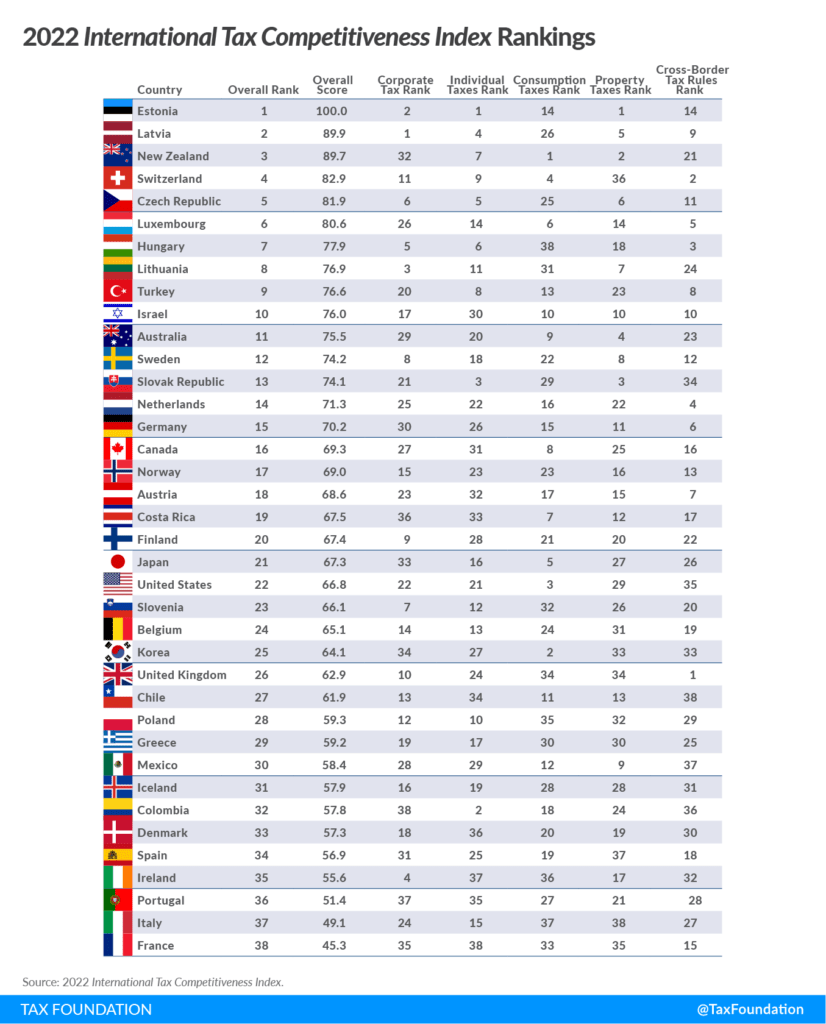

The Tax Foundation recently published the International Tax Competitiveness Index report for 2022. This is a fascinating study that measures important factors related to taxes and ranks the OECD countries. Estonia ranked 1 this year with the best tax code followed by Latvia and New Zealand. The US came in at number 22, the same as last year just below Japan but ahead of Slovenia.

From the report:

The International Tax Competitiveness Index (ITCI) seeks to measure the extent to which a country’s tax system adheres to two important aspects of tax policy: competitiveness and neutrality.

Click to enlarge

Source: International Tax Competitiveness Index 2022, The Tax Foundation

Below is an excerpt from the report that discusses how the ITCI index was measured:

To measure whether a country’s tax system is neutral and competitive, the ITCI looks at more than 40 tax policy variables. These variables measure not only the level of tax rates, but also how taxes are structured. The Index looks at a country’s corporate taxes, individual income taxes, consumption taxes, property taxes, and the treatment of profits earned overseas. The ITCI gives a comprehensive overview of how developed countries’ tax codes compare, explains why certain tax codes stand out as good or bad models for reform, and provides important insight into how to think about tax policy.

Due to some data limitations, recent tax changes in some countries may not be reflected in this year’s version of the International Tax Competitiveness Index.

One of the weaknesses of the US tax system is the high real property tax burden. This is not surprising. Property taxes in the US are as local as you can get. So naturally it has turned into a vehicle for states to add all kinds of extra items each year to jack up the rate. The following are the strengths and weaknesses of our tax system, as per this study:

✔️ Some strengths of the U.S. tax system:

The U.S. provides full expensing for business investments in machinery.

The U.S. allows for Last-In-First-Out treatment of the cost of inventory.

Corporations can deduct property taxes when calculating taxable income.

❌ Some weaknesses of the U.S. tax system:

U.S. states’ sales taxes apply on average to less than a third of the potential tax base.

The U.S. has a partial territorial system and does not exempt foreign capital gains income.

The real property tax burden is among the highest in the OECD.

There are many other interesting facts in this report on each country. So readers may want to visit the foundation’s site for the full report.