Stocks that pay dividends are always a better bet than those that don’t. There are thousands of dividend paying ADRs. The trick is to find stocks that have a higher “Payout Ratio” and payment consistency over many years.

“Payout Ratio” just means the percentage of profits a firm pays out as dividends to shareholders. For eg – if a company XYZ Inc makes $100M in profits and its dividend payout ratio is 50%, then the company pays out $50M in dividends to its shareholders. XYZ Inc will be better than a company that pays out only 40%.

Dividends in general are an indicator of a firm’s profitability. It is something that cannot be faked and is real cash coming out of profits. So if a firm does not make profits it cannot pay a dividend. For eg – XYZ cannot borrow $50M and pay it out as dividends if its business went bad and the firm makes $0 in profits.

Higher payout ratio indicates that the company believes that there is not enough growth opportunities to re-deploy the profit and hence it makes sense to distribute the cash to stockholders who may use it as they wish. Higher payout ratio also indicates that the company is making more profits than a firm with a lesser ratio.

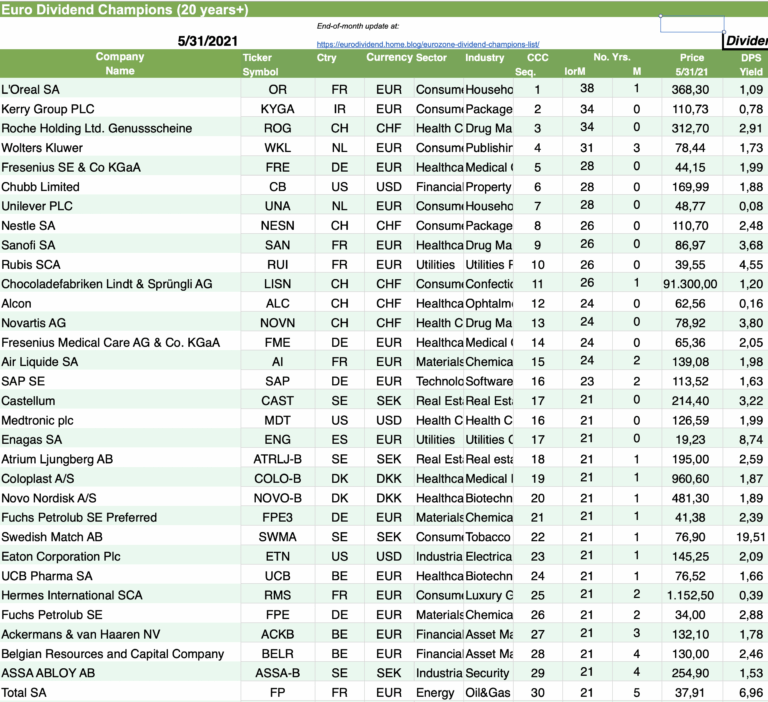

The following list shows a few ADR stocks that have high payout ratio. Most of them are banks as they tend to have higher yields.

[TABLE=32]

Note: More stocks will be added to this table periodically