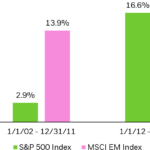

The theory that emerging, frontier markets are decoupled from developed markets in terms of performance is still dead. The chart below proves this point:

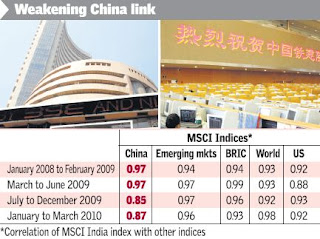

Souce: The Hindu Business Line

During the past couple of years investors worldwide learned that emerging markets and developed markets are not decoupled from each other. In fact, emerging markets went down more than markets in the developed world during the credit crisis. The notion that somehow emerging markets follow different dynamics and are not dependent on the U.S. economy was put to the test and it failed. This logic appears to be the case even now as the chart above shows.

Stocks in India re moving in lock step with global markets.In the past 3 months however they have started to decouple a bit from the performance of Chinese markets. India, BRIC and emerging markets are still closely related to the US markets based on the data for the first three months of this year.However Chinese equities are showing some variance from global markets primarily due to the Chinese government’s policies to cool down the over-heated economy and rein in liquidity.

Related ETFs:

MSCI Emerging Markets Index Fund (EEM)

iShares MSCI EAFE Index(EFA)