The Chinese equity market is the second largest in the world in terms of market capitalization. Despite the size and breadth of the market, the index provider MSCI recently decided to not add China’s domestic stocks (“A” stocks) to the MSCI Emerging Markets Index. From a recent journal article:

“International institutional investors clearly indicated that they would like to see further improvements in the accessibility of the China A shares market before its inclusion in the MSCI Emerging Markets Index,” said Remy Briand, global head of research at MSCI.

MSCI’s decision is a blow to Chinese authorities who have been eager to attract more foreign capital to their stock market. To win over MSCI, Chinese regulators recently stepped up their reform efforts, such as creating new rules that limit how long companies could suspend trading in their shares, and allowing foreign money management funds to take bigger stakes in the market.

The index provider welcomed those moves but said investors “stressed the need for a period of observation to assess the effectiveness” of these changes. Some investors raised concern that Beijing could impose new controls during the next market selloff.

MSCI said its decision to hold off also reflected continuing issues for foreign investors, such as provisions that prevented them from taking out more than 20% of their investment each month.

Source: MSCI Delays Adding China’s Local Currency shares to Emerging-Market Index, WSJ, June 14, 2016

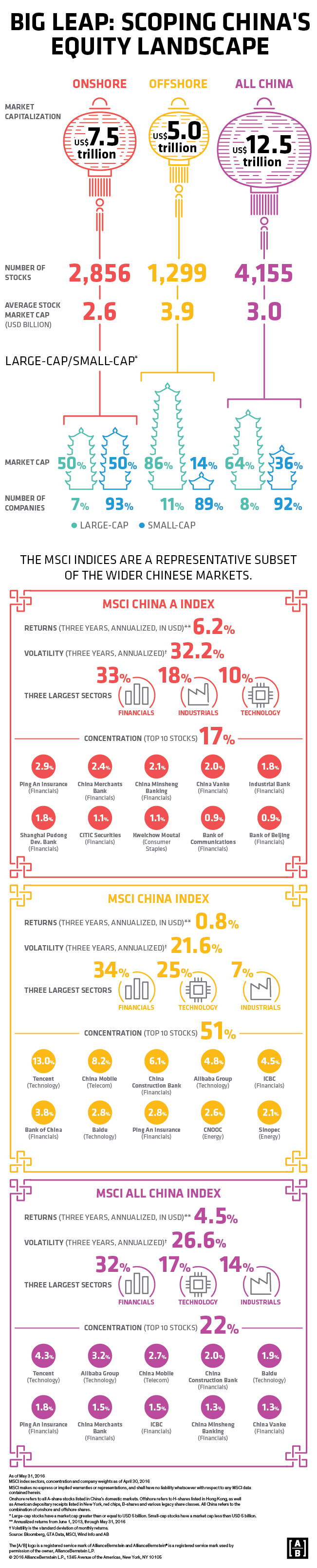

Chinese stocks listed on the domestic market are known as A stocks. These are not accessible to international investors unlike the ones traded on Hong Kong and US markets. A stocks are denominated in yuan and only local investors are allowed to invest in them. Since the Chinese equity market is vast, investors can feel overwhelmed on where to start. The following infographic gives an overview of China’s equity market:

Click to enlarge

Source: INFOGRAPHIC: Scoping China’s Equity Landscape, Context, TheAB Blog on Investing

US investors can access many Chinese companies easily as their stocks trade on the US market. Currently about 112 firms are listed on the organized exchanges and 199 trade on the OTC markets.