German equities declined swiftly in recent weeks due to the slowing economic growth in China.However some of the concerns regarding China’s impact on German firms may be over-estimated by investors.

From an article in the WSJ last month:

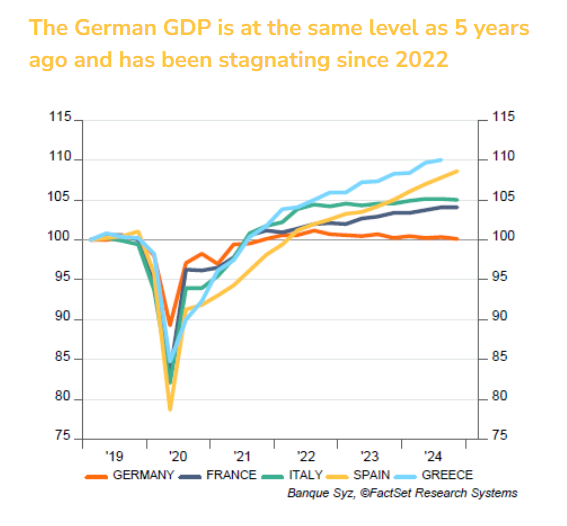

The DAX has had a wild ride this year. It was up 26.2% by April 10, but by Monday’s close the index had given up all its gains and more, falling into the red. Even after Tuesday’s rally, spurred on by a Chinese rate cut, it was lagging many European peers on a year-to-date basis, up 3.2%.

Germany’s economy expanded 0.3% in the first quarter from a quarter earlier and 0.4% in the second. The apparent inability of the economy to accelerate much could be cause for concern in an environment of weaker global growth, particularly given Germany’s export franchise. But there are reasons to believe that Germany can rely on domestic support.

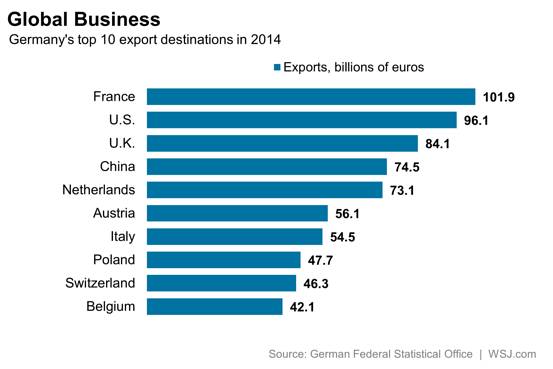

True, in the second quarter, German exports provided the biggest growth impetus, figures published Tuesday show. And in 2014, China was Germany’s fourth-biggest export market, accounting for EUR74.5 billion of German exports. That is equivalent to 6.6% of total exports, or 2.6% of German gross domestic product.

But the rest of the eurozone, U.S. and U.K., where growth has picked up, account for 52.6% of exports. While some 25% of exports do go to emerging markets, according to Berenberg, slower growth in these nations isn’t a new phenomenon, even if markets are only now panicking about it; Germany has kept its head above water. Eastern European countries, like Poland, Hungary and the Czech Republic, where Germany has major export exposures, are proving resilient.

Source: Germany’s Fate Doesn’t Depend on China, WSJ

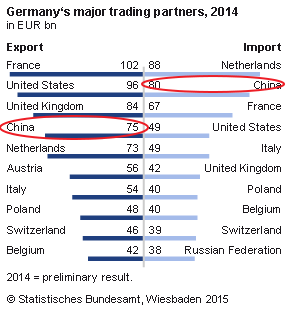

The following chart shows the major trading partners in 2014:

Click to enlarge

Source; De Statis

Though China is the 4th largest export market for Germany, it is the 2nd top source of imports for Germany.

For investors looking to gain exposure to German equities, one way is to invest in the largest firms. In order to identify such companies I referred to the Financial Times FT Global 500 2015 list. The German firms appearing the list are shown below:

| FT Global 500 2015 - Rank | Company | Market value $m (as of Mar, 2015) | Sector |

|---|---|---|---|

| 49 | Volkswagen | 124,335.3 | Automobiles & parts |

| 50 | Bayer | 124,157.7 | Chemicals |

| 74 | Daimler | 103,741.0 | Automobiles & parts |

| 87 | Basf | 91,489.5 | Chemicals |

| 90 | Siemens | 90,196.5 | General industrials |

| 92 | SAP | 88,793.3 | Software & computer services |

| 98 | Deutsche Telekom | 83,314.0 | Mobile telecommunications |

| 103 | BMW | 80,263.3 | Automobiles & parts |

| 106 | Allianz | 79,417.8 | Nonlife insurance |

| 200 | Henkel | 48,145.6 | Chemicals |

| 203 | Deutsche Bank | 47,978.8 | Banks |

| 208 | Continental | 47,106.4 | Automobiles & parts |

| 282 | Deutsche Post | 37,852.2 | Industrial transportation |

| 285 | Linde | 37,787.2 | Chemicals |

| 294 | Munich Re | 37,258.2 | Nonlife insurance |

| 383 | Fresenius | 30,129.9 | Health care equipment & services |

| 390 | E On | 29,817.3 | Gas, water & multiutilities |

| 478 | Fresenius Medical Care | 25,800.0 | Health care equipment & services |

Source: FT

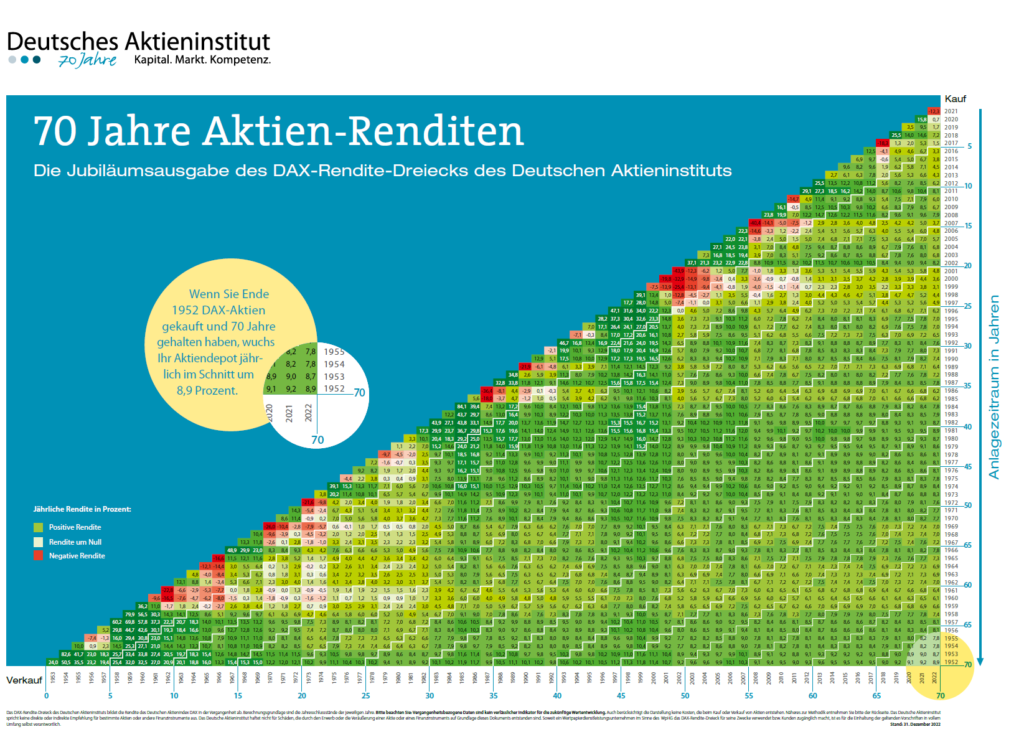

Investors with a long-term horizon can consider adding stocks such as Fresenius Medical Care AG & Co.(FMS), Allianz(AZSEY), Continental(CTTAY) and Henkel (HENKY) in a phased manner.

Disclosure: Long E.ON