In the equity market, the only thing that is constant is change. To put it another way, today’s winner could be tomorrow’s loser. So investors have to be cautious in betting too much on one company or sector with plans to hold them for the long term measured in decades or forever. For example, some of today’s over-hyped market darlings include Facebook(FB), Amazon(AMZN), Alphabet(GOOG) , Microsoft(MSFT) and Netflix(NFLX). Their market caps are in the billions or even a Trillion. However though they are top firms in this decade, there is no guarantee that they will stay that way in the next decade. Microsoft was already dead once during the dot com collapse but somehow was able to survive and revive due to its monopoly power.

All the others can easily be dislodged from their pedestal by some upstart in the next decade. For instance, Facebook in the most basic sense is a website that harvests personal information and makes money by selling ads. This idea can easily be copied or even made better by a startup in the future. The same goes for Amazon which is nothing but a giant flea market. One does not need to be a genius to set up a website and sell stuff. To make it even easier, one doesn’t need to sell goods on their own. Instead simply have other third-party sellers sell products on the site and make money by commissions.

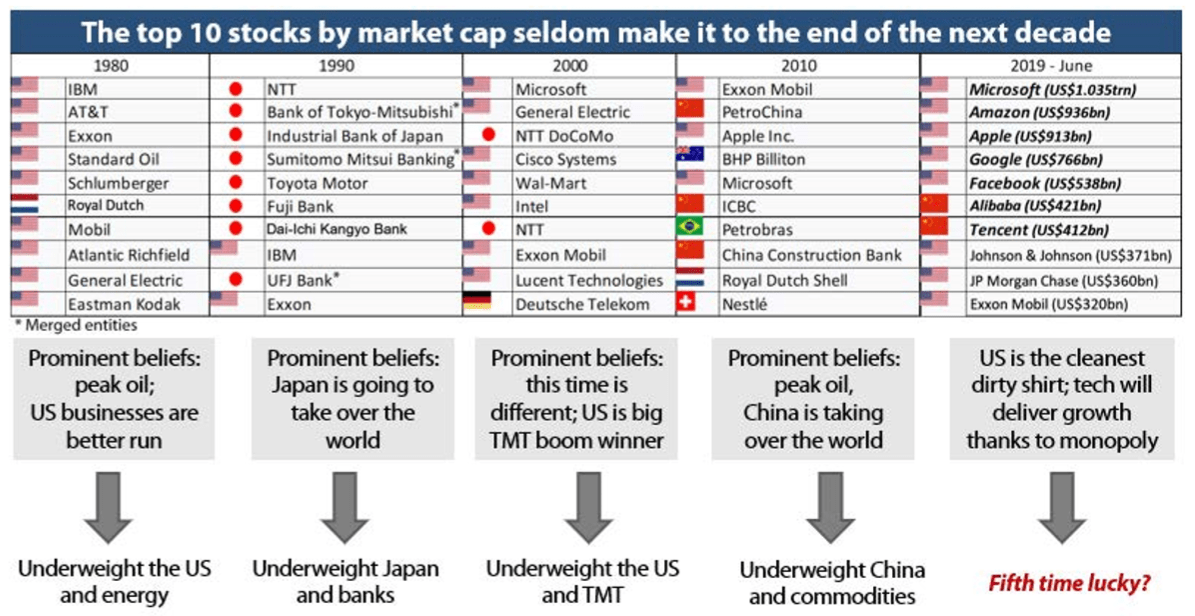

With that said, the past provides a great example of what we can learn with regards to winners turning into losers. The following chart shows the top 10 firms by market capitalization globally in each decade.

Click to enlarge

Source: AN INVESTMENT THESIS FOR THE 2020S by Louis-Vincent Gave, Evergreen Gavekal

The chart shows that most of the top firms in one decade do not make it to the next.

In 2000, some of the top firms were General Electric(GE), Cisco Systems(CSCO), Intel(INTC), Lucent Technologies. Since that peak GE has been a dead man walking. Today anyone with a sane mind would touch GE with a 10-foot pole. Lucent ended up a disaster as well and disappeared long time.

Similarly in the last decade, the leaders included companies like Petrobras(PBR). Now its a former shadow of itself. After a huge fraud was uncovered in Brazil’s world-class wonder, the company’s stock collapsed and almost became worthless.

So in summary, the important point to remember is no firm can be in the 1op 10 ranking decade after decade. Some of today’s market leaders will turn into losers or even disappear altogether. It is entirely possible that in 2030s or 2040s there may case studies written on the dramatic rise and stunning collapse of firms like Amazon, Facebook, etc.

Disclosure: Long PBR