Equity markets go through periods of bull run followed by mauling by the bear for some time. Then the bull market returns followed by bear market again. This cycle continues over the years and decades. The duration of bull and bear markets vary but traditionally the bull has stayed longer than the bear as we saw in a post yesterday.

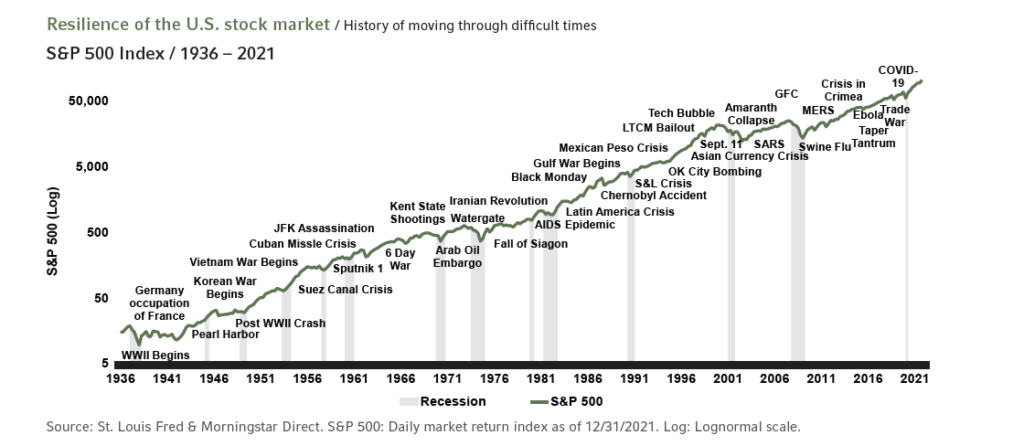

There is never a perfect time to invest. There are always some negative factors that would suggest to avoid investing in stocks at that time. For example, many years ago sovereign debt crises in Europe lasted over years in phases. Currently a few of the adverse factors that investors can worry about include soaring inflation, rising interest rates, climate crisis, etc. In the past, US equity market ploughed through many crises. When viewed over many years or decades, those major crisis events look like a small blip in the performance of markets.

The following chart shows the performance of S&P 500 index from 1936 to 2021 with major crisis events marked:

Click to enlarge

Source: Managing Market Volatility, Russell Investments

The key takeaway is that volatility in the markets is normal and so is bear markets. Investors with a long-term outlook can take advantage of stocks on sale – provided they do the due diligence required and not go all in.

Related ETF:

SPDR S&P 500 ETF (SPY)

Disclosure: No positions