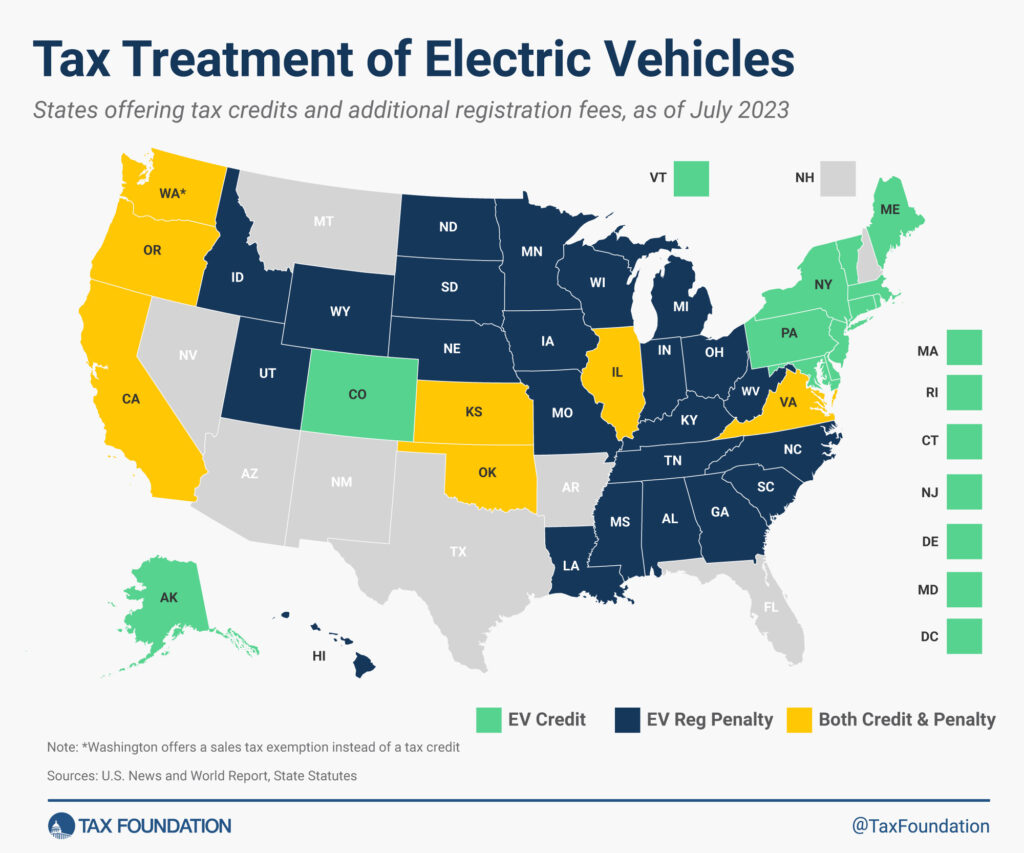

The tax treatment of Electric Vehicles(EVs) varies by state in the US. Some states give credit while others penalize consumers for purchasing EVs. Some pretend to be neutral by charging both the penalty and offering a credit. Consumers get a credit of $7,500 for qualified EV purchases from the Federal government. But at the state level it is a mess. The following chart from Tax Foundation shows the tax treatment of EVs by state:

Click to enlarge

Source: How Are Electric Vehicles Taxed in Your State? by Benjamin Jaros, Adam Hoffer , Tax Foundation

Some states charge higher annual registration fees in order to compensate for the loss of gas taxes from an EV owner. States charge gas taxes for each gallon of gasoline sold to fund road maintenance and build new roads.

Most of the “fly-over” states penalize EV buyers by not offering a credit and charging more registration fees. This is not surprising. Example of such states include Michigan, Kentucky, Missouri, etc. No wonder lots of brand new gas stations are popping up in these states instead of EV charging stations. Indirectly these states are implying that they prefer fossil fuels.

For more details on this topic checkout the above linked article.