“Home Sweet Home” – That may be the mantra some US investors may be tempted to follow now and avoid investing in foreign stocks. However following that strategy is not a wise move for many reasons. In this post, let us discuss some of the reasons on why abandoning foreign stocks is a bad idea.

While the S&P 500 is up by 3.54% so far this year, most developed European markets are still in the red with the Stoxx Europe 600 down 8.1%.

Jeffrey Kleintop at Charles Schwab published an article yesterday on global diversification. From the article “Three Reasons Why Now is Not the Time to Retreat from Global Diversification“:

1.The Brexit is another in a series of political, economic and financial shocks coming from outside the United States. So is it time for long-term investors to retreat from global diversification to the perceived relative safety of the U.S. stock market? We don’t think so for three main reasons:

2.Returns on global stocks have never been negative over the 10 years that followed valuations similar to where they are today.

3.International exposure offers increased diversification that can help buffer your portfolio against market downturns.The next investing megatrend may be the adoption of middle class lifestyles on a global scale with huge implications for global providers of goods and services.

The fact that foreign stocks have underperformed until now while American equities are rising is not the reason to sell overseas stocks. Instead the opposite is probably likely to occur in the future – that is foreign stocks beating US stocks.

Another excerpt from Jeff’s piece:

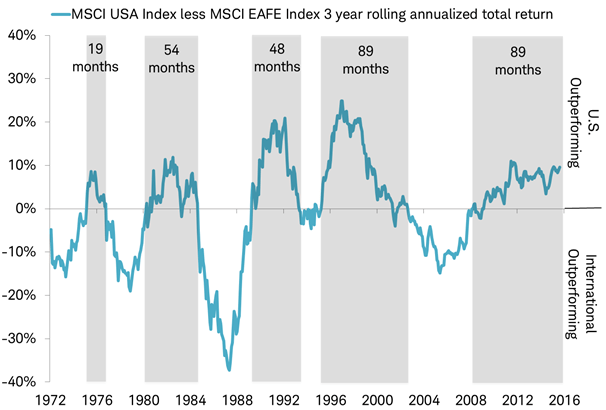

Over the past 45 years, there have been alternating periods of time when U.S. and international stocks consistently outperformed each other. The length of time on a three year rolling basis that U.S. stocks have outperformed international stocks is now tied for the longest ever at 89 months, as you can see in the chart below. While U.S. outperformance could continue, abandoning international stock exposure in your portfolio now as the duration of U.S. outperformance sets a new all-time record in July 2016 may turn out to be the worst time.

Shaded areas represent periods of MSCI USA Index outperforming MSCI EAFE Index for rolling 3-year period.

Source: Charles Schwab, Bloomberg data as of 7/10/2016.

In general, allocating between 25% and 50% of your stock holdings (or more, depending on your risk and return objectives) to international equities could benefit your portfolio.

The following are some additional reasons why investors should consider owing foreign equities in their portfolio:

- Many foreign markets offer dividend yields that are much higher than the average 2% of the US market. So investors looking for dividend stocks benefit from having exposure to overseas.

- Emerging countries can experience exponential economic growth. While not always guaranteed, equities in those markets can follow and soar to incredible levels. In these cases, owing emerging stocks can yield huge returns.

- It is highly unlikely that the same country is the best performer year after after continuously (Refer to The Callan Periodic Table of Investment Returns 2015). So instead of owing only US stocks owing a diversified portfolio across many countries and markets can cushion a portfolio and generate decent returns.

- Simply holding US multinationals to gain exposure to foreign markets won’t offer the same level of gain as investing in a domestic company of a foreign country. This is because multinationals are not always able to understand local markets and culture and accordingly cater to the demands of the market.A domestic company on the other hand is well positioned to meet local demand.

In summary, having a well-diversified portfolio including domestic and foreign equities, bonds and other assets and holding them for the long-term is a better approach. Ignoring foreign markets and putting all eggs into one basket like US stocks or vice versa is not a prudent strategy.