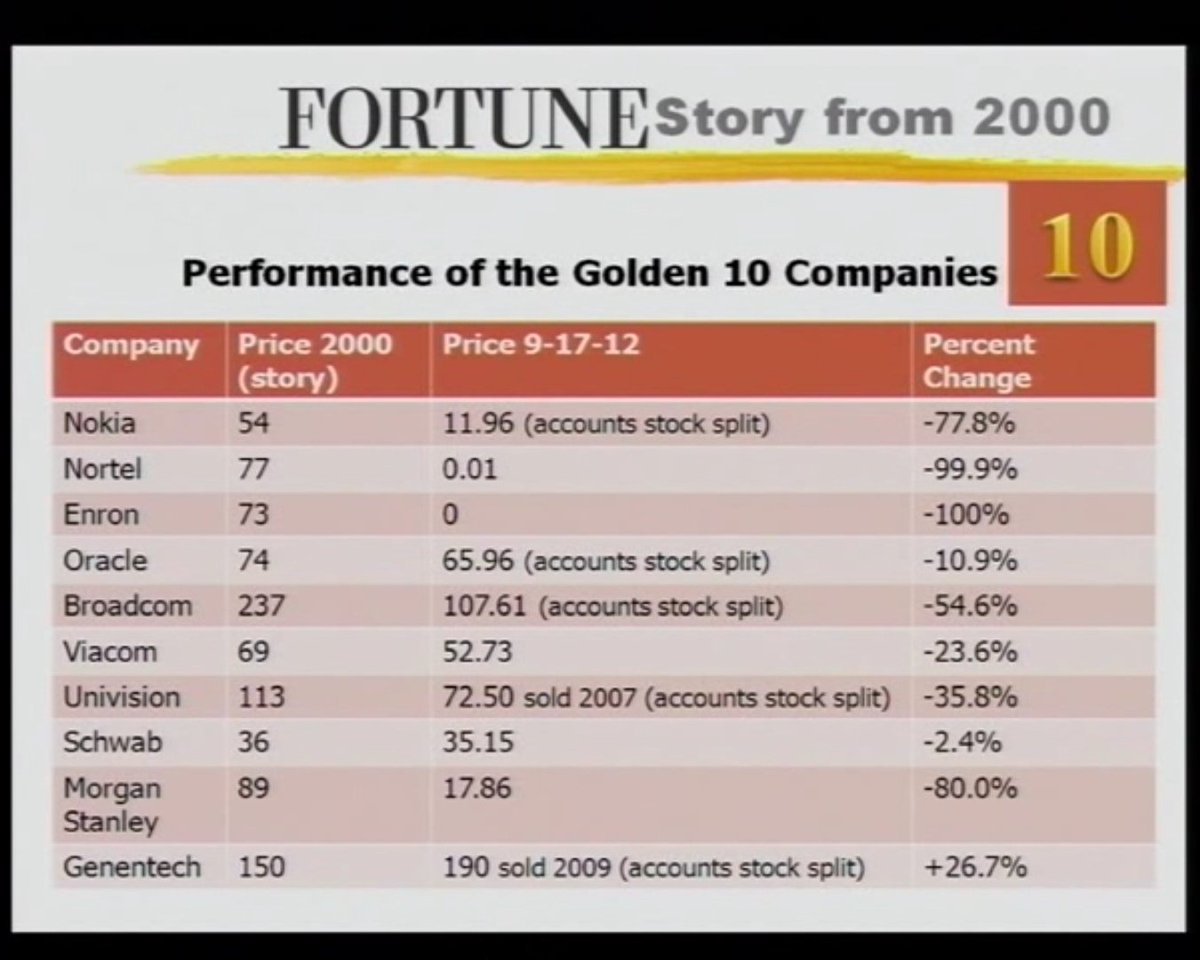

Success with equity investing is not easy. Seemingly solid blue chips can crash any time for any number of reason. Similarly volatility in the markets can appear any time like we are seeing in the global markets in the past few weeks. Trying to time the market is also a fool’s game. So the best way for investors to earn a decent return is to focus on the long-term and hold a well diversified portfolio. As I mentioned earlier, it is never a good idea to simply buy a bunch of stocks and simply forget about them. Instead of simply buying and forgetting for years, investors have to buy and monitor them. I came across the following picture posted on twitter:

Click to enlarge:

Source: @iancassel via Twitter

From the tweet:

In 2000, Fortune magazine came up with a ‘Buy-and-Forget’ portfolio – stocks that would last the decade. This is what the returns were like in 2012 after accounting for splits.Investing is hard.

The disastrous return of the above sample portfolio recommended by Fortune shows the need to be vigilant and monitor one’s investments. Moreover the portfolio is also heavy in tech stocks. So concentration risk is another risk that investors need to be aware of when building a portfolio for the long-term.

Disclosure: No positions