Bear markets are not always preceded by recessions and vice versa. The relationship between these two are tenuous at best. I came across an interesting piece by Liz Ann Sonders at Schwab on this topic.

From the article:

Stock market relative to recessions

What should we expect from the stock market during a recession? Should we assume 20% or more market losses given the tendency for stocks to enter into a bear market in anticipation of recessions?

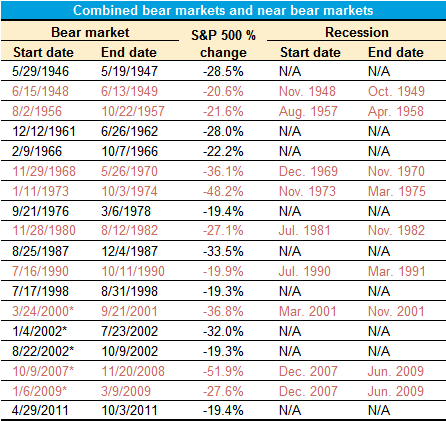

The table below shows every S&P 500 bear market (using the traditional -20% definition) in the post-Great Depression era, but also what I’ll call “near bear markets” (down at least 19% but less than 20%).

As you can see in the table below, there is typically an overlap between the two, with bear markets generally starting in advance of recessions (red entries are bear/near bear markets which overlapped with recessions). That said, there are bear/near bear markets that have not accompanied recessions (like 1987); and there are recessions that have only had near bear markets (like 1991). There are a surprisingly large number of near bear markets.

Source: Charles Schwab, Bloomberg, National Bureau of Economic Research. Bear market defined as 20% or greater drop in S&P 500. Near bear market defined declines of more than 19% but less than 20%. *3/24/2000–10/9/2002 is generally considered one long bear market (-49.1%), but there were two 20% rallies within that span. **10/9/2007 – 3/9/2009 is generally considered one long bear market (-56.8%), but there was one 20% rally within that span.

Bear markets that overlapped with recessions were generally more severe than those occurring outside recessions. The average bear/near bear market without a recession was -24.6%, while the average bear/near bear market with a recession was -32.2%.

Source: The Beginning is the End is the Beginning: A Look at Recessions, Liz Ann Sonders, Schwab