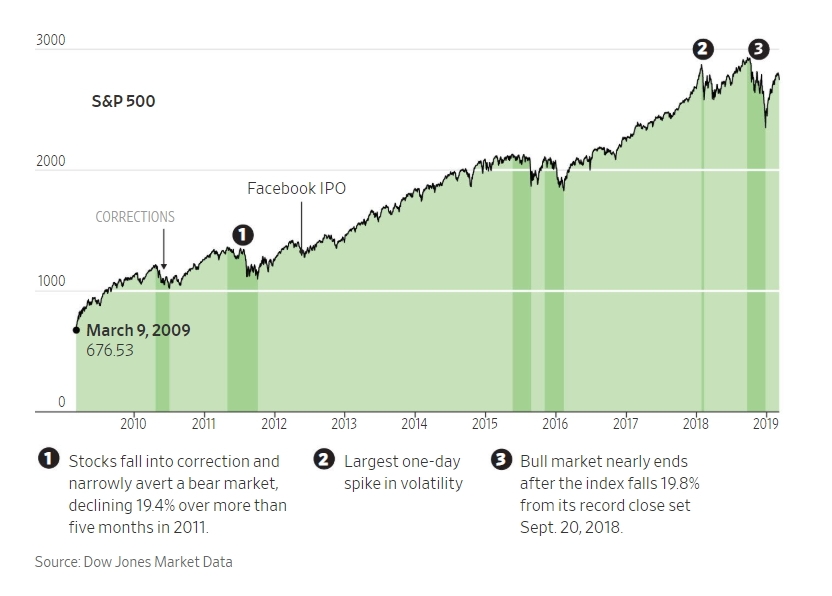

The bull market in U.S. stocks turns 10 years old today according to a Journal article. However most investors don’t care because unlike the previous bull runs this one doesn’t have the same feel. In March 2009, stocks reached their bear market trough and investors felt like a depression was on the horizon. But the market proved them wrong with a strong run.

From the article:

The U.S. bull market turns 10 years old Saturday, underscoring the resilience of a rally that has persisted despite tepid global growth, anxieties about central bank policies and mounting trade tensions.

The S&P 500 has climbed more than 300% since hitting its financial crisis low on March 9, 2009. Over that time, rising share prices and dividends have added around $21 trillion to the index’s value, according to S&P Dow Jones Indices.

Investors credited much of the first leg of the bull market to central banks slashing interest rates and scooping up trillions of dollars of bonds. But more recently, signs that U.S. growth remains solid—despite a slowdown across emerging markets and the eurozone—have helped stocks keep climbing.

Outsize gains among technology giants have also fueled the rally. Apple Inc., Microsoft Corp., Amazon.com Inc. and International Business Machines Corp. accounted for nearly 9% of the S&P 500’s gain through Wednesday, according to S&P.

Leading the Way

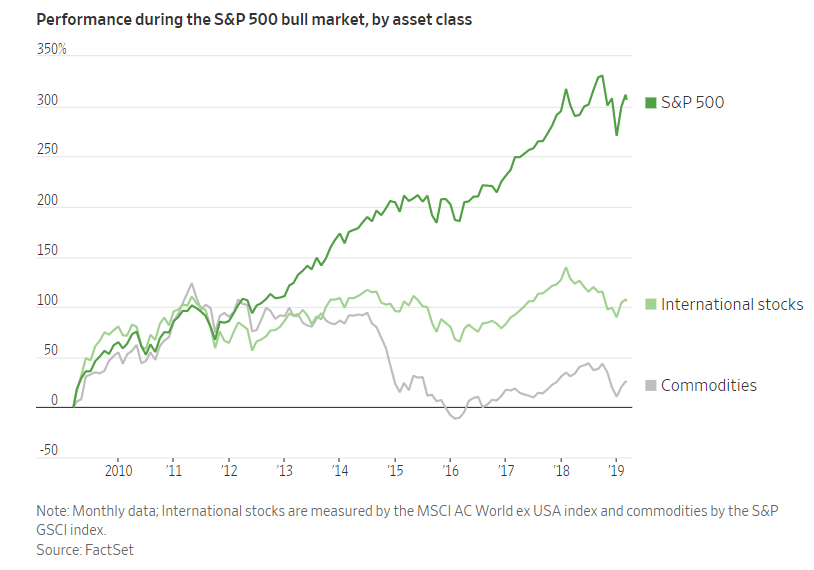

U.S. stocks have outgained international shares and commodities by a substantial margin in the past decade, a departure from previous bull markets.

Source: Inside a Decadelong Bull Run, WSJ, Mar 9, 2019

U.S. has far outpaced other countries in terms of returns since March 2009.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard MSCI Emerging Markets ETF (VWO)

Disclosure: No Positions