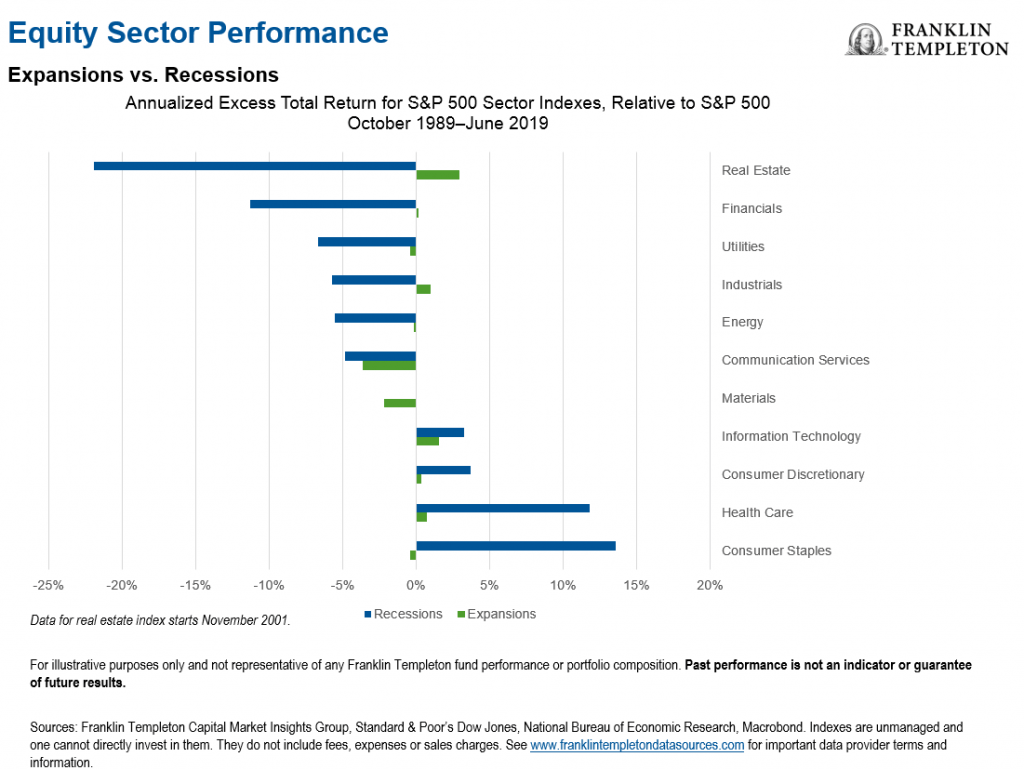

During periods of economic contractions some sectors perform well while others don’t. For instance, when the economy is in recession, sectors such as leisure, travel, consumer discretionary, luxury retail, etc. are adversely impacted as consumers cut back on spending on those items. On the other hand, consumer staples, energy and utility sectors remain stable during tough times since consumers still buy necessitates like toothpaste, soap, food, etc. Similarly the utility sector also offers stability during recessions since people still need electricity and gas to maintain their daily life.

The chart below shows how different sectors perform during recessions and expansions:

Click to enlarge

Source: End-of-Cycle Management, Franklin Templeton

A few of the stocks from the sectors that outperform in recessions are listed below:

- Kimberly-Clark Corp (KMB)

- Southern Co. (SO)

- Unilever PLC (UL)

- Colgate-Palmolive Co (CL)

- Henkel AG & Co KGaA (HENKY)

Disclosure: No positions