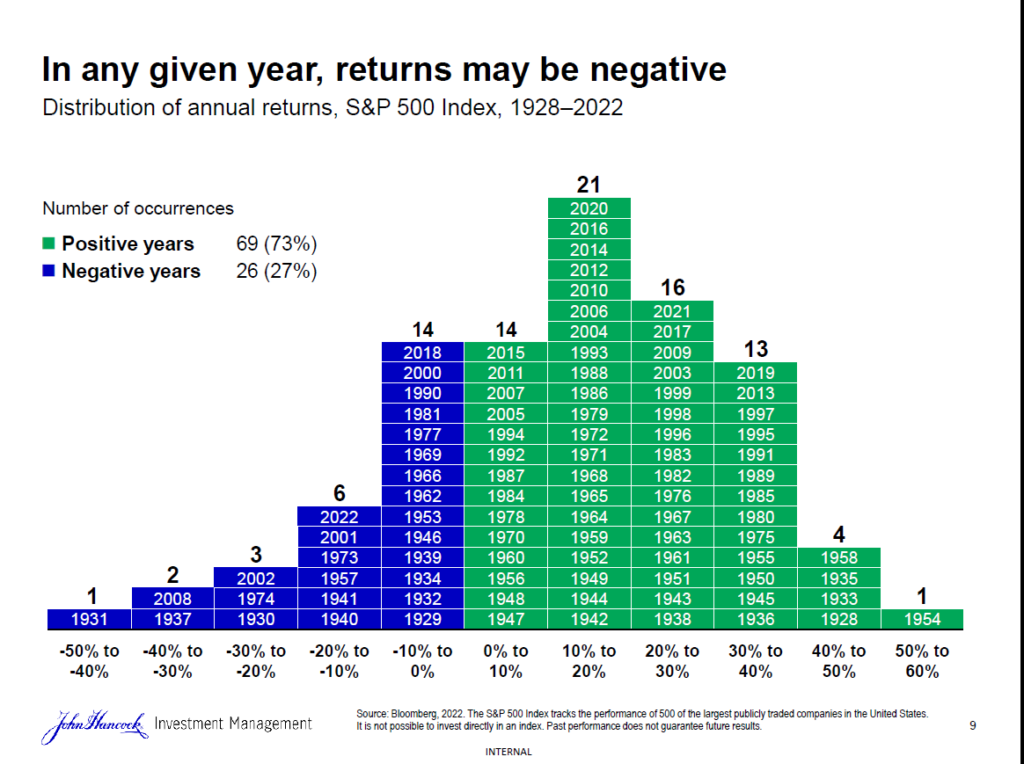

I have written many times in the past that investors should keep their long-term goals in mind and not worry too much about short-term gyrations of the market. While markets may be down one year they can come back roaring the next year. For instance, the S&P 500 was down over 20% in 2022 but this year it has recovered strongly. The following chart shows the importance of the need to maintain a long-term view with equity investing. The annual returns of the S&P 500 index from 1928 to 2022 shows that the returns were positive 73% of the time and negative only 27% of the time. In addition, when returns where positive it was more than 10% in majority of the years shown.

Click to enlarge

Source: 10 things every investor should know about investing workbook, John Hancock Investments

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

Disclosure: No positions