Taj Mahal, India

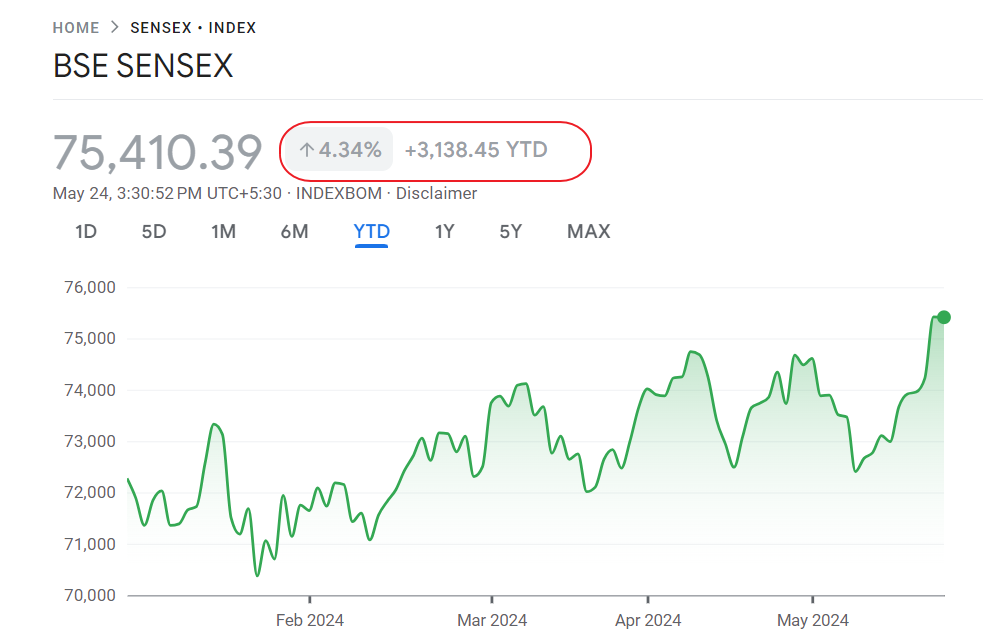

The main stock market index in India called the Sensex plunged 606 points to close below the psychologically important level of 10,000 at 9975 yesterday(Oct 17th). After reaching a peak of 21,200 in January the index has fallen by 53% in just nine months.

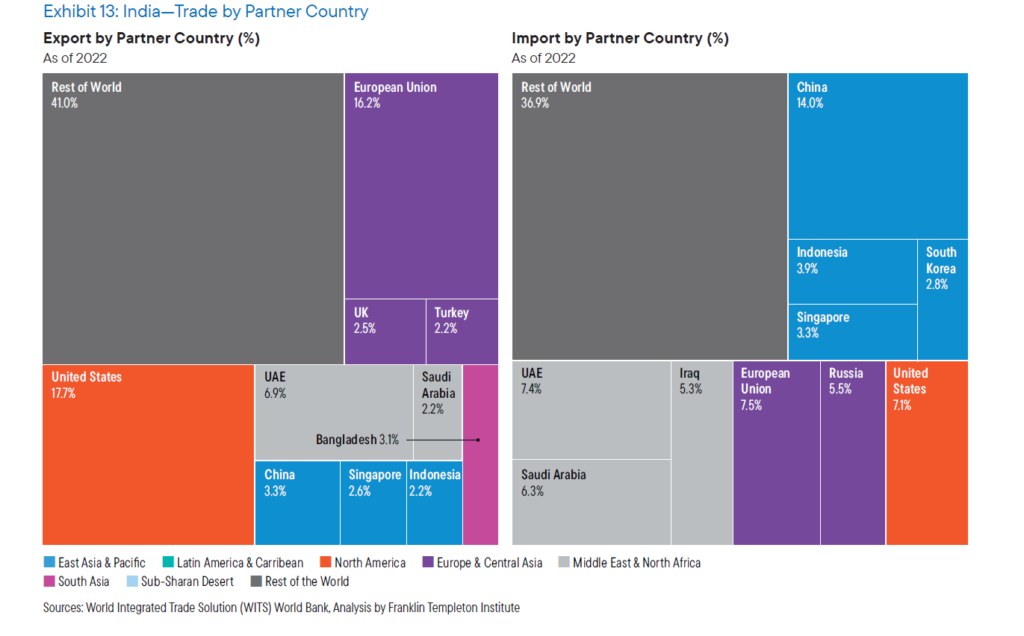

Similar to the other three BRIC countries, India rode the wave up during the past few years and now the market has been hit hard as the commodity-driven economies have crashed. Foreign investors are pulling out their investments from Indian companies on a daily basis. Out of a total market cap of $680 for the entire market, foreigners have invested about $55B. Spooked by the crash in Sensex and markets worldwide local investors are getting out as well. The theory that somehow India was decoupled from other markets has been put to rest.

The last time Sensex saw the below 10,000 level was in July 2006. The P/E of the Sensex has come down to 12.6 from 28.5 back in January.While the main index has fallen 53% year-to-date this year,some stocks have fared even more. The following table lists the Indian ADR stocks traded in the US and their performance:

Indian Stocks Year-To-Date Change

[TABLE=111]

Chart

Click on image to enlarge

As seen in the above chart, some of the stocks like IBN, TM are down over 70%.IT services stocks like SAY,WIT,INFY seems to be holding well now.But they may face tough times if US companies reduce or cancel off-shoring projects.

Due to domestic and overseas market conditions the index may take some time before finding a stable level. While in the long-term “The Incredible India Growth Story” may be intact,however in the short-term it has been interrupted.