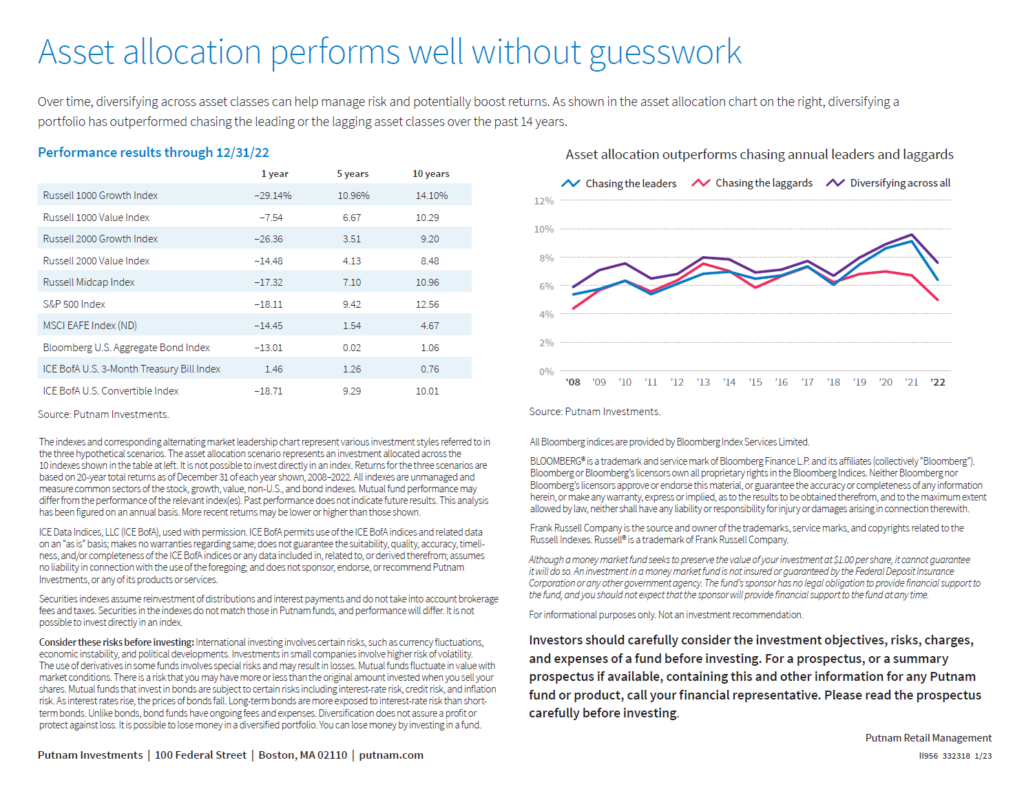

Diversification is one simple way to reduce risk. A well-diversified portfolio among various asset classes tend to perform well over the long run. Another reason why diversification is necessary because market leadership changes over time. A few years ago we discussed this topic in my post titled The Largest 10 US Stocks at the Start of Each Decade. With that brief introduction, let’s review the below chart that shows why diversification is necessary:

Click to enlarge

Source: Putnam Investments

A classic example of this scenario is S&P 500 was the top performer in 2021. But the following year cash earned the best returns while large cap companies(LCC) declined by over 18%.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

- SPDR Portfolio S&P 500 ETF (SPLG)

- Vanguard Total Bond Market ETF (BND)

- Vanguard MSCI Emerging Markets ETF (VWO)

- Vanguard Developed Markets Index Fund ETF(VEA)

- iShares TIPS Bond ETF (TIP)

Disclosure: No positions