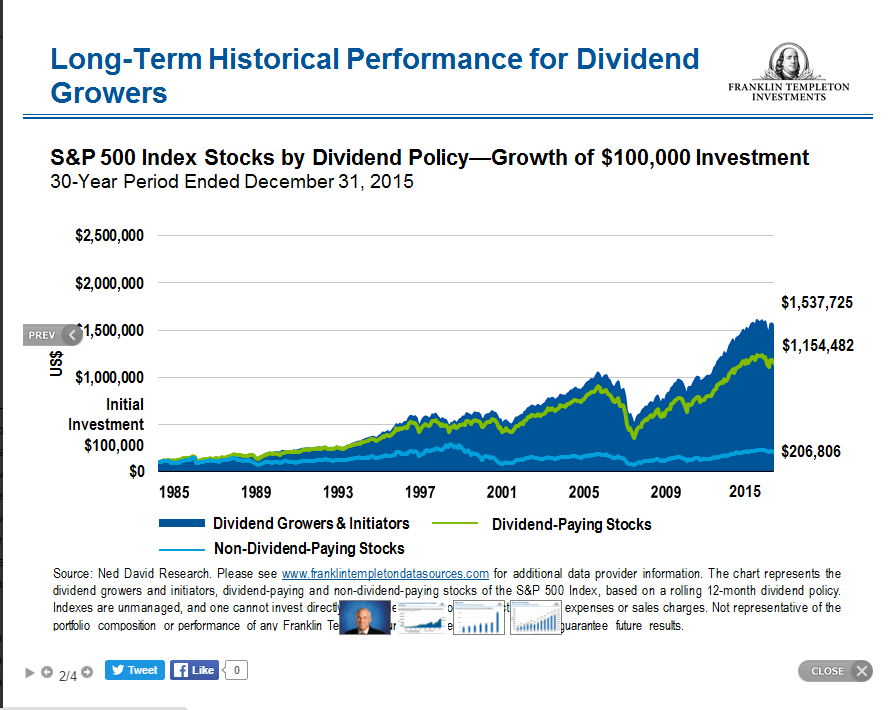

When picking stocks to hold for the long-term it is important to not only buy dividend payers but also own dividend growers. Companies that consistently raise their dividends year after year or even every few years tend to outperform those firms in terms of stock price growth that do not pay dividends or maintain the same dividends. The capital growth is especially huge when returns are calculated over many years due to the effect of compounding of dividend reinvestment.

The chart below illustrates the phenomenal growth of dividend growers over the long-term:

Click to enlarge

Source: Dividend “Achievers”: Most Likely to Yield?, Franklin Templeton Investments, May 24, 2016

The S&P 500® Dividend Aristocrats® Index comprises of companies that have increased dividends consistently every year at least for the past 25 years. The following are ten constituents from the index that investors can explore for potential investment opportunities:

- Emerson Electric Co. (EMR)

- Lowe’s Companies, Inc. (LOW)

- AT&T, Inc. (T)

- Colgate-Palmolive Co. (CL)

- Leggett & Platt, Incorporated (LEG)

- Stanley Black & Decker, Inc. (SWK)

- Kimberly-Clark Corporation (KMB)

- Johnson & Johnson (JNJ)

- PPG Industries, Inc. (PPG)

- Abbott Laboratories (ABT)

Disclosure: No Positions