The banking market in UK is dominated by a handful of major banks similar to Canada, Australia and the super-banks in the U.S. Of the five large banks, Royal Bank of Scotland (RBS) and Lloyds Banking Group (LYG) have been the worst performers since the credit crisis.

In a recent interview FE Alpha Manager Jan Luthman said that RBS and Llyods are worthless due to their astronomical debt levels and rising social and political pressure. Some of the specific points Mr.Jan noted include higher taxation and harsher regulations on the sector, the current bank-bashing culture and the inability of banks to repossess (foreclose) many thousands of homes as in the past.

I agree with Mr.Jan’s view on the UK banking sector. RBS and Llyods took on huge unnecessary risks before the credit crisis and almost failed. But instead of allowing them to fail, the state bailed them out based on the mistaken belief in the “Too-Big-To-Fail” theory. As a result of this action and other policy failures, the British economy is in a much worse shape than the U.S. economy with the real estate industry in both countries still in doldrums.

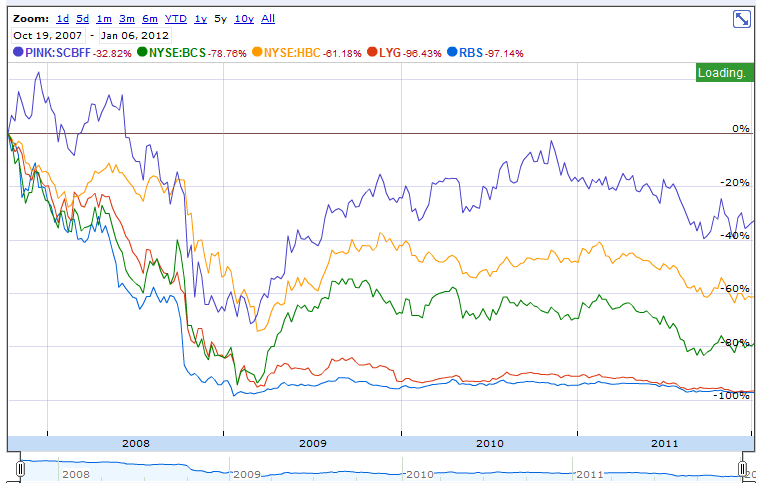

The following chart shows the 5-year performance of the five British bank stocks on the US markets:

Click to enlarge

Source: Google Finance

Despite the state bailout, RBS and Llyods have been disasters for their equity investors with both of them off about 97% in the past five years. Only Standard Chartered Bank (SCBFF) has fared relatively well during the same period.

From an investment standpoint, it is better to avoid British banks now especially RBS and Lloyds. Investors holding RBS and Llyods stocks can dump them and take any losses.

Disclosure: Long LYG