Canada and Australia have many similarities and some differences. Both countries are Federal parliamentary democracies and former British colonies. Canada has a population of 33 million while Australia has 21 million. The GDP per capita is also very similar. For example, in 2008 it was $39,183 for Canada and US$37,298 for Australia (Source: Wikipedia).

The following is a summary from a speech titled “Australia and Canada – Comparing Notes on Recent Experiences” given by Glenn Stevens, Governor, Reserve Bank of Australia, in Sydney on 19 May 2009. The table below shows the economic structures of the countries:

Click to enlarge

The production sectors are of similar size in the two countries. However Canada has more manufacturing than Australia. Canada has less mining than Australia. In mining, there are significant differences between the countries in terms of resources.

In 2008, exports of goods and services accounted for one third of the GDP in Canada compared to about one quarter in Australia. Commodities form a major portion of the exports in both countries. Commodity exports is important to Australia than Canada since machinery, automobiles and other equipments form a sizable portion of exports for Canada. The great white north exports more crude oil, natural gas and forestry products than Australia. Coal, iron ore, nickel, copper, precious metals form the major commodities of Australia.

Australia’s terms of trade grew much more faster than Canada’s after the 2001 recession. Between mid-2002 and 2008, Australia’s terms of trade grew by 60% compared to Canada’s 30%. The difference in growth is due to the differences in price increases of the commodities exported by the two countries. Coal, iron ore, aluminium and copper prices rose significantly in the time period mentioned relative to crude oil and natural gas prices.

Australia’s exports have not suffered as much as Canada’s exports since the main customers of Australian exports are in Asia. Demand from countries like China, Taiwan, Korea have stayed relatively strong. Canada on the other hand depends heavily on the US. As the US economy went into a tailspin last year Canada’s auto, machinery and forestry exports fell drastically.Compared to Canada, Australia has a diverse set of trading partners.

One of the key strengths of Canada and Australia have been their banking sectors. Unlike their peers in the developed world, Canadian and Australian banks came out of the credit crisis strong. Return On Equity stood at 17% and 14.5% for Aussie and Canadian banks in 2008. Due to their limited exposure to complex derivatives and the sub-prime mortgages losses have been much less severe than British and US banks.

Click to enlargeÂ

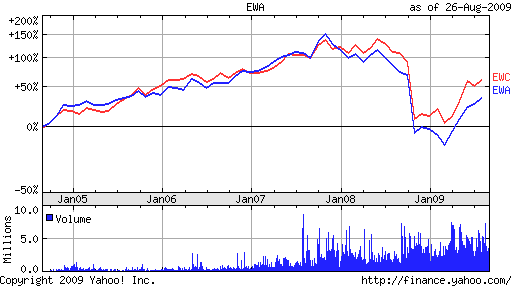

5-year performance comparison of country specific ETFs:

The iShares MSCI Australia Index (EWA) ETF has outperformed the iShares MSCI Canada Index (EWC) ETF in the past 5 years. EWC has more than $2 B in assets compared to EWA’s $1.19. But the dividend yield for the Australian ETF is much higher than the yield for the Canadian ETF. For the next few years, EWA is probably a better buy than EWC since China is growing due to the huge stimulus and other emerging in markets in Asia will follow the lead of China as well. As the US economy is projected to have slow and sluggish growth in the next few years, Canada might have to search for other overseas buyers in order to diversify its export markets.

Update (2/27/17):

Also see: Philip Lowe: Australia and Canada – shared experiences, Speech by Mr Philip Lowe, Governor of the Reserve Bank of Australia

great information for my macroeconomics project!

Cool.Glad this article helped you.