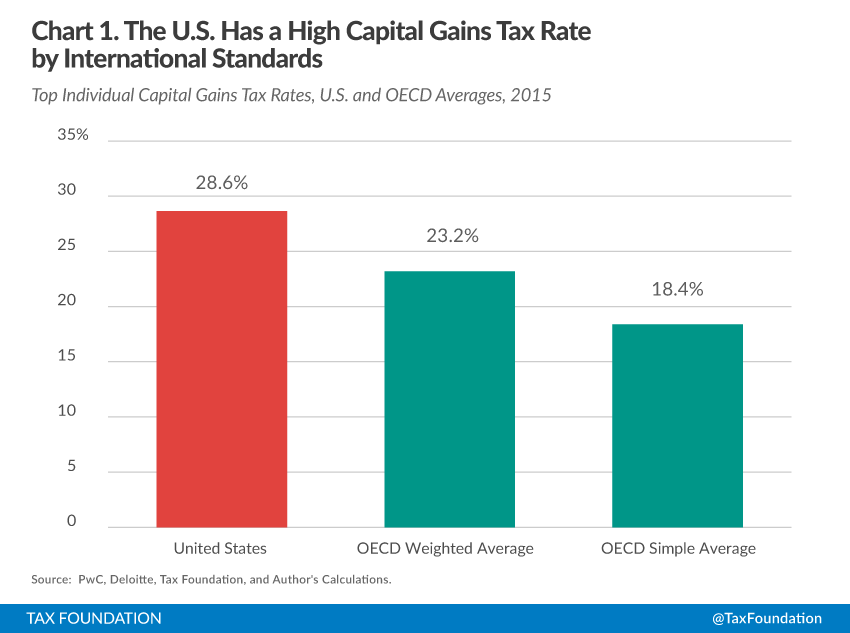

Many years ago I wrote an article comparing tax rates on capital gains across countries. In this post, let us take a look at the Top Marginal Tax Rate on Capital Gains In OECD Countries for 2015.

Click to enlarge

The US has the sixth highest rate among OECD countries. The US rate is 10% higher than the OECD average of 18.4%.

The table below shows the Top Marginal Tax Rate on Capital Gains in OECD countries for 2105:

| Top Marginal Tax Rate on Capital Gains, by OECD Country, 2015 | ||

|---|---|---|

| Rank | Country | Rate |

| 1 | Denmark | 42.00% |

| 2 | France | 34.40% |

| 3 | Finland | 33.00% |

| 3 | Ireland | 33.00% |

| 5 | Sweden | 30.00% |

| 6 | United States | 28.60% |

| 7 | Portugal | 28.00% |

| 7 | United Kingdom | 28.00% |

| 9 | Norway | 27.00% |

| 9 | Spain | 27.00% |

| 11 | Italy | 26.00% |

| 12 | Austria | 25.00% |

| 12 | Germany | 25.00% |

| 12 | Israel | 25.00% |

| 12 | Slovak Republic | 25.00% |

| 16 | Australia | 24.50% |

| 18 | Canada | 22.60% |

| 19 | Estonia | 21.00% |

| 20 | Japan | 20.30% |

| 21 | Chile | 20.00% |

| 21 | Iceland | 20.00% |

| 23 | Poland | 19.00% |

| 25 | Hungary | 16.00% |

| 26 | Greece | 15.00% |

| 27 | Mexico | 10.00% |

| 28 | Belgium | 0.00% |

| 28 | Czech Republic | 0.00% |

| 28 | Korea | 0.00% |

| 28 | Luxembourg | 0.00% |

| 28 | Netherlands | 0.00% |

| 28 | New Zealand | 0.00% |

| 28 | Slovenia | 0.00% |

| 28 | Switzerland | 0.00% |

| 28 | Turkey | 0.00% |

| OECD Simple Average | 18.40% | |

| OECD Weighted Average | 23.20% |

Data Source: Ernst and Young and Deloitte Tax Foundation Calculations.

Canada has a lower rate than the U.S.

Source: U.S. Taxpayers Face the 6th Highest Top Marginal Capital Gains Tax Rate in the OECD, Tax Foundation