According to an article in one of the India’s business newspapers, Indian bank stocks are being bought heavily the government-owned insurance company, Life Insurance Corporation of India (LIC). This bodes well for Indian bank ADRs such as ICICI Bank’s IBN and HDFC Bank’s HDB.

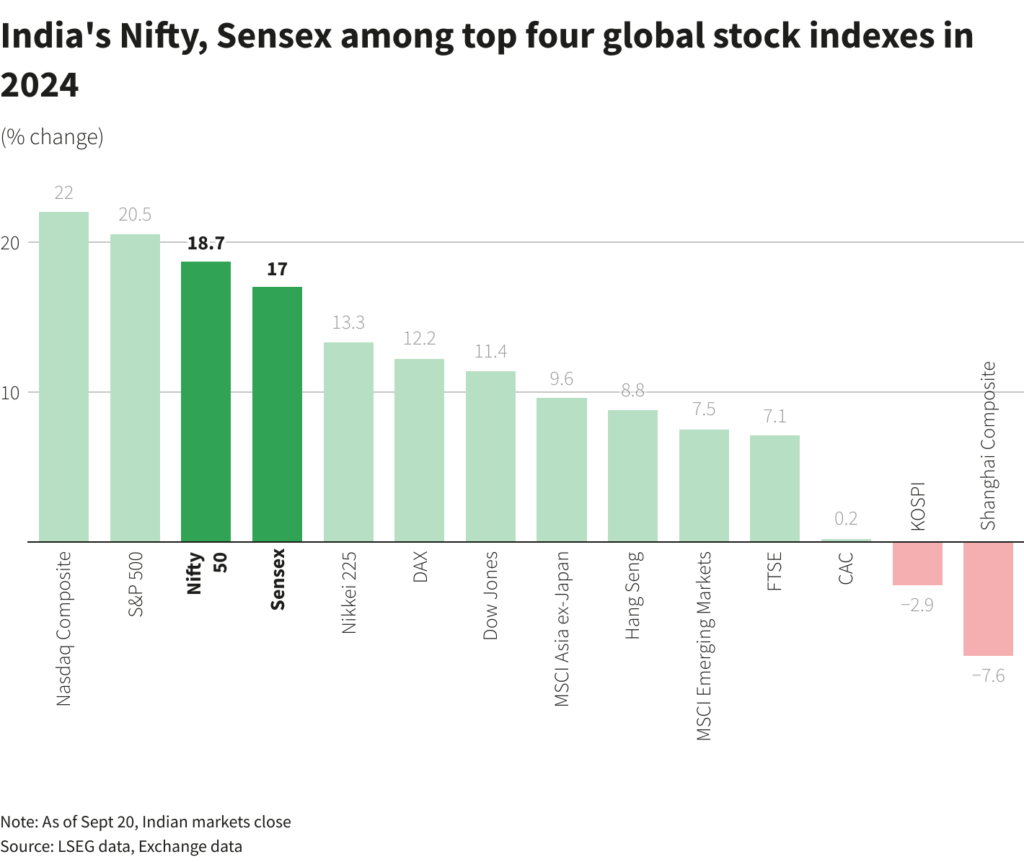

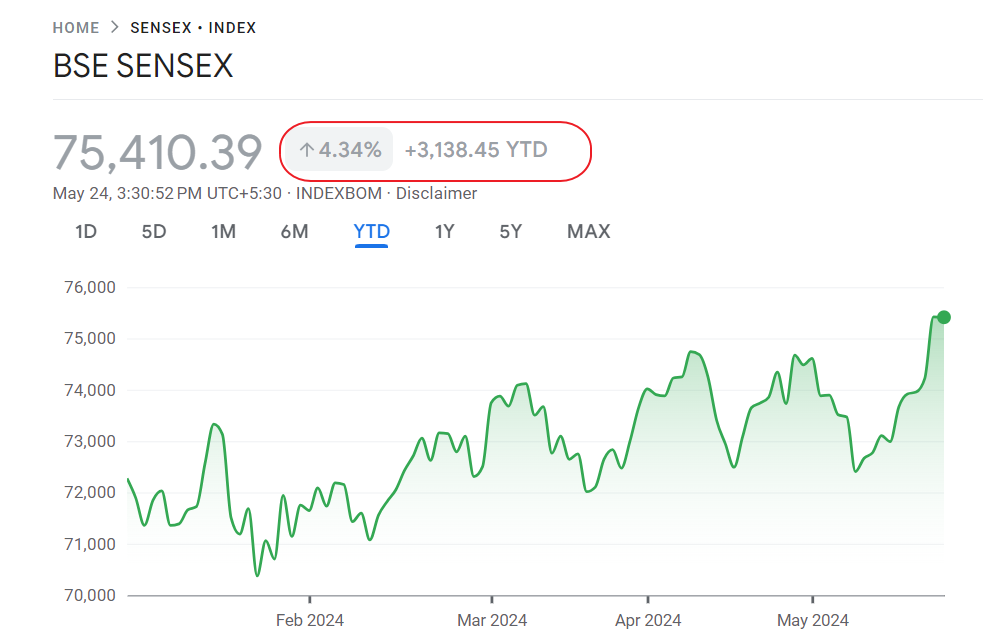

The main stock market index of India, Sensex returned an incredible 68.98% in 2007.

But gave back most it in 2008 with a loss of 61.18%. As of the end of first quarter the index is down just 3.29%.As of April 29, it is up by 23.50% in the past 3 months.

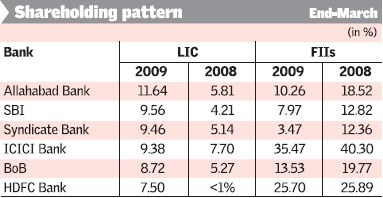

As foreign investors continue to pull out of Indian equities, the insurer has been increasing stakes in many bank stocks as shown by the chart below:

Source: The Hindu Business Line, India

Note: FII denotes Foreign Institutional Investors

With a huge asset base, India’s largest insurer is a major investor in many banks and other domestic companies. As governments in many western countries continue to bailout many financial institutions, the government of India seems to have taken an indirect route to supporting the banks.The article quotes an analyst as saying “Some banks, especially those in the private sector, have grown by leaps and bounds in the last few years. They have now become systemically important. So, it makes eminent sense for the Government to have a foothold in the banks via the State-run insurance company,â€

The above chart shows that the insurer has raised its holdings in HDFC Bank (HDB) much more than ICICI Bank (IBN) in 2009. ICICI and HDFC are the first and second largest private-sector banks in India and they are also constituents in the Sensex index.Currently IBN offers a 2.51% yield and has a market cap of $11.4B. On April 25th, the bank reported a 35% fall in profits in the fourth quarter over the same period last year. HDFC Bank (HDB) has a dividend yield of just 0.79%. The stock is expensive on a relative basis with a PE of 21.81. On April 31, the bank reported a 34% jump in fourth quarter profit. While the interest income, commissions and fees increased the bank’s provision for loan losses also increased indicating a deterioration in its loan portfolio.