Many emerging market stocks have performed poorly so far this year. After a strong run until last year, emerging markets have declined this year due to a multitude of factors including rising oil prices, impact of trade war initiated by the US, rising US dollar, etc. Hence some of the major markets of the developing world are down. For example, Mexico’s IPC Index is off by 1.9%, Chile’s IPSA is down by 6.7%, China’s Shanghai Composite is down by over 14%, etc. The benchmark MSCI Emerging Markets Index has declined by 7.15% in USD terms.

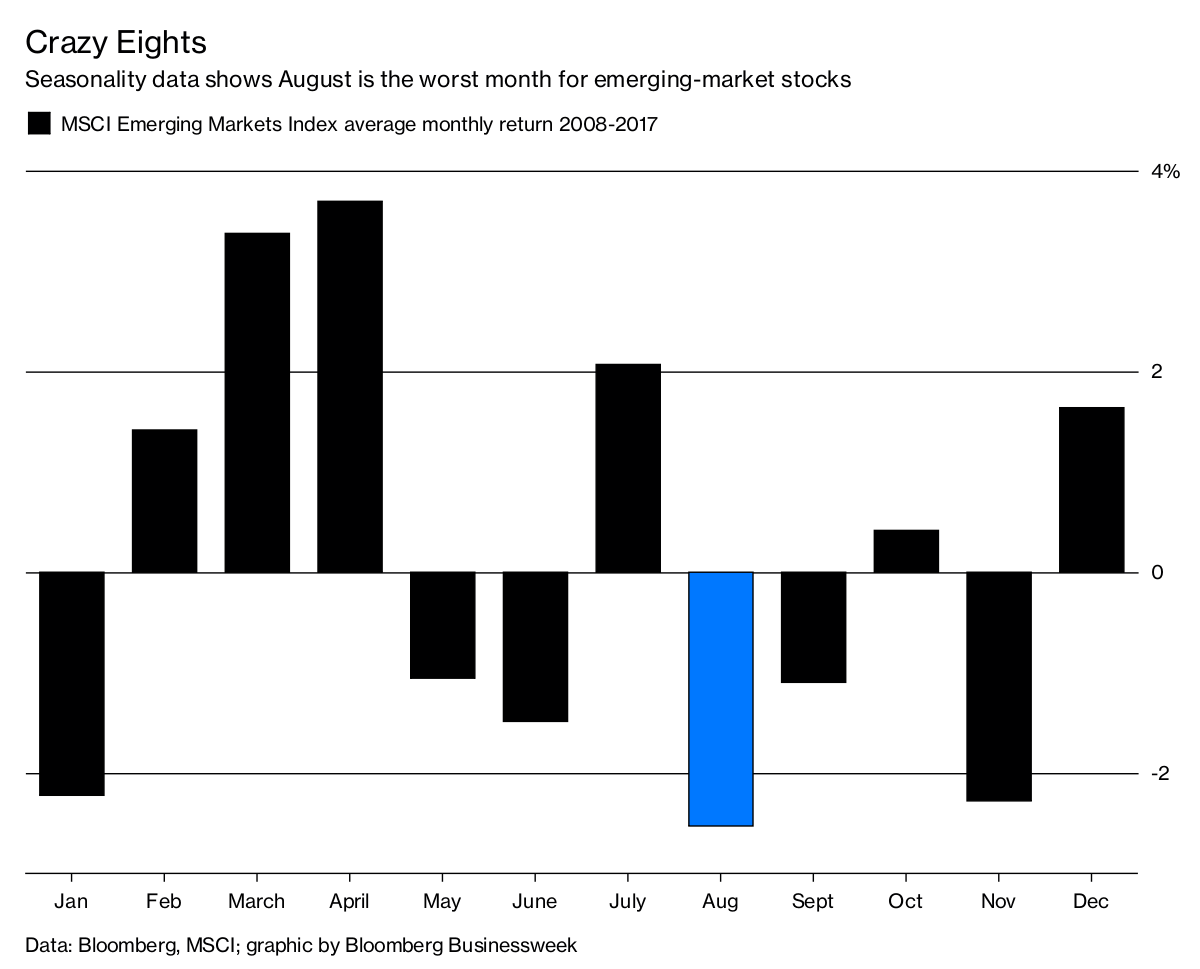

Given the under-performance of these markets, Lilian Karunungan of Bloomberg notes in an article that August has been historically the worst month for emerging market stocks.

Click to enlarge

Source: Emerging-Market Investors May Want to Skip Next Month, Bloomberg

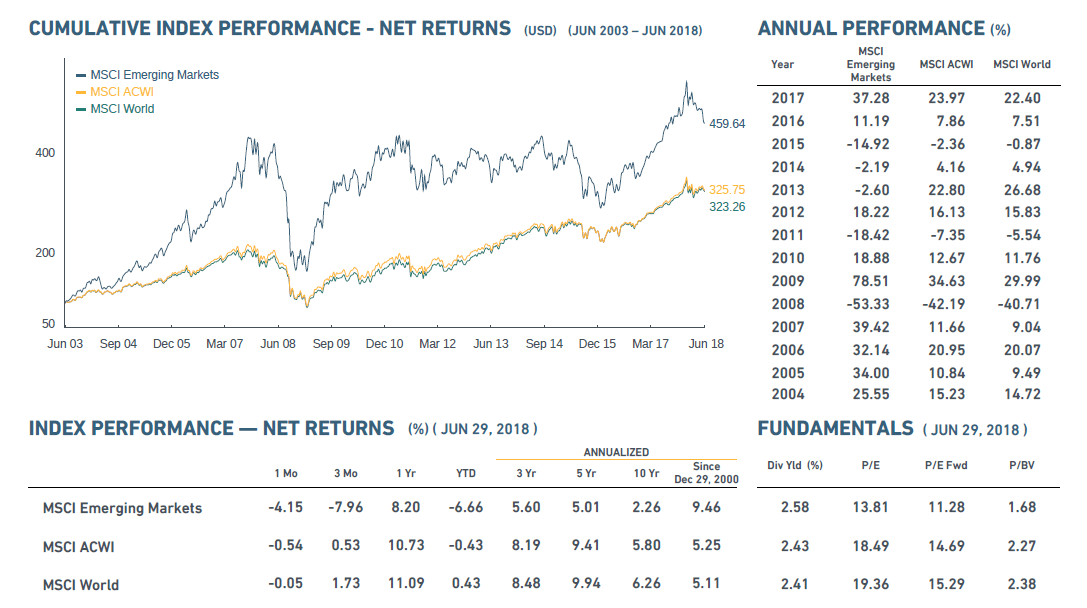

The Long Term Net Return for the MSCI Emerging Markets Index against two other major MSCI indices are shown in the chart below:

Click to enlarge

Source: MSCI

Related ETFs:

Disclosure: No Positions