The Russian invasion of Ukraine will go down in history as one of the major crisis events of the 21st century. For more than two years the world has been dealing with disastrous impacts of Covid-19. Though the pandemic has not ended in any way, Russia decided its the best time to start a war on Ukraine. Almost overnight the world’s attention has shifted from Covid-19 to this new war.

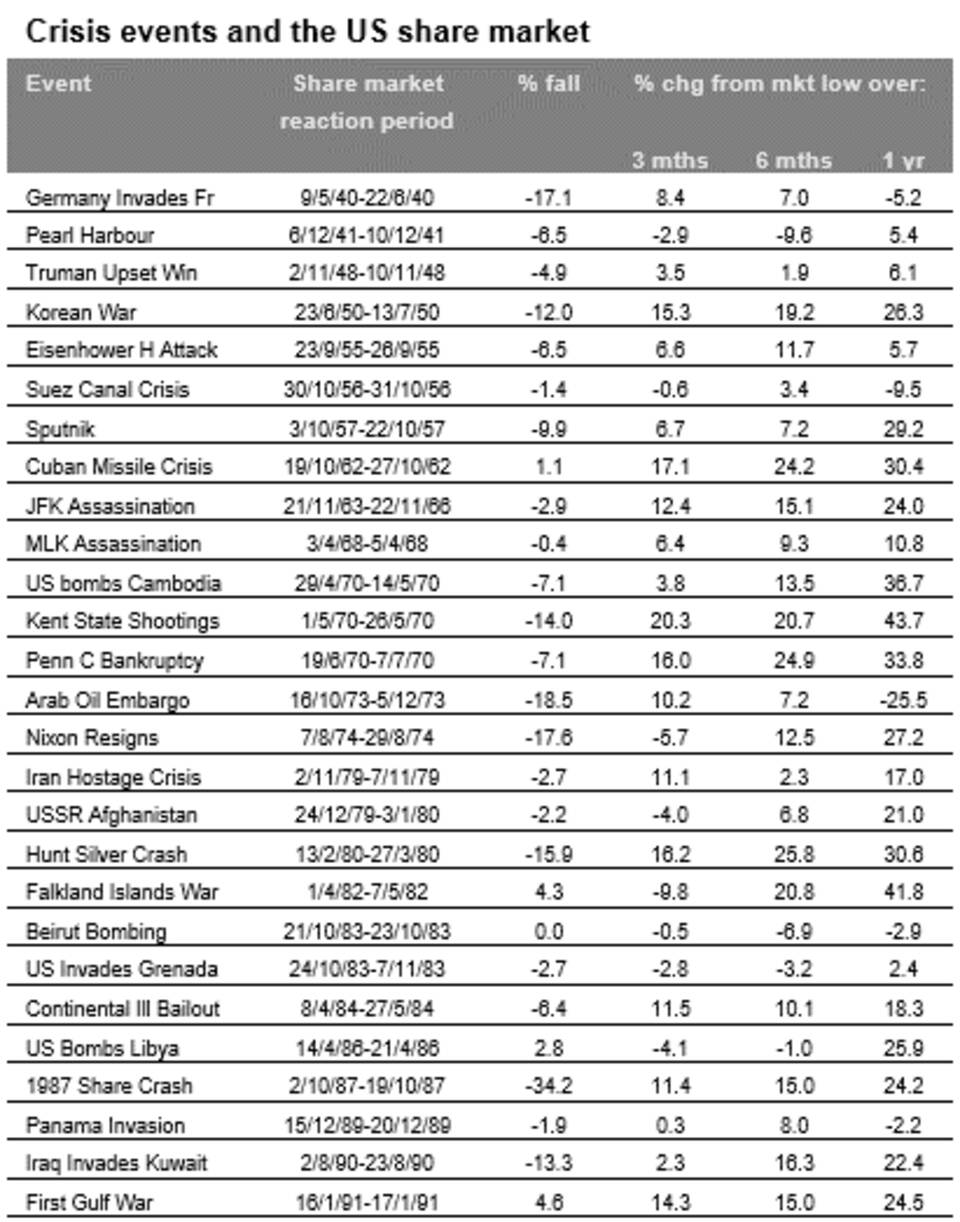

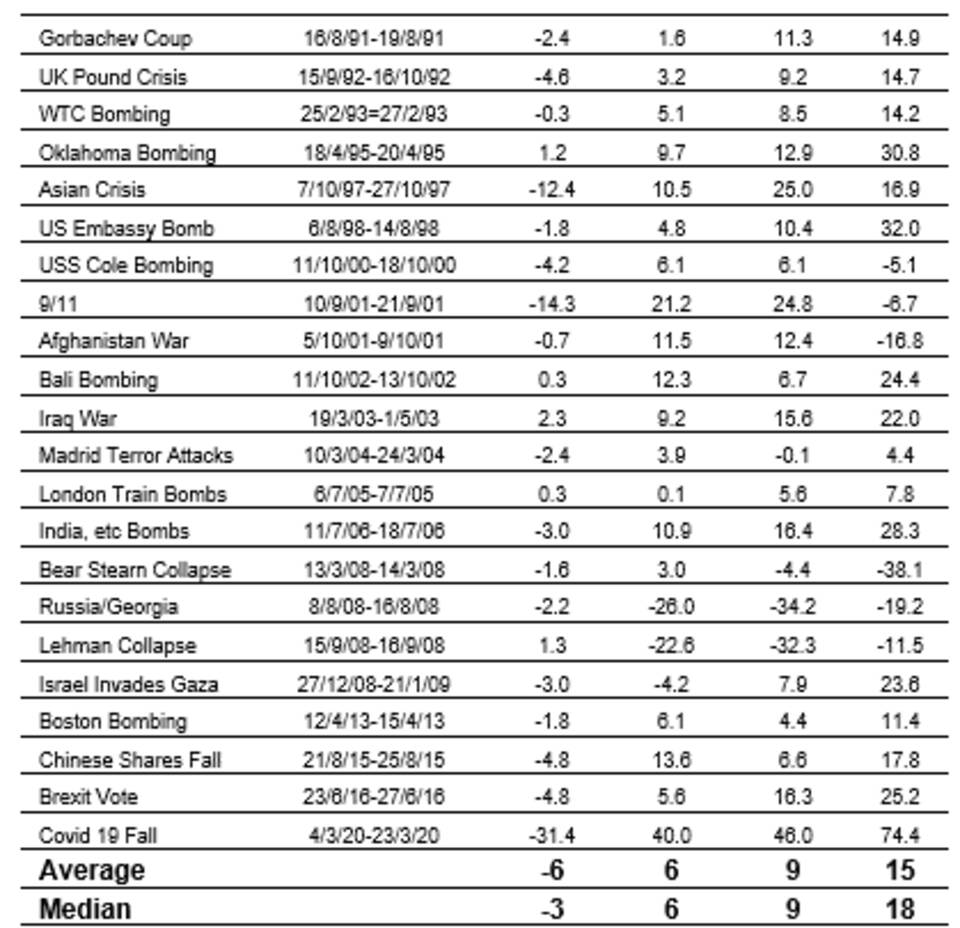

According to an article by Dr.Shane Oliver at AMP Capital, there is a long history of major crisis events that impacted equity prices. In almost most of these cases, initially the stock market fell sharply only to rebound in the following months and years. Since World War II, the average decline for US stocks has been 6%. But six months later stocks were up by 9% on average. And the returns were even better after 1 year at around 15%.

The following table shows the major crises since 1940 and the performance of US stock market later:

Click to enlarge

Source: The escalation in Ukraine tensions – implications for investors by Dr.Shane Oliver, AMP Capital