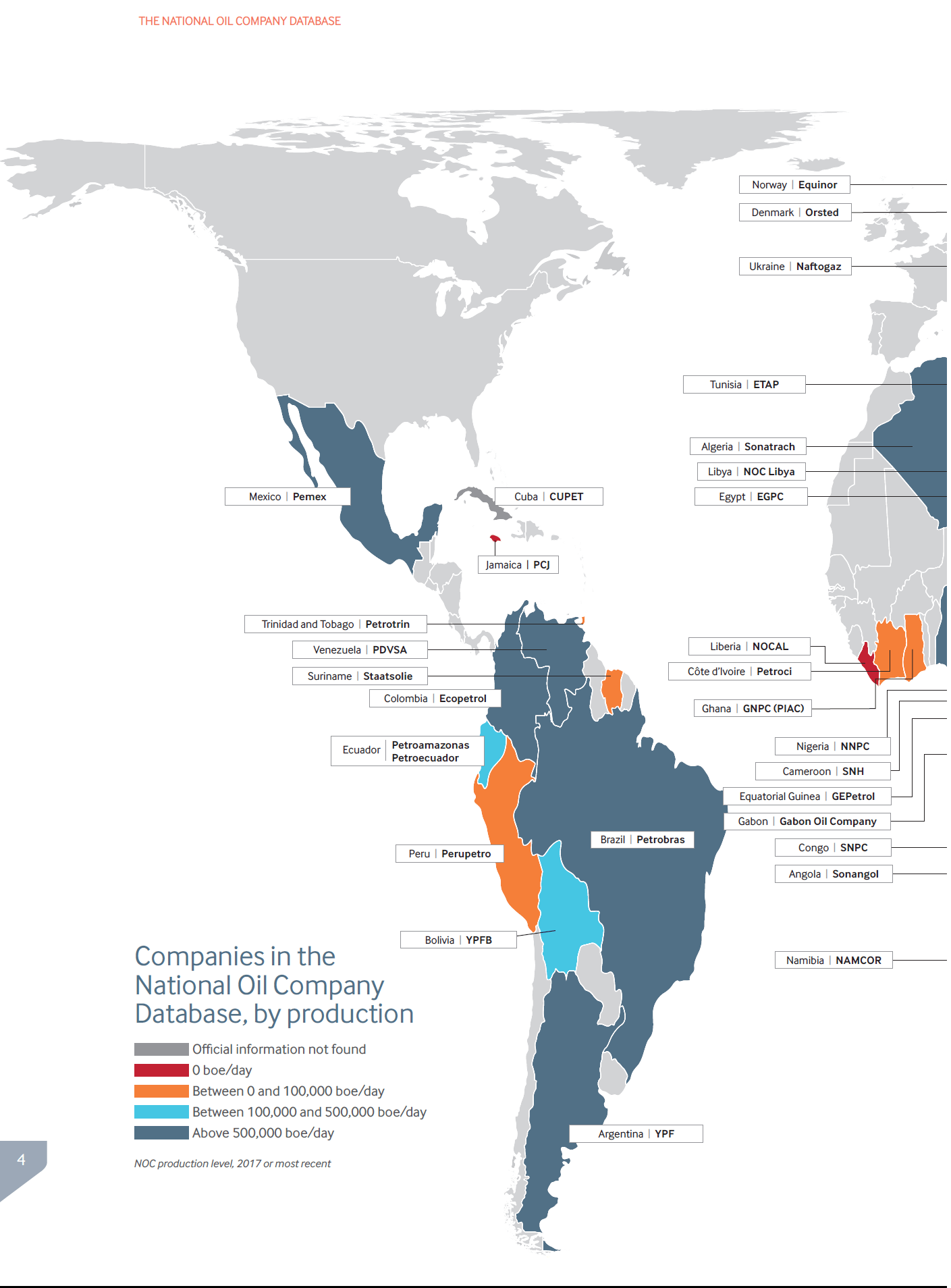

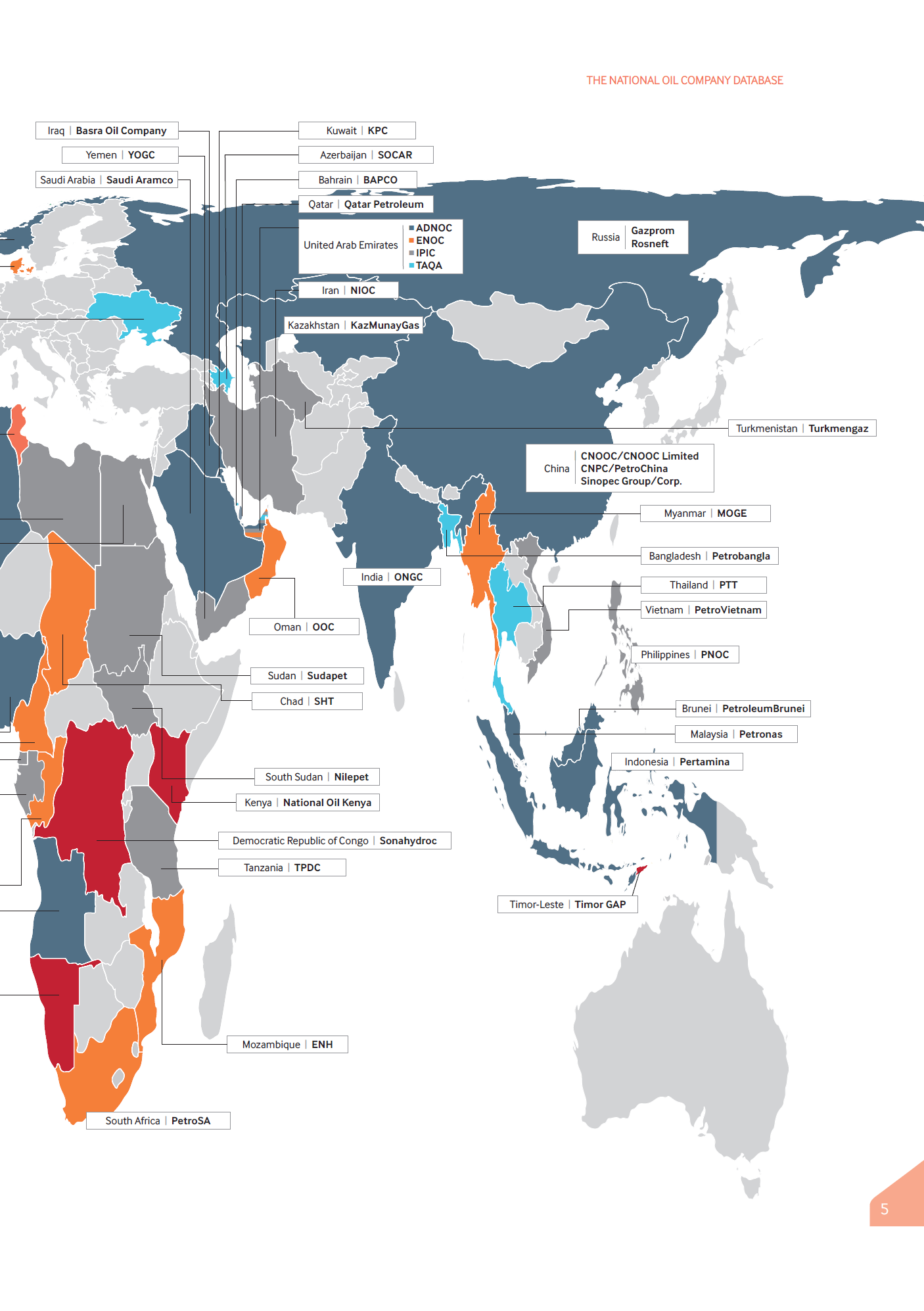

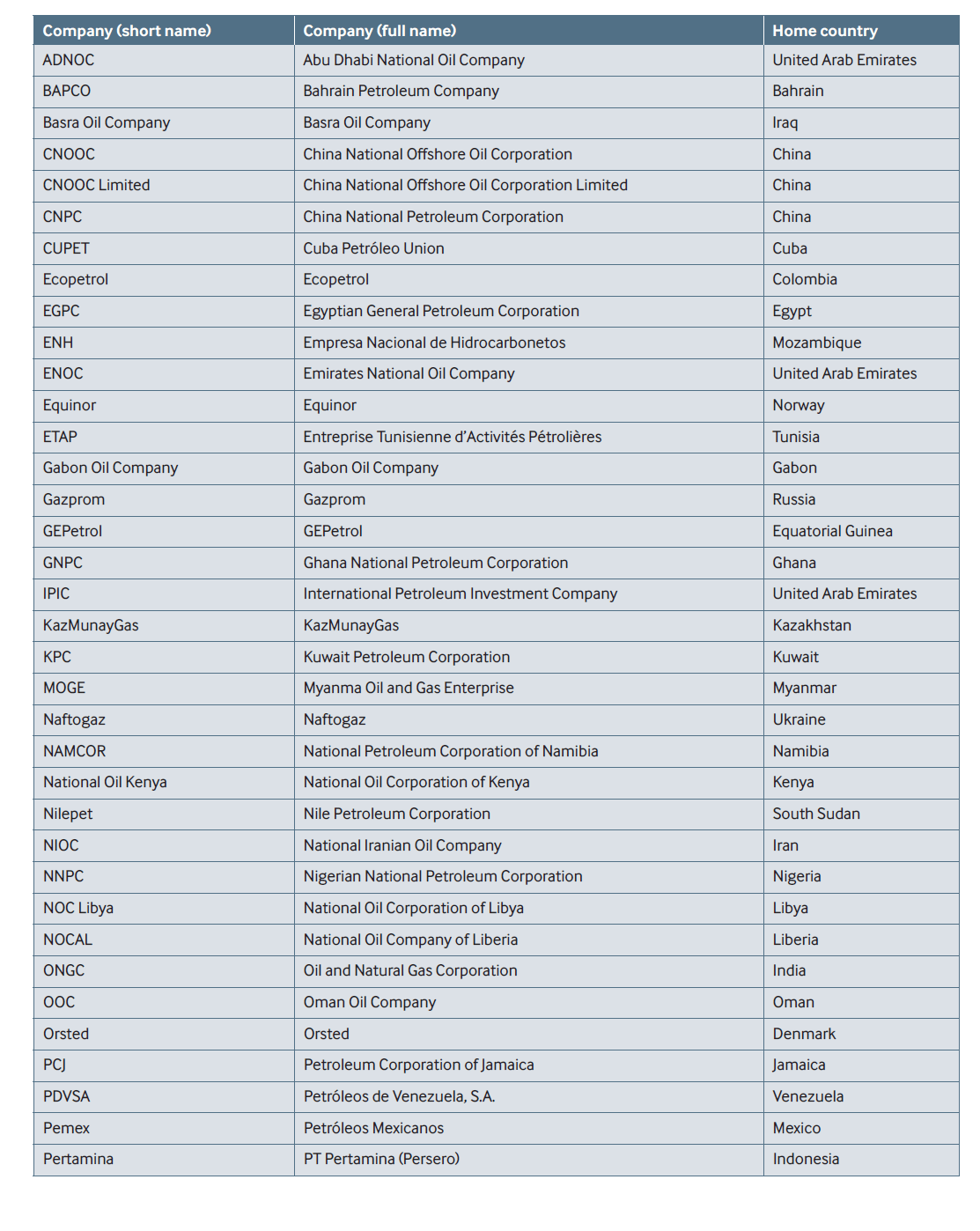

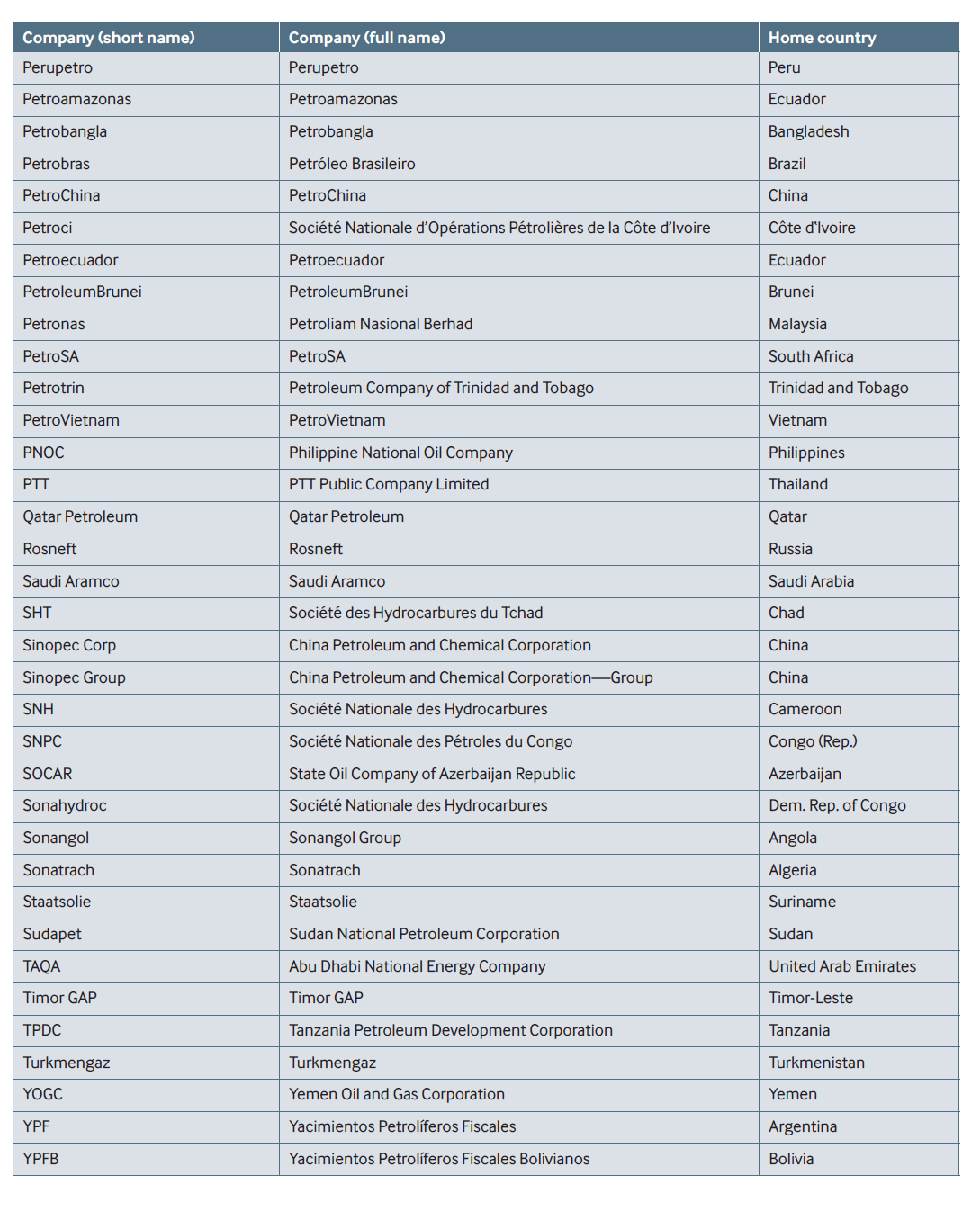

The following charts and lists show all the NOCs of the world:

National Oil Companies (NOCs) by Country in Map:

Names of National Oil Companies (NOCs) by Country:

Source: The National Oil Company Database, National Resource Governance Institute

Disclosure: No positions