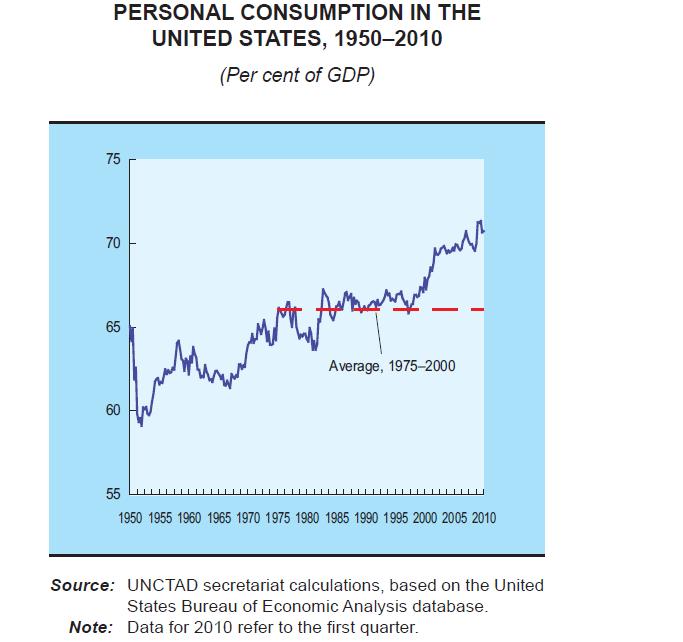

The U.S. economy at over $14.0 Trillion is the largest economy in the world. However personal consumption accounts for most of the GDP. Since the late 1990s, the share of personal consumption in the GDP has been growing consistently and exceeded the long-term average of about 66%. In 2009 it peaked at 71% of the GDP.

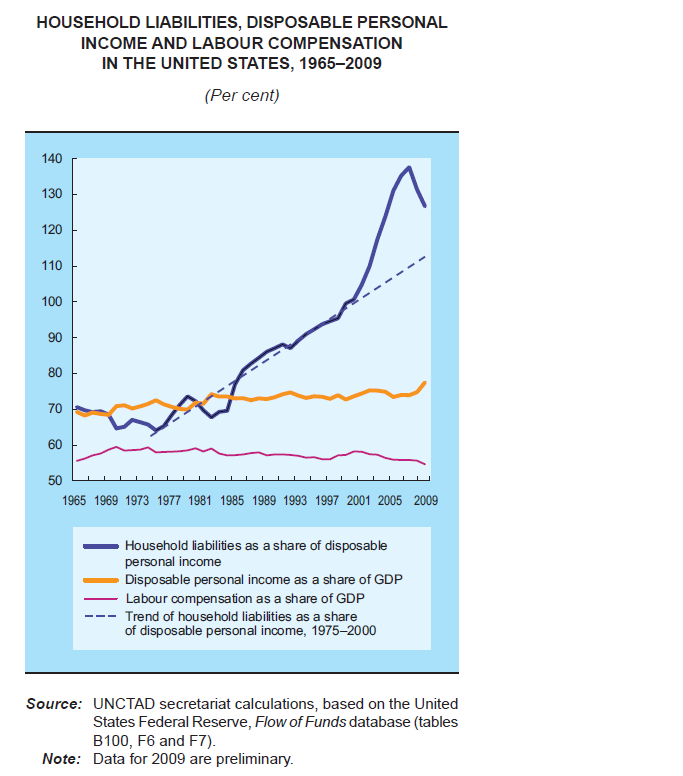

The tremendous increase in consumption was not supported by rise in income but was mostly debt financed thru home equity loans, credit cards, etc.”The increase in household consumption in the United States was unsustainable because it was not supported by a similar expansion of labour compensation.”In 2007, the ratio of debt to personal disposable income reached an all-time high exceeding 130%. The chart below shows that since 2000 labor compensation as a percentage of GDP has steadily declined while household liabilities continued to grow until 2007. As the unemployment rate continues to be stubbornly high, companies are under pressure to increase profits with flat sales which has to led to further reduction in wage levels. Hence economic growth will be anemic until households deleverage their balance sheets to manageable levels and incomes stabilize.

Source:Â TRADE AND DEVELOPMENT REPORT, 2010, UNCTAD