When equity markets turn volatile astute investors go hunting for high-quality stocks. During such periods, market participants engage in indiscriminate selling by dumping both good and bad companies. This leads to situations where stocks of well-established high-quality companies tend to trade at cheap levels. For example, early 2009 was a great time to buy equities as the Global Financial Crisis was peaking. Since then the US market has more than doubled. However due to the fear of the unknown not many investors including myself were brave enough to take the plunge and buy stocks at that time.

The main point to remember is there will always be crises and market corrections. The trick for most retail investors is to take advantage of opportunities when it seems like the world is about to end. In a globalized world, it is not possible to expect perfect market conditions such as no crisis, no wars, no geo-political risks, etc.

From an article by

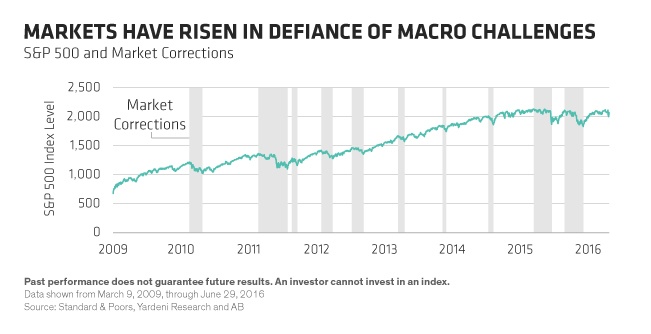

In recent years, investors have had to cope with plenty of uncertainty: three summers worth of the Greek default crises (2010, 2011, 2012); the US “fiscal cliff” in early 2013 and the government shutdown that October; the Ukraine–Russia conflicts; the collapse in oil prices; China’s slowdown and currency devaluation; and now, Brexit.

In terms of severity, we believe that the current chaos surrounding Brexit falls toward the bottom of the list. Sure, the market reacted quite alarmingly in the first two days—as much due to the unexpected result as to the unknown full, long-term implications of the decision to exit the European Union. But we’re already seeing some stabilization following that immediate global market reaction.

And therein lies one of the preeminent lessons of long-term investing.

Corrections Often Need Corrected Vision

While it’s happening, a correction feels terrible. But despite the many corrections and spikes in volatility during this cycle (from March 9, 2009, through June 29, 2016), the S&P 500 Index hasn’t collapsed. In fact, it climbed 206%, or an annual average of about 16%, over that period (Display). In other words, all those episodes of volatility have created attractive opportunities to buy stocks. And in our view, that holds true now—perhaps even more than over the past seven years.

More recently, the markets have lost some steam. For roughly the past 12 months, the net market movement has been flat (just slightly lower after the past several days), despite increased volatility. The rising tide that lifted all boats for the past several years probably won’t help an investor’s returns going forward.

Instead of relying on market returns, it may prove more useful to keep an eye on the long term, and to look at the volatility of any particular moment with more objectivity than emotion.

Source: Beware of “Perma-Bears” in Volatile Markets by Kurt Feuerman, Alliance Bernstein

Investors looking to deploy capital during the current volatility can consider the following foreign stocks:

1.Company: Fresenius Medical Care AG & Co (FMS)

Current Dividend Yield: 1.04%

Sector: Health Care Providers & Services

Country: Germany

2.Company: Novo Nordisk A/S (NVO)

Current Dividend Yield: 1.77%

Sector: Pharmaceuticals

Country: Denmark

3.Company: Siemens AG (SIEGY)

Current Dividend Yield: 3.66%

Sector:Industrial Conglomerates

Country: Germany

4.Company: Magna International Inc(MGA)

Current Dividend Yield: 2.85%

Sector: Auto Components

Country: Canada

5.Company: Valeo SA (VLEEY)

Current Dividend Yield: 2.39%

Sector: Auto Components

Country: France

6.Company: Nestle SA (NSRGY)

Current Dividend Yield: 2.97%

Sector: Food Products

Country: Switzerland

7.Company: Nordea Bank AB (NRBAY)

Current Dividend Yield: 8.56%

Sector: Banking

Country: Sweden

8.Company: DBS Group Holdings Ltd(DBSDY)

Current Dividend Yield: 3.73%

Sector: Banking

Country: Singapore

9.Company: Legal & General PLC (LGGNY)

Current Dividend Yield: 7.69%

Sector: Insurance

Country: UK

10.Company: Royal Dutch Shell PLC (RDS-A)

Current Dividend Yield: 6.77%

Sector:Energy

Country: UK

Note: Dividend yields noted above are as of July 1, 2016. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long MGA