In bear markets there are very few places that investors can hide. Traditionally a few sectors such as utilities, healthcare and food offer shelter from the market storm. These sectors are somewhat immune to factors such as inflation and are necessities that consumers will need even during market downturns. For example, while consumers may cut down on discretionary items such as vacations, furniture, autos, etc. they are not going to avoid buying food.

Among the major food producers, General Mills(GIS) beat earnings and revenue forecasts in the most quarter and also increased its dividend payments by about 6%. This was possible because the firm has pricing power and consumers pay higher prices for their favorite cereals and other items.

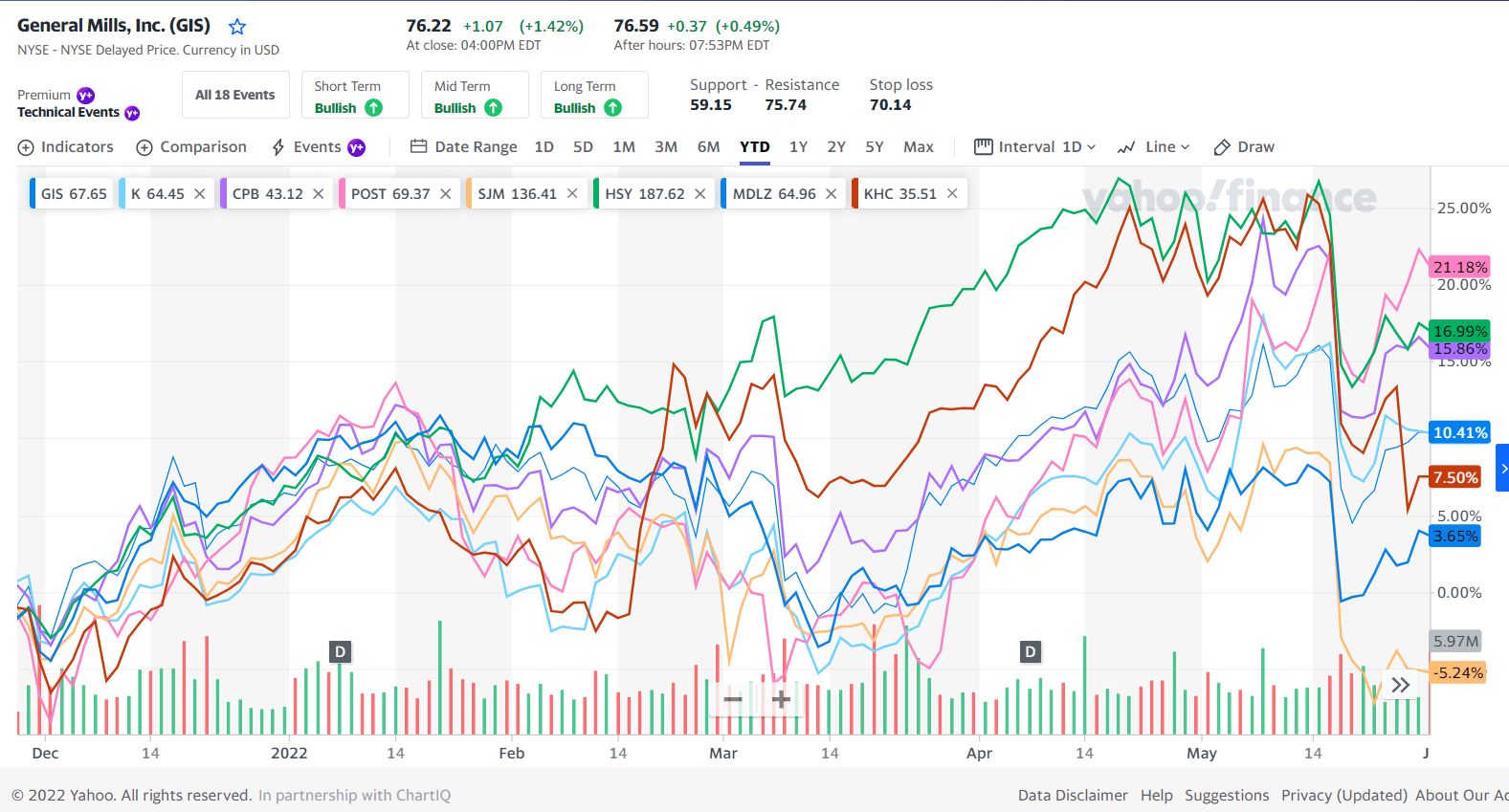

With that said, the below chart shows the comparative year-to-returns of major food stocks:

Click to enlarge

Source: Yahoo Finance

With the exception of J M Smucker Co (SJM) all of the stocks shown are in the positive territory. This type of performance is hard to come by in a bear market when everything keeps going down.

The contrast in the performance of food stocks vs. the overall market is substantial. While the S&P 500 is down 20%, Post Holdings Inc (POST) has shot up by 21% so far this year. The company even implemented a stock split a few months ago.

The key takeaway is that food stocks offer stability and some growth during adverse market conditions. These stocks may seem like offering no returns during bull markets. But their true value becomes clear when growth stocks plunge and the bear is in control.

Disclosure: Long GIS