Investors in funds such as mutual funds and ETFs tend to earn lower returns than the funds they own over a time period. Many studies in the past have proven this theory. The gap in return between investors and funds is due to a variety of factors such as timing the market, lack of patience, poor decisions on the part of investors, etc. It is not uncommon for investors to chase a hot fund for example based on past returns only to stampede out of it when the market turns volatile. A research study by MorningStar in August this year also shows that fund investors fared poorly in returns when compared to the total returns of the funds. The study found fund investors earned 1.7% less than the total return of funds over the 10-year period ending in December, 2020.

From the research study:

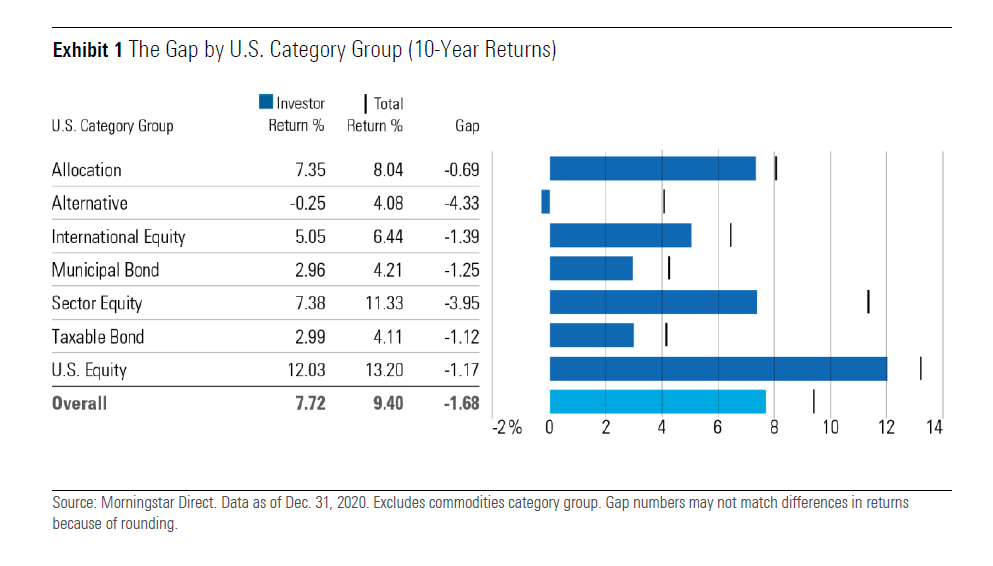

Our annual study of dollar-weighted returns (also known as investor returns) finds investors earned about 7.7% per year on the average dollar they invested in mutual funds and ETFs over the 10 years ended Dec. 31, 2020. This is about 1.7 percentage points less than the total returns their fund investments generated over the same period. This shortfall, or gap, stems from inopportunely timed purchases and sales of fund shares, which cost investors nearly one sixth the return they would have earned if they had simply bought and held.

That investor-return gap is more or less in line with the gaps we found for the four previous rolling 10-year periods. The persistent gap between the returns investors actually experience and reported total returns makes cash flow timing one of the most significant factors—along with investment costs and tax efficiency—that can influence an investor’s end results.

Our research imparts a few lessons on how investors can avoid these gaps and capture more of their fund investments’ total returns. Investors can improve their results by holding a small number of widely diversified funds, automating mundane tasks like rebalancing, avoiding narrower or highly volatile funds, and embracing techniques that put investing on autopilot, such as dollar-cost averaging.

The following chart shows the difference between investor returns and fund returns for various fund types:

Click to enlarge

Source: Mind the Gap 2021 – A report on investor returns in the United States, MorningStar

The worst gap is for alternative funds and the next worst was for sector equity funds.

Some of the ways investors can generate a better return include:

- Trying to time the market – that is getting out and in of funds at the wrong times

- Avoiding high cost funds

- Automatic reinvestment of fund distributions

- Investing on a regular basis such as bi-weekly, monthly, etc.

- Increasing contributions during market downturns, if possible.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- S&P MidCap 400 SPDR ETF (MDY)

- SPDR Consumer Discretionary Select Sector SPDR Fund (XLY)

- SPDR Consumer Staples Select Sector SPDR Fund (XLP)

- SPDR Energy Select Sector SPDR Fund (XLE)

- SPDR Financials Select Sector SPDR Fund (XLF)

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

Disclosure: No Positions