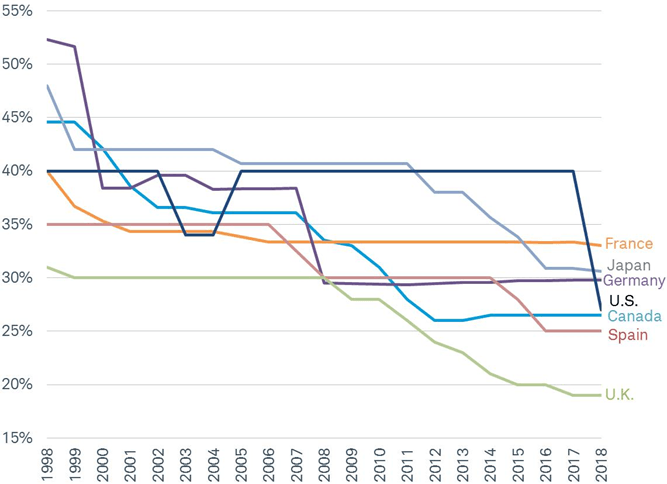

The Corporate Tax Rates have been on a downward slope in many developed countries for some years now. The Global Financial Crisis (GFC) gave another boost to further reduction in rates as countries struggled to stimulate their economies. The UK has the lowest corporate tax rate at 19% and politicians are considering to cut it to 17% by 2020 as a result of the Brexit debacle.

Click to enlarge

Source: Charles Schwab, KPMG data as of 1/17/2019.

Source: Tax War: Will Global Competition to Lower Taxes Lift Growth? by Jeffrey Kleintop, Charles Schwab

Lowering tax rates for corporations is not necessarily good for a country all the time. For example, one unintended consequence of low tax rates for companies leads to higher tax rates for individuals as governments look to fill the tax revenue gap. This situation may look like robbing Peter to pay Paul. So the key for regulators and politicians is to find the optimal rate that is fairer to both corporations and individuals.