Preferred Stocks are better than common stocks in some ways.For instance, preferred stock holders rank higher in claims against a company’s earnings and assets. So in case a company goes bankrupt preferred holders will be paid first before common stock holders, provided there is any assets leftover after other creditors are paid.However preferreds are not risk-free investments. One can still lose money just like stocks. Preferreds are just a little better than common.

I came across a short article on Preferreds on the Charles Schwab site.From the article:

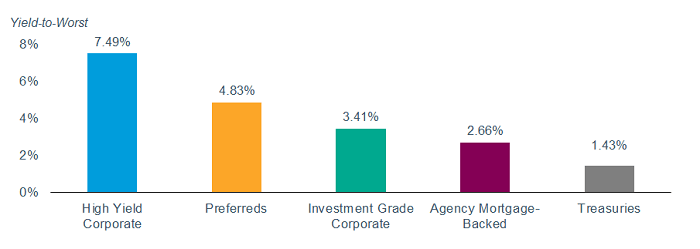

Preferred stock and hybrid preferred securities typically offer higher yields than traditional domestic fixed income investments, such as U.S. Treasury securities or investment-grade corporate bonds. With low bond yields across the globe, we think preferreds can complement a diversified fixed income portfolio for investors looking to boost their income.

Preferreds do come with heightened risks, including less growth potential than common stock and higher credit risk than corporate bonds. However, with economic growth still positive and market participants generally expecting the Federal Reserve (Fed) to take a slow-and-low approach to raising interest rates, we believe that they can perform well even after the first rate hike.

Preferred securities: the basics

Preferred securities—including preferred stock, hybrid preferred securities, and senior notes—share certain characteristics of both bonds and stocks.

Like bonds, they have fixed par values, generally carry ratings from credit rating agencies like Standard & Poor’s or Moody’s, and pay set coupon rates. Preferreds often have very long maturities—30 years or longer—or no maturity date at all. This means they can remain outstanding in perpetuity, which increases their sensitivity to interest-rate changes. However, most preferred securities are “callable,” meaning the issuer can retire the debt prior to maturity at a specified price after a certain period of time (usually five years after issuance), which balances the interest rate risk.

Like stock, preferred securities can represent ownership in the issuing company; however, unlike common stock, they have a fixed par value. They also rank lower in the company’s priority of payments, so their coupons are usually paid only after the issuer’s bond interest payments have been made. That means they carry higher credit risk. Consequently, preferreds tend to have slightly lower credit ratings than the issuer’s bonds.

Source: Preferred Securities Can Offer Opportunities for Yield-Seeking Investors by Collin Martin, Charles Schwab

One way to invest in preferreds is via ETFs.Three of the top Preferred Stock ETFs based asset size are: iShares U.S. Preferred Stock ETF(PFF), Preferred Portfolio(PGX) and Financial Preferred Portfolio (PGF).

The iShares U.S. Preferred Stock ETF(PFF) has an asset base of over $13.5 billion and an expense ratio of 0.47%. Currently the fund has a distribution yield of 5.27%.

Disclosure: No Positions