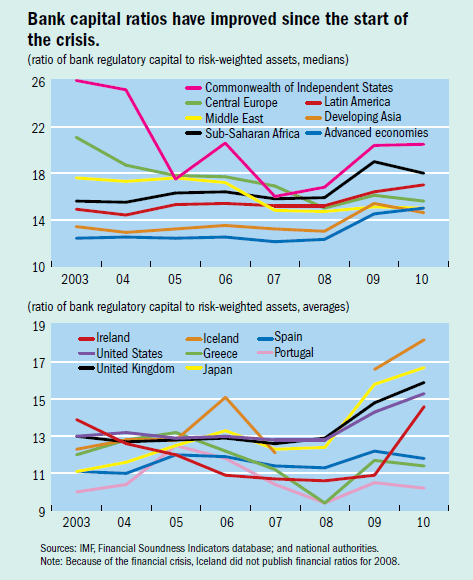

The health of the banking industry as measured by the Capital Adequacy Ratios (CARs) has improved in all regions of the world since the start of the credit crisis in 2008 according to a report by José M. Cartas and Ricardo Cervantes of the IMF.

Definition of Capital Adequacy Ratio:

Capital requirements are designed to ensure that banks hold enough resources to absorb shocks to their balance sheets. A standard measure of the health of individual banks is their capital adequacy ratio (CAR). Introduced in 1988 with the Basel I Accord, the CAR is calculated as the total regulatory capital of a bank divided by its risk-weighted assets. The Basel II revision refined the calculation of risk weights and incorporated three major components of risk: credit, operational, and market risk.

The Basel Accords set the minimum CAR at 8 percent. Conservatively-run banks tend to have high CARs to cushion against higher losses.

The graphic below shows the improvement in capital ratios of all regions and select developed countries:

Source: Finance & Development, June 2011, IMF

In developed countries, banks lent money liberally before the credit crisis. Whether it was the now failed Northern Rock in the UK or Washington Mutual in the U.S. banks juiced up their earnings by lending heavily to the subprime mortgage sector. In addition, commercial real estate loans, home equity loans, credit credit loans and other types of lending boomed. After the credit crisis, banks in the developed countries have strengthened their CARs by limiting lending to their customers and shifting their portfolios to low-risk assets such as government securities.

The graph also shows the deterioration of the banking sector in Greece, Spain and Portugal.The CAR for Iceland hovered slightly above 12 percent until 2007 and jumped to more than 18 percent in 2010 after the painful restructuring of the country’s banking system.